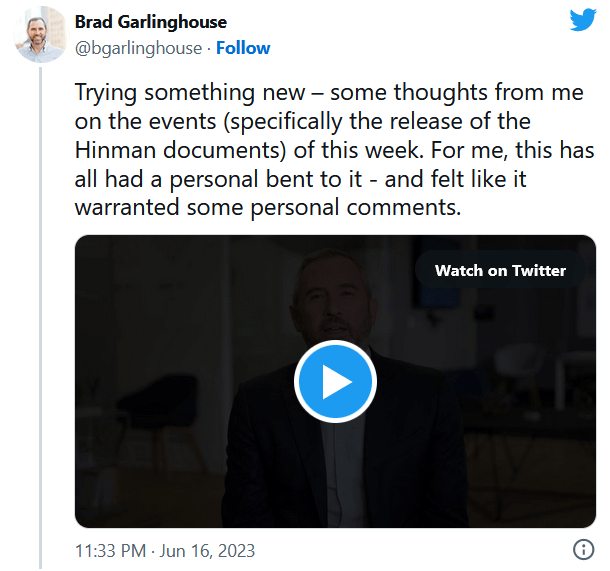

Ripple CEO Brad Garlinghouse has stated that the recently released Hinman documents reveal the SEC might not have jurisdiction to fill the “regulatory void” on crypto.

According to Garlinghouse, Hinman’s speech in 2018 created new factors to demonstrate that sufficiently decentralized crypto assets can no longer be considered as an investment contract. However, the documents reveal disagreements among senior officials within the financial regulator on how to regulate crypto. These executives had warned Hinman that his speech would cause more confusion.

In Garlinghouse’s view, Hinman intentionally overlooked laws and attempted to create new ones. He added that the former SEC official was trying to usurp Congress’s powers with his speech. Garlinghouse specified that the speech was not about any particular token or blockchain. Instead, it highlighted the extent to which the SEC continued its enforcement actions against crypto players while telling the public that crypto firms could come and register.

The Ripple executive pointed out previous meetings with former SEC chairman Jay Clayton and Bill Hinman. During these meetings, the regulator never stated that XRP was a security. He sees this as another instance of the SEC’s malicious actions.

“They preached (and demanded) transparency from the people they regulated, but they fought tooth and nail when held to the same standards.”

The Ripple CEO did not make a new statement about the estimated end date of the lawsuit. His previous statements were implying that the lawsuit would end by the end of June or July.

The SEC is Using This as a Weapon

In the US, because there are no laws regulating cryptocurrencies, the securities regulator is focused on the normalization of applying existing laws to them. All the statements made by the SEC chairman so far have been that laws apply to all markets. However, SEC lawyers make different defenses in court. For example, in the Binance US case, the SEC lawyer admitted the need for extensive regulations.

Ripple CEO Garlinghouse said that Gary Gensler is currently “using the lack of regulatory clarity to enforce jurisdiction over the entire crypto space.”

“Gensler refuses to comment on specific projects (except BTC), but indirectly and erroneously labels tokens as securities in lawsuits. Then, while trying to highlight his agency, he says “how clear the rules are.”

After the publication of the Hinman documents on June 13, XRP reached its highest level in 10 weeks at 0.566 dollars, but then turned its direction downwards again.

Türkçe

Türkçe Español

Español