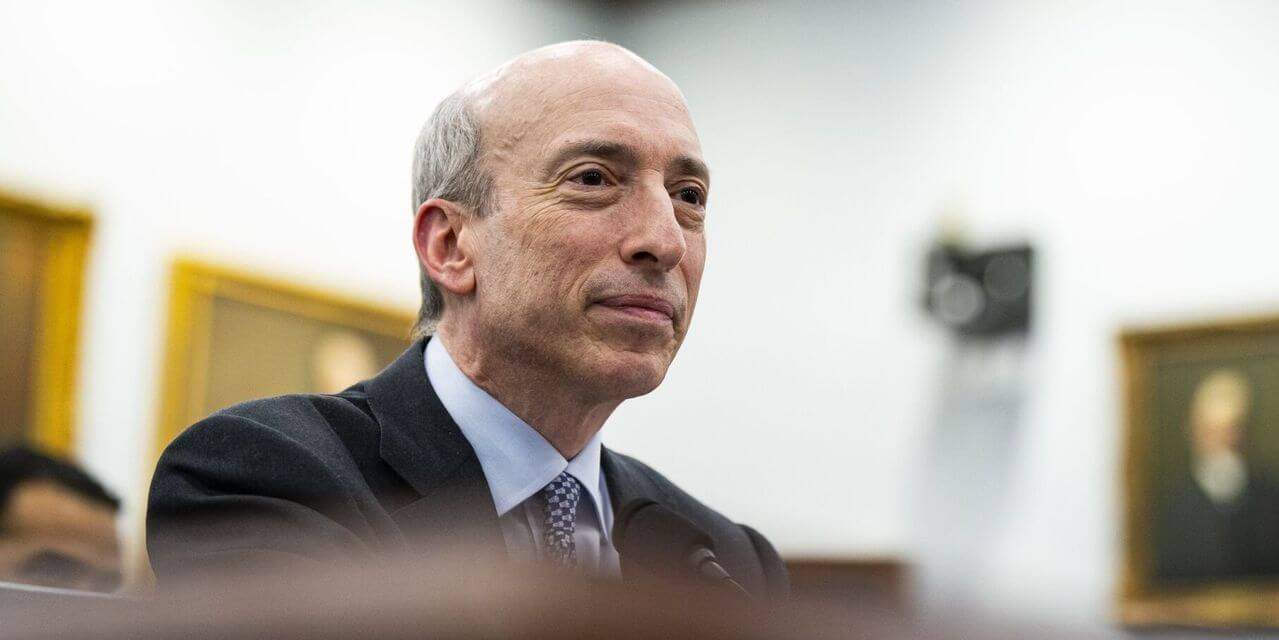

SEC Chairman Gary Gensler recently shied away from proclaiming Ethereum as a security, even when pressed by Republicans in the House Financial Services Committee in Congress last April.

Did Gensler Step Back?

Before his tenure at SEC, Gensler had a much clearer view on which crypto tokens were considered securities and which ones weren’t. He had previously stated several times that Bitcoin, Ethereum, Litecoin, and Bitcoin Cash were unlikely to cross the threshold, whereas tokens released through initial coin offerings (ICOs) did.

This distinction is intricate and at the core of numerous legal disputes involving major names in crypto, including Ripple and Coinbase. If a token is determined to be a security, it would fall under stricter regulatory scrutiny and under the jurisdiction of the SEC.

In a corporate crypto conference organized at Bloomberg’s headquarters in 2018, Gensler expressed that over 70% of the crypto market was made up of Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. He argued that these four were not securities and, likely, neither were three-quarters of the market.

He repeated these comments in his crypto course, Blockchain and Money, at the Massachusetts Institute of Technology the same year.

Therefore, he claimed, we already know that three-quarters of the market aren’t ICOs and will not be termed securities, even in jurisdictions like the U.S., Canada, and Taiwan.

Are Most ICOs Securities?

Gensler also alluded to listeners hearing debates about initial crypto offerings and which cryptocurrencies were securities. He added that although these debates were generally relevant and significant, they weren’t legally or regulatorily pertinent for three-quarters of the crypto market.

However, at the Bloomberg conference, Gensler suggested that most ICOs, citing Ripple’s XRP and EOS as examples, met all four criteria of the Howey test and thus became securities. He added that Ethereum, launched in 2014, likely met the same criteria and was a security upon its release.

Yet, he also referenced former SEC Chairman William Hinman’s comments that this status changed over time.

Nowadays, Gensler and the SEC assert that most tokens are securities, aligning greatly with Gensler’s previous views on ICOs. However, neither has clarified whether this applies to Ethereum. In a lawsuit against Coinbase earlier this month, the SEC alleged that the exchange, offering Ethereum through a staking service, was a security. But it didn’t touch on the underlying asset itself.

In April, Gensler had been ambiguous when asked about Ethereum. If the public is expecting profit based on the efforts of others in a common enterprise, those are indicators of a security, he said.

Regarding whether the SEC needs to publish more guidance on Ethereum, he stated that the area already had clarity. Coinbase is currently suing the SEC to ascertain what this clarity entails, and Ripple Labs hopes that documents released today related to Hinman’s 2018 speech may shed some light.

Türkçe

Türkçe Español

Español