Even though Bitcoin (BTC), the largest cryptocurrency, has surged past $28,000 and caused volatility in the crypto market, it may be premature to rejoice. Experienced crypto analyst PlanB recently highlighted that an important resistance level, historically triggering the onset of Bitcoin bull runs, is on the verge of being broken. He suggests that the historical price rise model is about to signal an upward trend once again.

Focus on Two-Year Realized Price

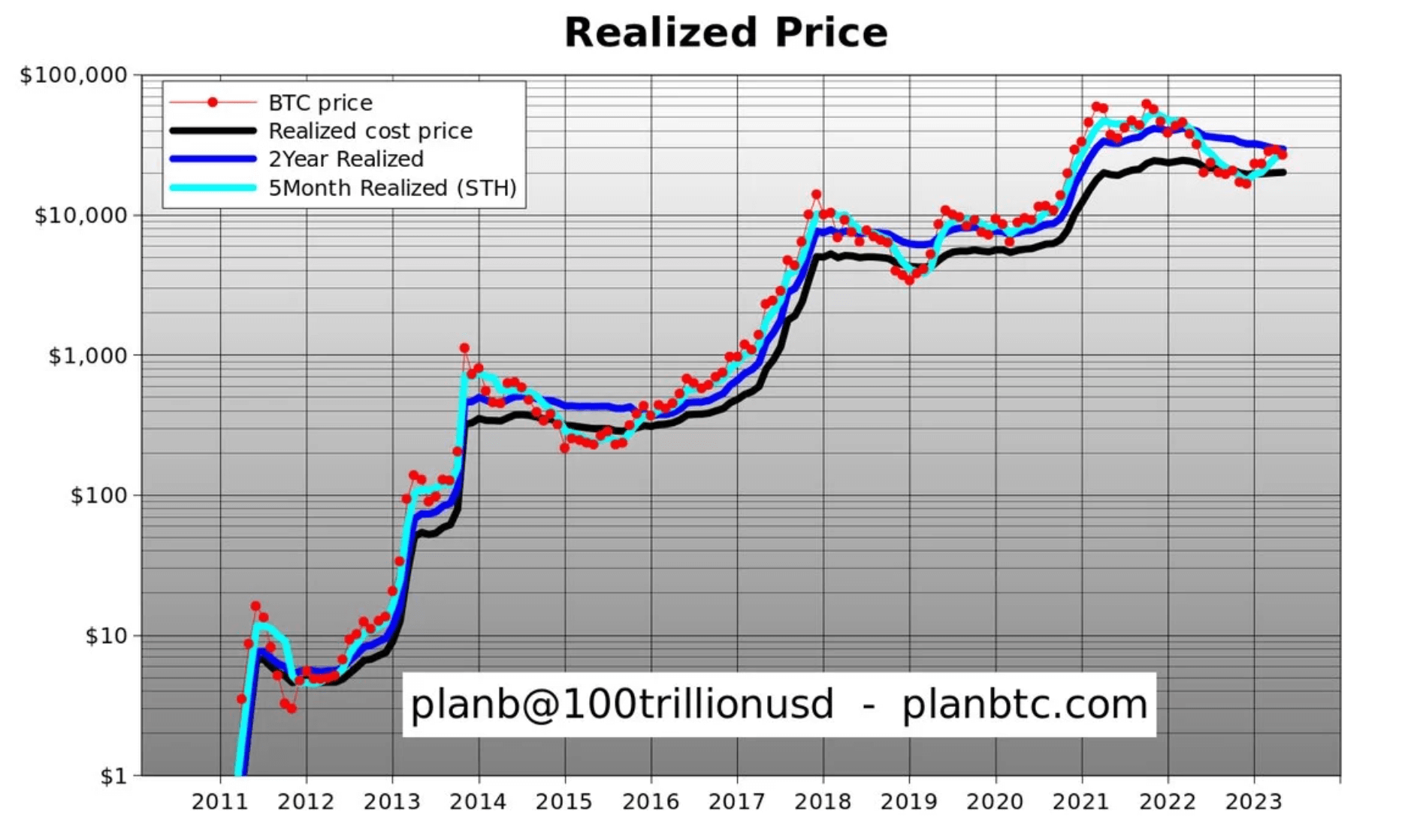

PlanB, the veteran crypto analyst, expressed his anticipation for the leading cryptocurrency by market cap to exceed the two-year realized price, currently at $29,500. The realized price that PlanB refers to is calculated by dividing the total value of all BTC purchases by the number of BTC in circulation.

In a video released three months ago, the analyst pointed out that during bull markets, the price of Bitcoin tends to exceed its realized price, emphasizing the significance of this model. As he discussed the importance of the realized price, PlanB insisted that it has always been a historical model signaling the beginning of a bull market for Bitcoin. He explained:

In the bull markets of 2011, 2013, 2017, and 2021, the Bitcoin price was always above the red dots, i.e., the realized price. Conversely, in bear markets, the Bitcoin price consistently remained below the realized price. The crucial point is Bitcoin‘s leap in January above the five-month realized price of short-term investors and the realized price represented by the black line, moving towards the two-year realized price. Historically, this has always been a significant model indicating the onset of a bull market.

Last Situation in Bitcoin

Last week, PlanB, in his Bitcoin assessment, stated that the largest cryptocurrency is in the first phase of a bull market.

As for the current state of Bitcoin, it began the new week with a rise. Trading just below $28,000 at $27,948 with a 24-hour increase of 2.74%. Over the last seven days, BTC has increased its value by 4.15%, though it has suffered a 4.84% loss over the past 30 days.

Türkçe

Türkçe Español

Español