Investors in the cryptocurrency market have been staring at chaos, red candles, and negative PNLs for the past eight hours. But cryptocurrency is more than just that. There have been massive crashes in the past that have caused investors to lose faith, but Bitcoin has always risen from the ashes despite all these setbacks. So, let’s talk about the future.

The Nature of Cryptocurrencies

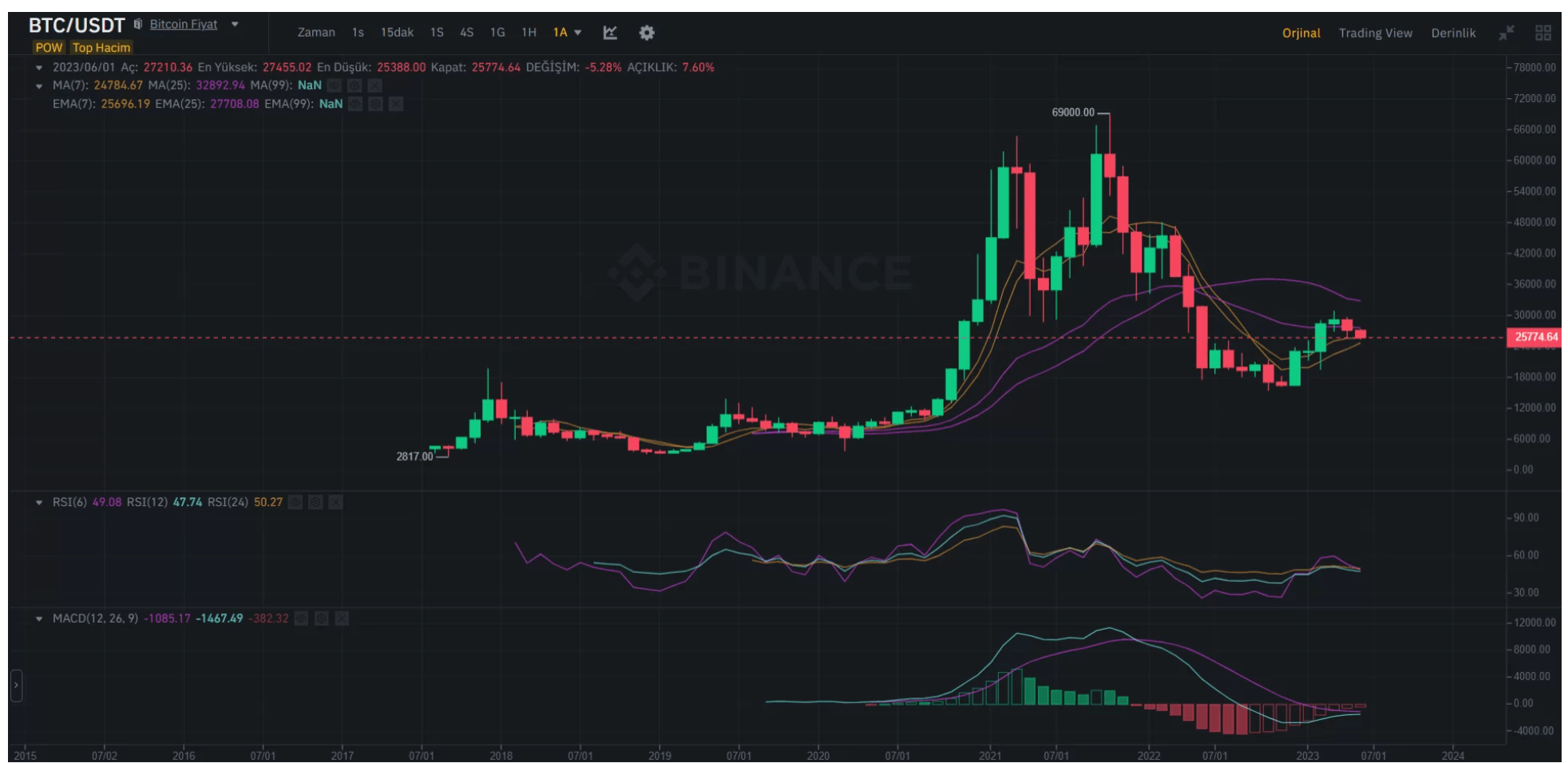

Inherent in the nature of cryptocurrencies, investors are aiming to earn millions of dollars from the crypto markets by sticking to 4-year cycles. However, there is a problem. During this process, you will experience events that will make you believe that the Bitcoin price will never rise again. For instance, the China bans in 2021 pushed everyone into pessimism, and the majority of investors said it was over. Before that, the COVID period, the 2018 crash, the MTGOX incident, and recently, the bankruptcy of FTX exchange.

This is inherent in the nature of cryptocurrencies, and if the last bull season wasn’t the last, you will experience this: When Bitcoin reaches $100,000, for example, headlines reflecting mainstream astonishment will be published. On social media, people will explain how easy it is to profit from cryptocurrencies. Some will talk about how the altcoin they bought in 2023 has increased in value tenfold. Larger crowds will regret their sell-offs during the fear waves of 2022 and 2023. Those who first encountered cryptocurrencies in 2024-2025 will accuse them of cowardice, mocking them. Those entering the market during the rise will see themselves as investment geniuses, being amazed as everything they buy increases in value.

Then the storm will begin again, and those big crowds will give back most of their profits to the market. Every period is hard in its own conditions, but bear markets of cryptocurrencies are very adept at eliminating true believers.

Hong Kong and the Future of Cryptocurrencies

Now, let’s talk about some good things. Hong Kong is an important global economy serving as an investment and trade center in the region. The city, a cosmopolitan metropolis influenced by Western and Asian cultures, is a hub for significant businesses in finance, shipping, trading, and retail. While China has been strongly against crypto for almost half a decade, Hong Kong introduced its crypto legislation allowing individual investors to invest directly in crypto assets last year.

In 2023, while most Western countries were still cautious about cryptocurrencies, Hong Kong certainly showed a crypto-friendly stance. In January, while the crypto industry was rocked by the FTX crisis, Hong Kong’s Financial Secretary Paul Chan said that the local government and regulators were eagerly anticipating building a crypto and fintech ecosystem in 2023. On January 13, just a few days after Chan’s announcement, Korean tech giant Samsung announced the launch of a Bitcoin Futures Active ETF fund on the Hong Kong Stock Exchange.

In the middle of February, sources claimed that some Chinese officials were tacitly approving Hong Kong’s crypto-friendly endeavors. Local business operators noted that the Chinese government might even be open to using Hong Kong as a testbed for crypto, as long as it does not threaten the country’s financial stability.

By March, more than 80 crypto firms had expressed their interest in opening an office in Hong Kong.

In April, Hong Kong Monetary Authority (HKMA), the region’s central banking institution and regulator, called on banks to serve cryptocurrency firms. The HKMA asked banking institutions to be vigilant of market developments and demonstrate a forward-looking approach to the newly emerging technology sector, including cryptocurrencies.

In May, the president of the Hong Kong FinTech Association said that the crypto-friendly government would initiate a licensing regime for crypto service providers and exchanges by June 1. Later in the month, the Hong Kong Securities and Futures Commission (SFC) announced that licensed crypto platforms would be permitted to serve individual customers.

At the time of writing this article, crypto exchanges Huobi and Gate had applied for virtual asset licenses. Huobi became the first member of the Hong Kong Virtual Assets Consortium on May 31.

On May 29, Huobi launched its individual trading services as the company submitted its license request to the SFC. A spokesperson from the company stated, “Hong Kong regulations allow existing virtual asset platforms to operate without a license for another year.”

Gate also revealed that it had applied for a virtual asset license since it had been operating as a custodian in Hong Kong since August 2022. Binance, the largest global crypto exchange with a significant presence in the Asian market, is currently monitoring developments in Hong Kong. A Binance representative mentioned that it “actively participated in the public consultation period and contributed to the policy-making process of the virtual asset platform regulation in Hong Kong.”

Bitfinex, another leading global crypto exchange, stated that the developments in Hong Kong’s crypto environment clearly reflected the constantly evolving nature of the digital asset field.

Many individuals within the industry believed that China’s crypto policy would inevitably impact Hong Kong. However, Hong Kong’s progressive approach to cryptocurrency, coupled with interest from Chinese banks in Hong Kong-based crypto firms, might offer a potential refuge for crypto users and associated parties in China.

Corporations such as Shanghai Pudong Development Bank, Bank of Communications, and Bank of China have begun to offer banking services to crypto businesses in Hong Kong or are in direct communication with such organizations to provide services.

As of April 2023, the Bank of Communications, a significant state-owned Chinese entity, is cooperating with several cryptocurrency businesses through its Hong Kong branch.

Yuanjie Zhang, a founding partner of Conflux Network, commented, “While a stage for Chinese founders, venture capitalists, institutions, and exchanges to collectively explore the industry’s boundaries is being set, on the other side, mainland China will continue its policy to prevent onshore crypto prevalence under central bank guidance, ensuring capital control consistency. More exchanges will exit mainland markets, cleanse mainland identity users, and transfer personnel to Hong Kong, Thailand, and Singapore.”

So, what should this tell us? Perhaps, the narrative for the next bull season is already being written while everyone else focuses on fear and panic.

Could we see the following headlines within a year?

- Massive influx of ultra-rich Asian investors into crypto.

- Bitcoin halving propels the king cryptocurrency beyond $40,000.

- US Presidential candidates pledge tax exemptions to woo crypto-supporting voters.

- Biden protested by tens of thousands of crypto-supporting voters.

- The Fed makes its first interest rate cut, triggering a rapid rise in Bitcoin.

- Long-awaited US crypto laws finally come into force.

- JPMorgan begins offering crypto services to individual customers following the implementation of crypto laws.

- Fidelity’s monthly crypto trading volume exceeds $10 billion.

We may never see these headlines. However, remember that senior investors boasting of buying Bitcoin below $2-3,000 are leading better lives due to their resilience during similar periods of fear. Maybe they were rewarded for the last time in the 2021 bull season, but that’s the reality.