Litecoin (LTC) saw a double-digit price rally last week, driving its Market Value to Realized Value (MVRV) ratio over 30% on the 30-day moving average. This position generally signals a potential drop in LTC’s price.

A Potential Fall for LTC!

Crypto analyst Sumit Kapoor noted in a Twitter post on July 4th that every time LTC’s MVRV crossed the 30% limit since 2018, the LTC price has dropped by an average of 41%. According to data from Santiment, this metric peaked at 36.25% on July 2nd, then entered a downtrend.

At the time of writing, with LTC changing hands at $105.07 as per data from CoinMarketCap, should analysts anticipate a price drop? Litecoin, operating on a Proof-of-Work (PoW) network, has been steadily gaining momentum over the past week as investors and enthusiasts eagerly await the chain’s third halving event.

LTC Data Insight!

This anticipation led the local cryptocurrency of the network to close the second quarter with a local price of $85. This implies the exit of “weak investors” and the entry of “smart money”. This event has since resulted in a 20% increase in LTC’s value.

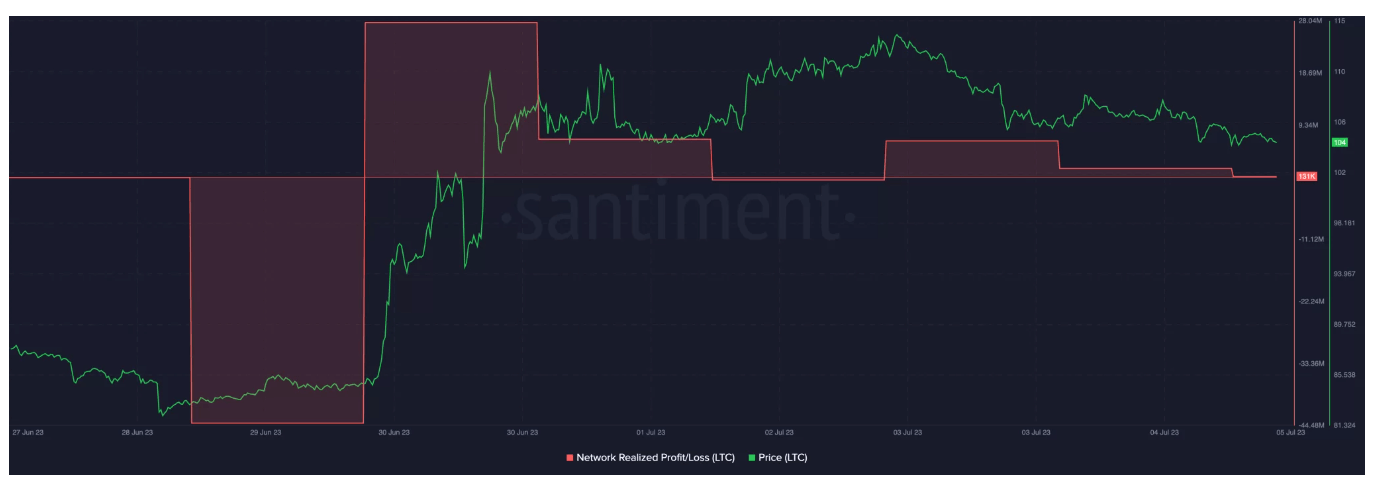

Chain assessment of the altcoin’s Network Profit/Loss (NPL) metric confirmed this. This metric monitors the average profit or loss of all cryptocurrencies changing addresses daily on-chain, to capture periods of profiting or holder capitulation.

According to Santiment’s data, LTC’s receivables in circulation dropped to -44.04 million on June 30th, after which the lower price started to rise. The impact of LTC‘s ‘smart money’ activity appears to maintain upward momentum.

Another crucial metric to note is the Consumed Age metric. LTC saw an unexpected increase in Consumed Age to 438.91 million on June 30th. This indicated a significant movement of idle LTC coins to new addresses and signaled a notable change in behavior among long-term holders.

Türkçe

Türkçe Español

Español