When FTX collapsed, UniSwap (UNI) was among the few cryptocurrencies expected to perform positively. However, that didn’t happen. While the lawsuits involving Binance and Coinbase were supposed to attract more users to this altcoin, that excitement quickly faded. This industry-leading altcoin’s price could fall to as low as $3.75. But why?

UniSwap (UNI)

UniSwap’s (UNI) price experienced a rapid 12% increase last week as worried investors flocked to the leading DEX while the prominent CEXs grappled with lawsuits. One week later, the UNI price dropped by approximately 3% as it couldn’t overcome the critical $5 resistance.

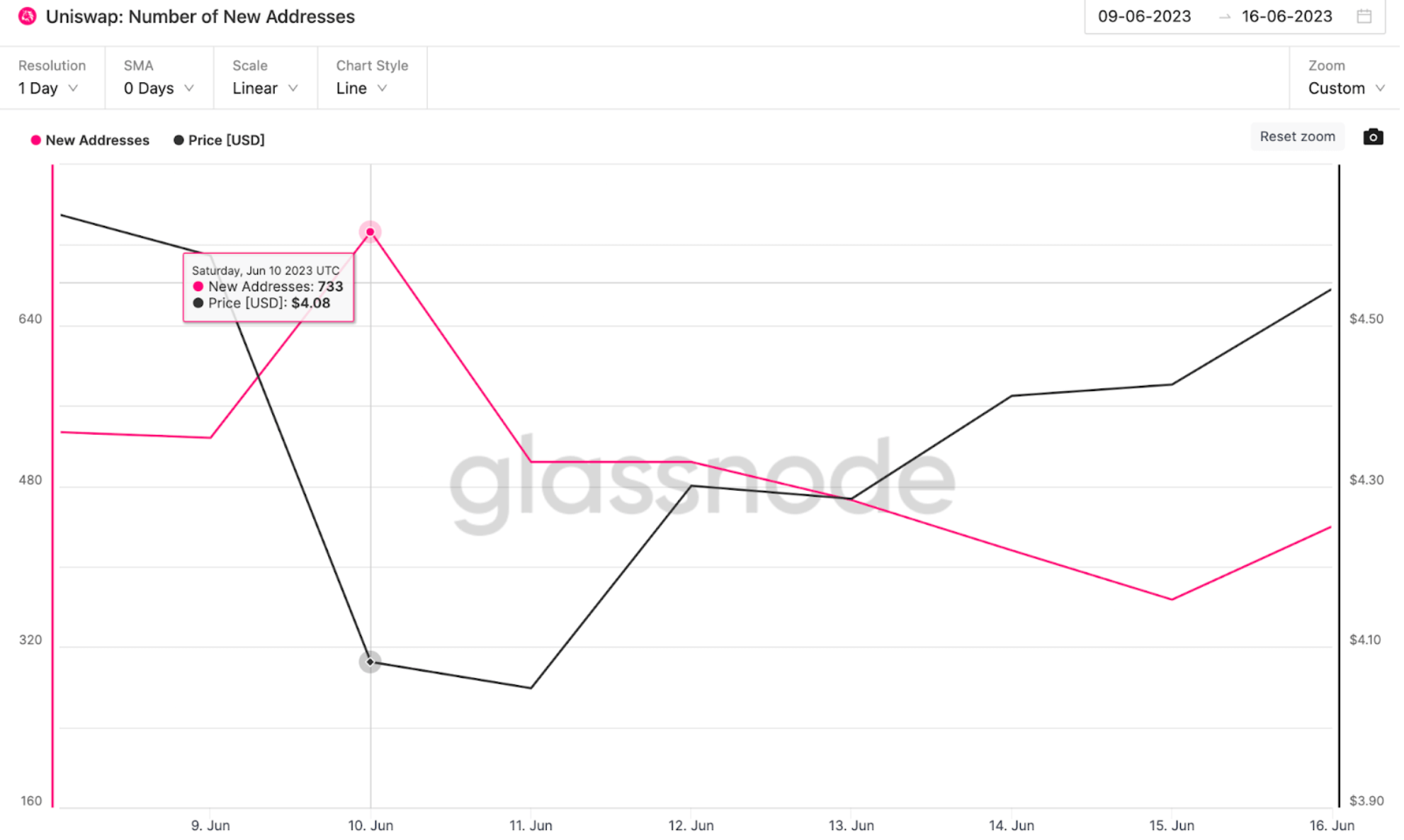

Although UniSwap is the largest decentralized exchange globally, rivals like PancakeSwap and Balancer have made significant inroads into its market share in recent weeks. According to data provided by Glassnode, UNI is struggling to attract new users this week. The chart below shows a decrease in new addresses created on the Uniswap network since the last peak on June 10.

Between June 10 and 19, new addresses fell by 66%, indicating that the initial excitement had quickly waned.

As if to confirm the declining trend, the market share of Uniswap’s rivals grew rapidly. Between June 5 and 7, when the SEC first announced its lawsuit against Binance and Coinbase, UNI’s trading volume skyrocketed by 900%. However, there’s a decline here as well, according to Santiment data.

UNI Coin Comment

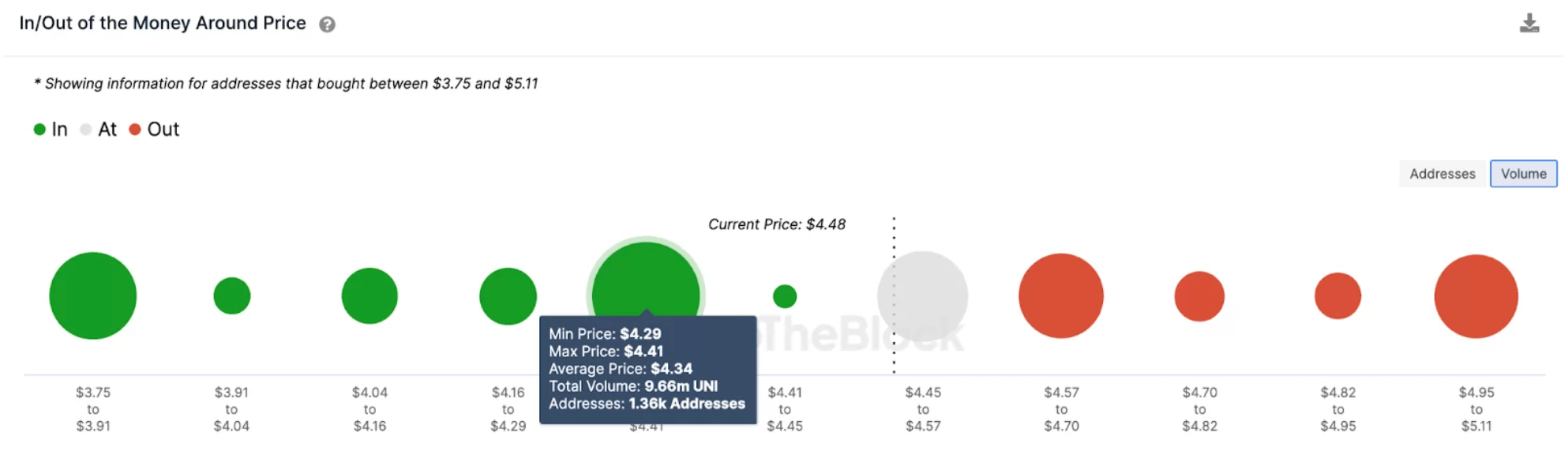

According to IntoTheBlock’s IOMAP distribution data, the UNI price will likely enter a downward trend towards $3.75. At present, 1,360 investors who bought 9.66 million UNI tokens are expected to provide significant support as the price approaches their average purchase price of $4.34. If this support doesn’t remain strong as expected, the Uniswap price will likely drop to $3.75.

If it manages to close above $4.7 in the short term, it can target $5.2. However, the increasing BTCD and the platform’s struggle to attract new user demand weaken this possibility.

Türkçe

Türkçe Español

Español