Every significant event in the crypto world tends to spawn various conspiracy theories and distortions. The case of BlackRock is no different. Popular social media accounts have made claims, stretched by contrived comments, that don’t appear to reflect the truth. Today, we will focus on two misconceptions gaining attention.

BlackRock Will Fork the Bitcoin Network

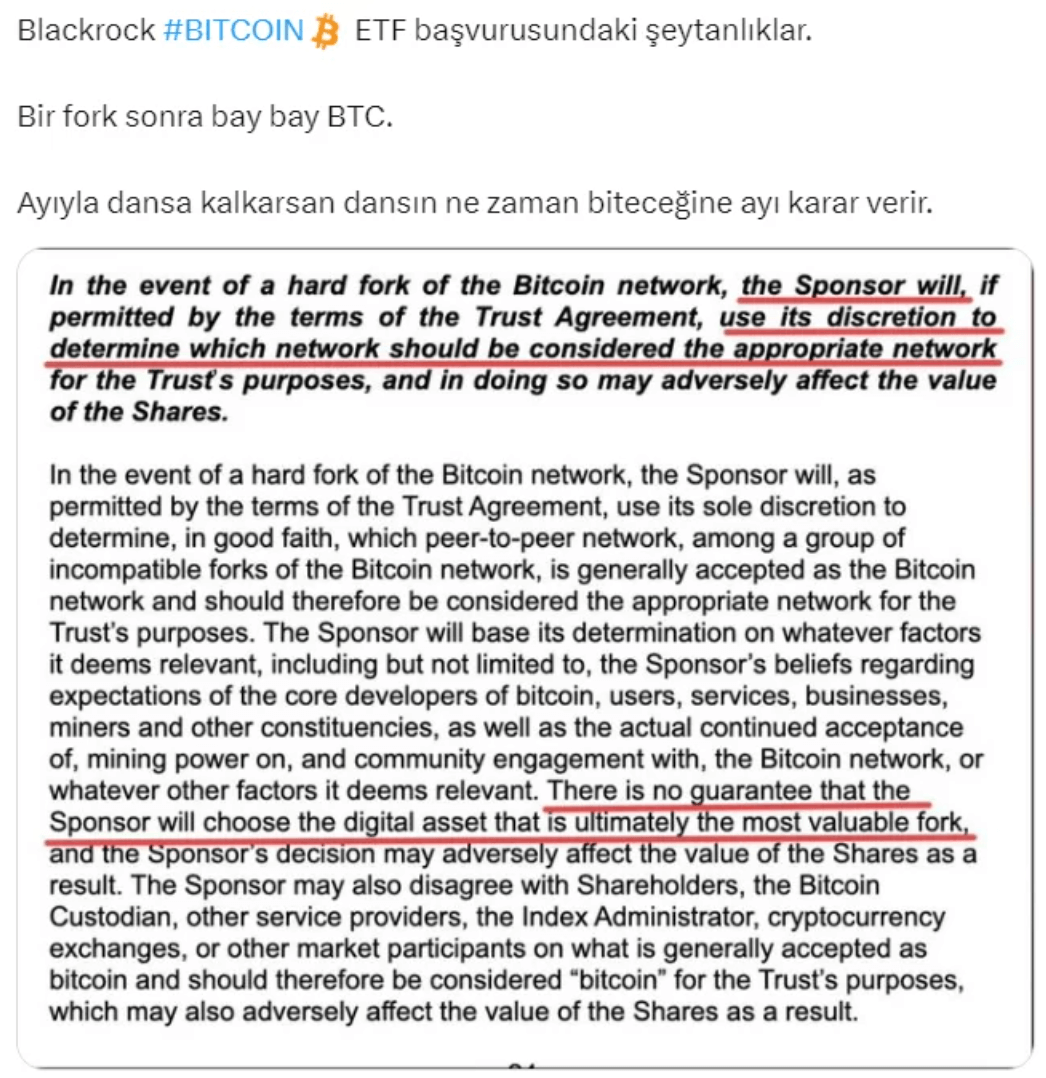

What is the basis of this claim? Numerous accounts on Twitter today have stated that the world’s largest asset management firm will fork the network after the ETF goes live. Countless accounts suggest that Bitcoin (BTC), the largest cryptocurrency with a market value of $510 billion, will become a toy in the hands of this $10 trillion giant.

The fork declarations in the application documents denote potential risk, which is mentioned in every Bitcoin ETF application (in the risk section).

The basis for the first claim? Experts interpreting the word “fork” from the application file for the Spot Bitcoin ETF have arrived at this conclusion. The sections talking about the potential forking of the network are actually being considered as “potential risks.” If they examined other ETF applications, they would understand that the same risk has been mentioned in previous applications as well.

Various topics are addressed in ETF applications, and potential risks are just one of them. Can Bitcoin, operating with a PoW consensus mechanism, be forked? Yes, it has been done before. However, whether it would be popular is another question. Given that Bitcoin Cash (BCH) and others have faded into history, it doesn’t appear that they garnered much interest. Can a trillion-dollar company pull this off? In other words, could they create a PoS Bitcoin Fork that would draw interest? Technically, yes. However, this possibility has nothing to do with what is written in the application file.

The conclusion is, BlackRock will not fork the network to switch it to PoS with a sinister plan after launching the ETF. At least, it is impossible to draw such a conclusion from the application documents.

BlackRock’s Application Is Not an ETF

This was the second most popular topic of discussion on social media. Many popular accounts are claiming that this is the same as the GBTC issued by Grayscale. Though both are technically trusts, there is a significant distinction that makes what BlackRock proposes an exchange-traded fund (ETF). The terminology of Exchange Traded Funds (ETF) can sometimes be misleading, and the application made by fund management giant BlackRock for its spot Bitcoin ETF has raised some questions.

BlackRock’s iShares unit applied to the U.S. Securities and Exchange Commission (SEC) on Thursday to establish the iShares Bitcoin Trust. The name of the proposal and other details caused some confusion among industry experts about whether BlackRock was applying for an ETF or a trust with similar characteristics to the Grayscale Bitcoin Trust (GBTC).

Noelle Acheson, editor of Crypto is Macro Now, said;

This reminds us how complex the terminology for ETFs is. Technically, BlackRock’s proposal is for a trust, but this trust allows for redemptions, so it functions like an ETF.

Acheson stated that in this sense, the iShares product is not similar to the GBTC, which does not have a redemption mechanism. “When the market hears the word ‘trust,’ it thinks this will be like GBTC without redemptions, but that’s not the case here,” she said.

The fundamental distinction is that an ETF for spot bitcoin “can purchase bitcoin to align the fund’s assets with the trading price at the end of the trading day. Joe Consorti, a market analyst at The Bitcoin Layer, said that a trust does not have this capability.

In conclusion, although BlackRock’s application may look like a Trust, it should be classified as an ETF in terms of its operation mechanism. It has nothing to do with GBTC.