Years ago, authorities like IMF claimed that blockchain technology, cryptocurrencies, and Bitcoin were useless. Their centralized ledger systems, servers, and SQL (etc.) databases were sufficient for them. However, over time, they began to realize the wonderful opportunities the technology they denied offers. They started to understand Bitcoin and blockchain. This is fantastic. Now they are going to understand why ZK-based blockchain solutions are important.

The Serious Consideration Stage of Cryptocurrencies

Cryptocurrency groups have been developing blockchain technology for years. There are actively used products in dozens of areas such as decentralized finance applications, NFTs, ZK solutions, blockchain-based Oracle solutions, and more developed by crypto companies.

The IMF has started to admit that blockchain is a great thing. The next step will be for them to meet literature (advanced blockchain solutions) like a child learning to read (blockchain).

IMF and the XC Platform

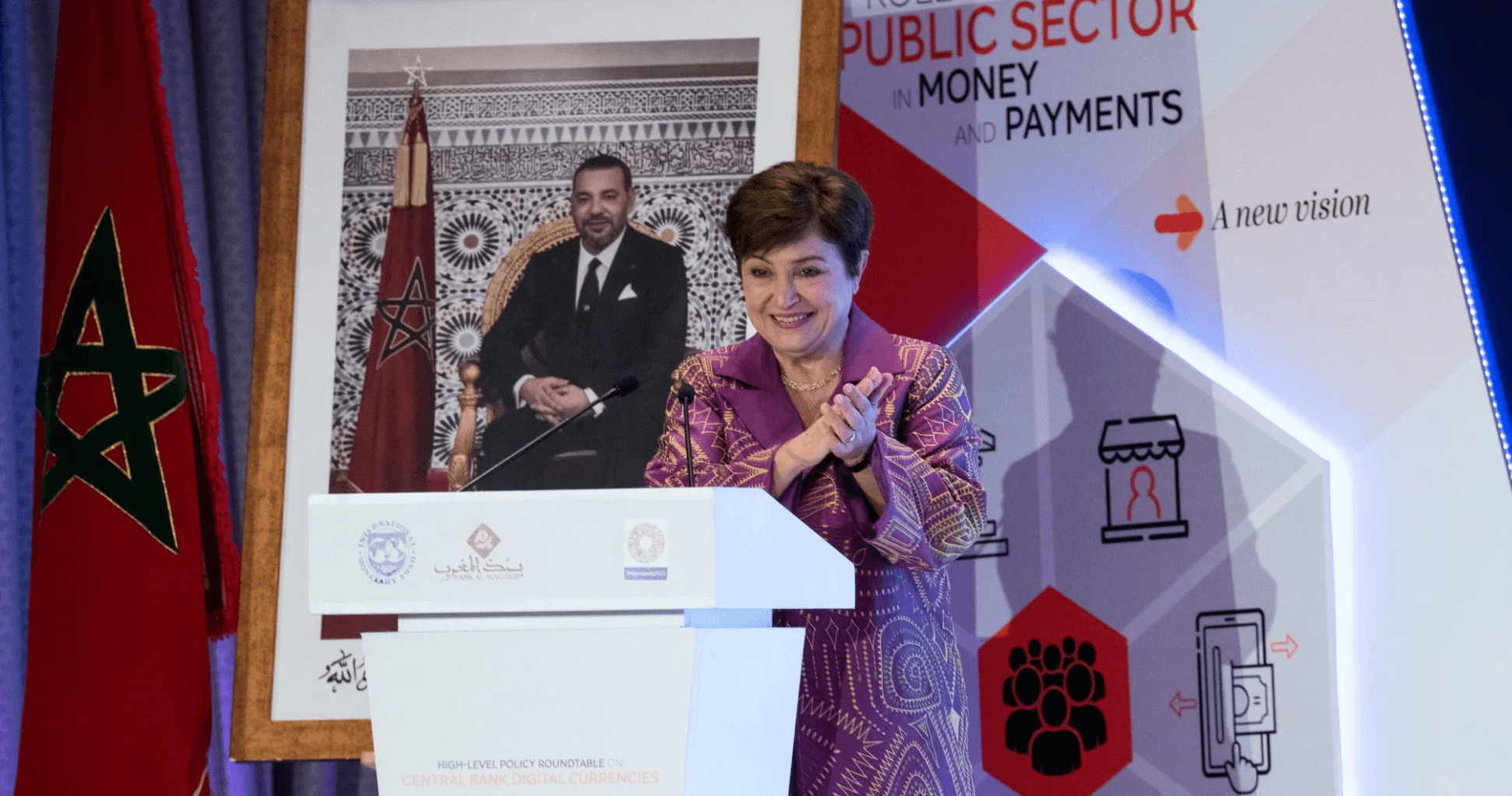

IMF officials held a meeting on CBDC policy to explain new platform concepts on June 19. At the event organized with the Bank of Morocco, IMF’s Director of the Monetary and Capital Markets Department, Tobias Adrian, said the new type of platform could provide benefits to individual and corporate users through lower fees and faster transaction times. He added that a part of the $45 billion paid to remittance providers annually could go back into the pockets of the poor. Furthermore, the platform would help central banks intervene in foreign exchange markets, gather information on capital flows, and resolve disputes. Adrian also mentioned that the platform could be adapted for domestic wholesale and retail CBDC.

Details of the platform, dubbed the XC (cross-border payment and contract) platform, were revealed in an IMF Fintech Note penned and published the same day by Adrian. The proposal was defined as follows:

XC platforms offer a single ledger – a document representing property rights – where standardized digital representations of central bank reserves in any currency can be exchanged.

The XC platform is designed according to the CBDC infrastructure model. It would have a consensus layer with a single ledger. Access to this will be expanded. Currently, institutions need to have a reserve account at a central bank to conduct cross-border operations, but the XC platform will allow trading of tokenized local central bank reserves. Liquidity will still come from institutions with reserve accounts.

A programming layer will offer opportunities to innovate and customize services. An information layer will include the necessary AML details to meet trust conditions and privacy protections.

Türkçe

Türkçe Español

Español