Investors are now questioning the strength of Bitcoin‘s $30,000 support. Analyzing what caused the recent price rally and understanding how investors are positioned in the Bitcoin margin and futures markets becomes crucial.

Cause of BTC Rise!

Some analysts attribute Bitcoin’s 21.5% increase over the last 11 days to BlackRock’s spot Bitcoin exchange-traded fund (ETF) application. However, other events may have boosted cryptocurrency gains. For instance, it was reported on June 26 that HSBC Bank in Hong Kong initiated its first local cryptocurrency services using three listed crypto ETFs.

Additionally, the ProShares Bitcoin Strategy ETF, a Bitcoin futures fund, experienced its largest weekly inflow within a year, with $65 million pushing assets over $1 billion. It was the first BTC linked ETF in the United States and one of the most popular among institutional investors. More importantly, the US crypto regulation environment might be evolving following a period marked by sanctions targeting assumed exchanges operating as unregistered securities brokers by the Securities and Exchange Commission (SEC).

Fed Statements!

On June 25, Federal Reserve Chair Michelle Bowman stated that financial institutions have been left in a “regulatory gap” in terms of emerging technologies, including digital assets. Bowman added that policy makers relied on “general but non-binding statements,” creating significant uncertainty and imposing new operational requirements after major investments had been made. A bill in the U.S. House of Representatives aims to prevent the SEC from denying registration to digital asset trading platforms as a regulated alternative trading system. The bill, introduced on June 2, would allow such firms to offer “digital commodities and payment stablecoins.”

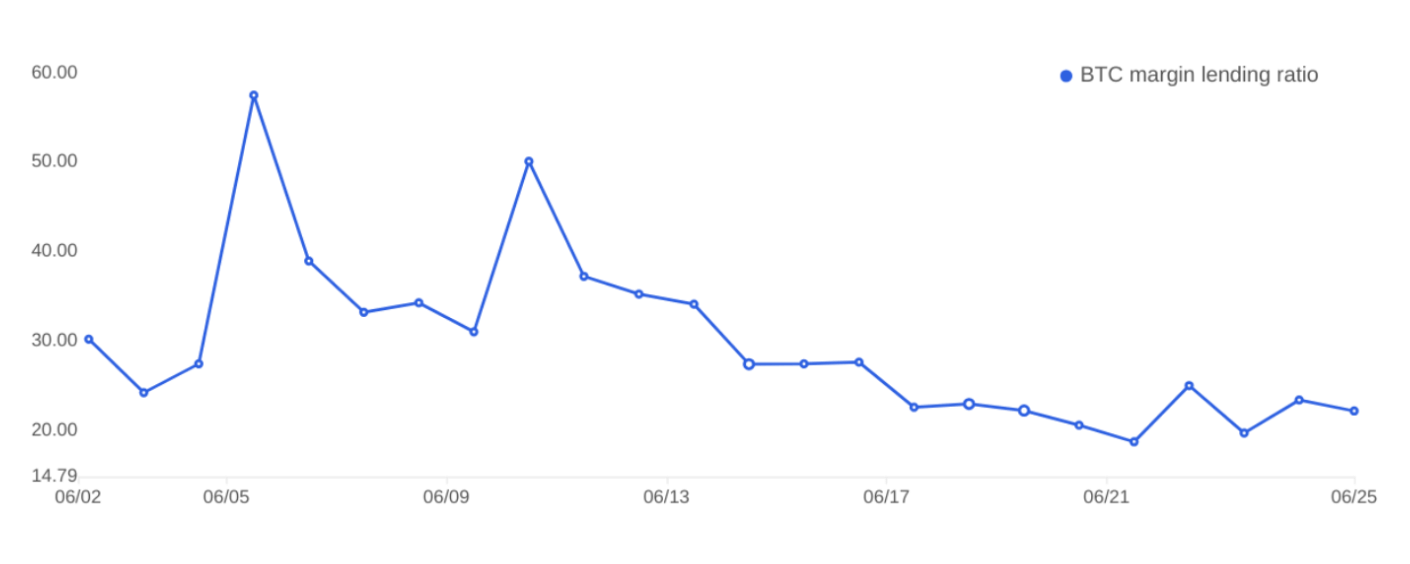

Now, let’s examine Bitcoin metrics to better understand how professional investors are positioned amid the evolved regulatory perspectives and significant institutional entry. Margin markets give insight into how professional investors are positioned, as they allow investors to leverage their positions and borrow cryptocurrency. For instance, OKX provides a margin lending indicator based on the stablecoin/BTC ratio. Investors can increase their risk by borrowing stablecoin to buy Bitcoin. Conversely, those borrowing Bitcoin may only focus on the possibility of a cryptocurrency’s price decrease.

Türkçe

Türkçe Español

Español

Nice