Bitcoin and Ethereum, along with the whole cryptocurrency market, responded to the latest maneuver by the SEC. Following the noticeable decrease in trading activities triggered by the SEC’s recent action, a significant bounce back occurred.

Rise in Bitcoin and Ethereum Volume

After the announcement that Binance US and Coinbase are facing legal action, major cryptocurrencies, including Bitcoin and Ethereum, experienced a decline in both price and trading volume. This fall could be attributed to FUD as market participants observed the overall market reaction.

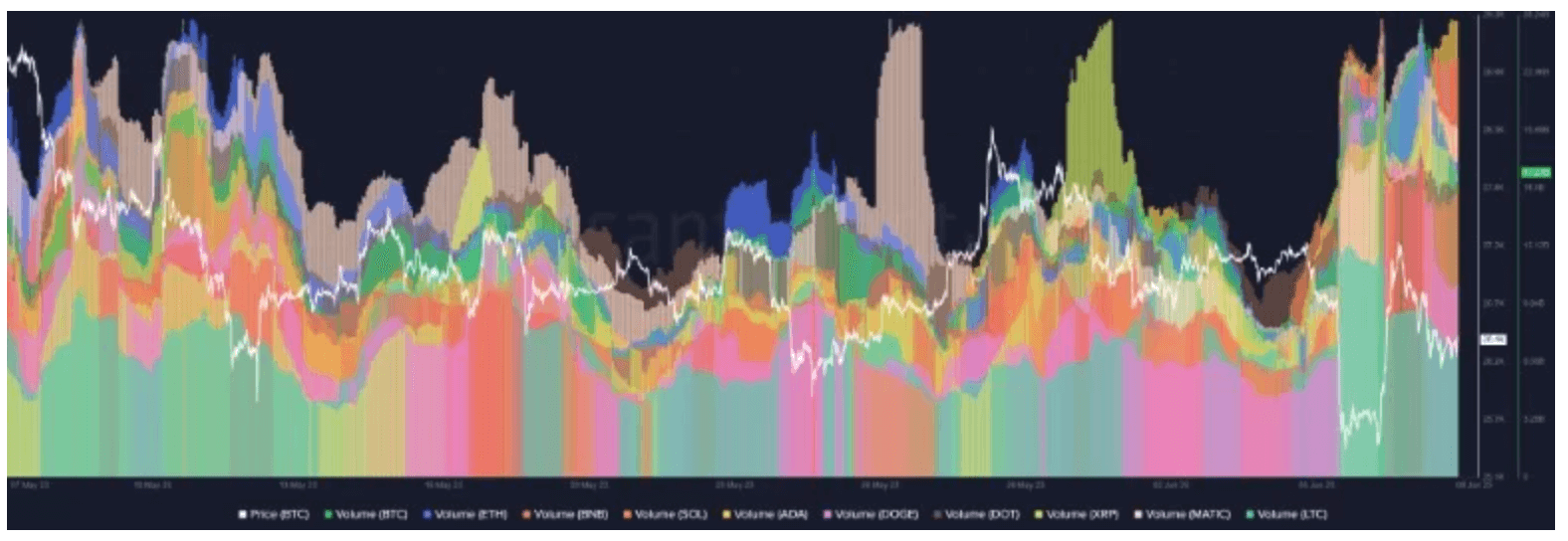

However, following the initial drop on June 5, a significant resurgence in trading volume across the market was observed, leading to a renewed interest in dip buying and panic selling. Santiment data revealed that Bitcoin and Ethereum reached their highest monthly volume levels.

Upon examining the chart, it is evident that Bitcoin’s volume surpassed 20 billion following the drop on June 4. Volume, which briefly dropped to around 8 billion that day, rapidly climbed the following day, reaching the month’s peak.

Similarly, Ethereum’s volume fell to about 3 billion on June 4 but rose to approximately 10 billion in the following days. At the time of writing, Ethereum’s volume had reached around 7 billion. This surge in volume was not limited to Bitcoin and Ethereum but was also observed in other cryptocurrencies, such as Binance Coin (BNB), Solana, and Cardano.

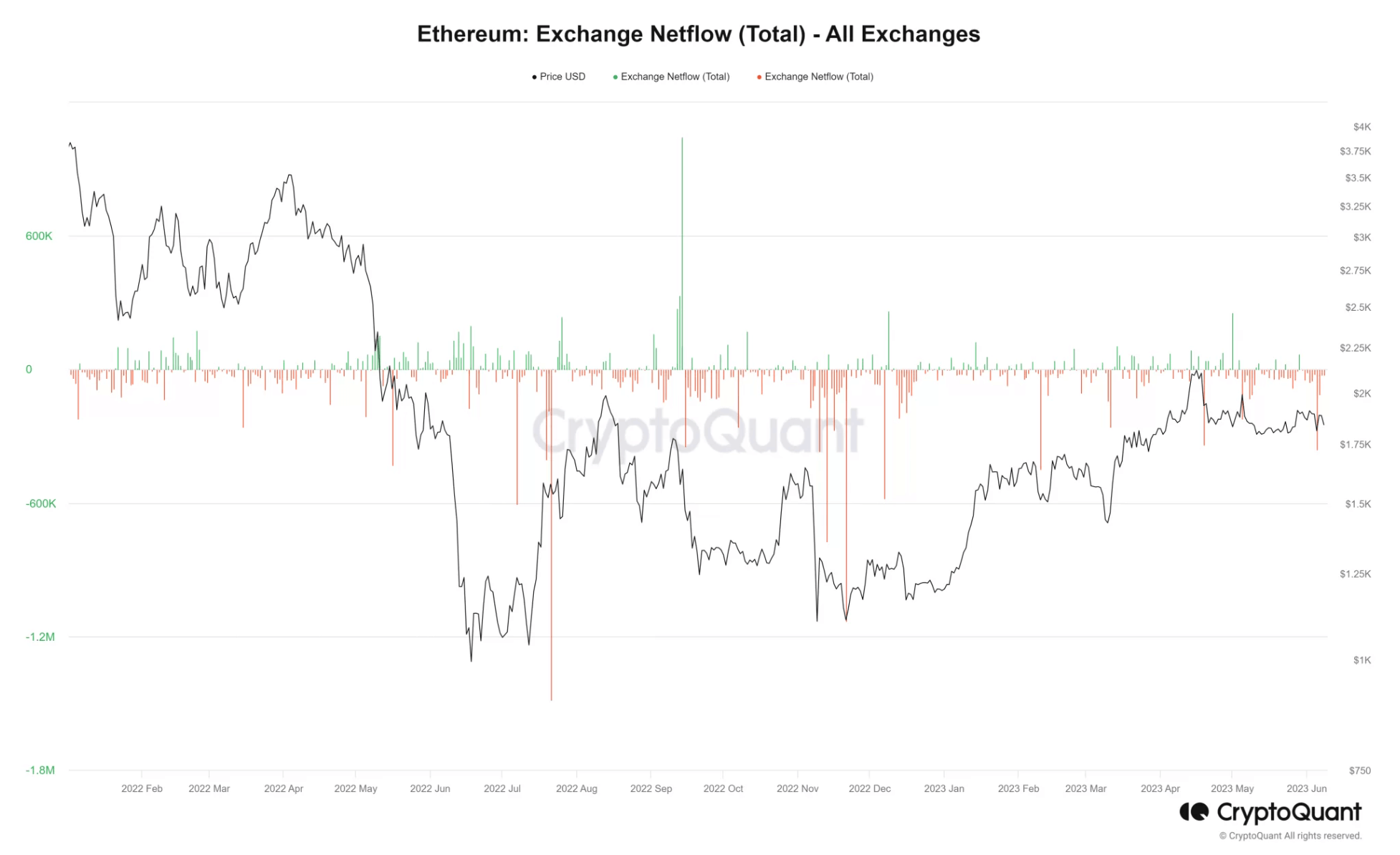

Negative Flow in Bitcoin and Ethereum

Analysis of Bitcoin and Ethereum‘s Netflow data on CryptoQuant revealed a consistent negative flow over the past few days. This suggests that sellers, rather than buyers, influenced the recent rise in trading volume.

In particular, upon examining Bitcoin’s Netflow metric, it went above -10,000 on June 7. This represented the highest flow recorded in the month. At the time of writing, the netflow remained on the negative side and exceeded 1,000.

Ethereum’s Netflow also experienced a spike in the negative zone on June 5, hitting approximately -360,000, indicating the highest flow for the month so far. As of this writing, the Netflow for ETH has already surpassed 9,000 on the negative side.

Coinglass data, despite the prevailing market view, indicated that investors maintained a positive outlook towards Bitcoin and Ethereum. This optimism was reflected in the funding rate metric, which showed investors betting on a price increase for these two assets.

As of writing, the funding rate remained positive for BTC and ETH on most exchanges, indicating the sentiment prevailing among investors, as per Coinglass.