Despite the price volatility of Bitcoin (BTC), the number of Bitcoin assets has increased. Although the total asset amount may seem modest at first glance, it can serve as a compass indicating the possible location of Bitcoin’s next support level.

A Turning Point in Bitcoin!

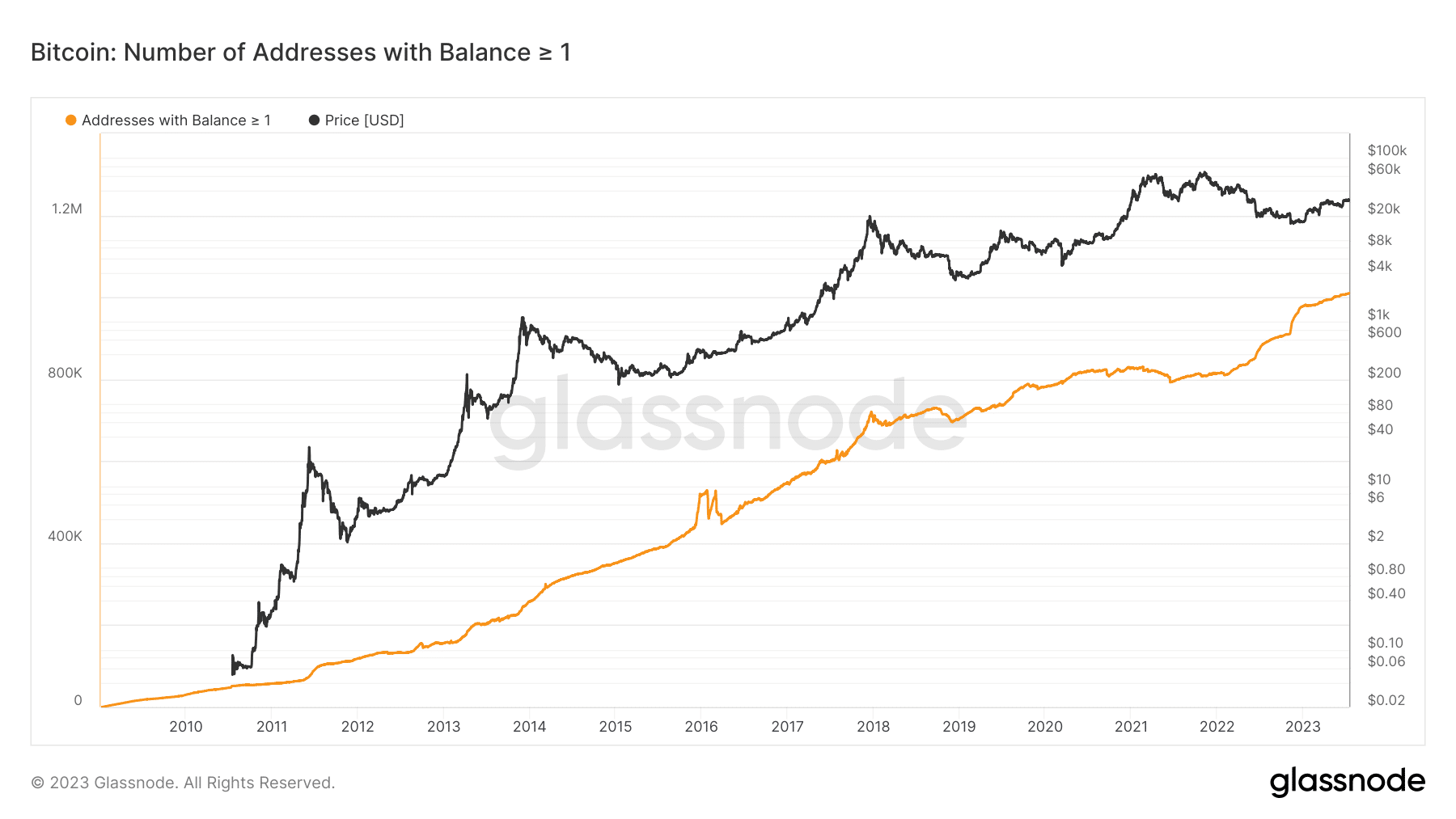

A notable update by Glassnode Alerts on July 16 revealed that the number of addresses holding a single Bitcoin reached an all-time high of 1,009,850. This extraordinary turning point could signal a trend of accumulating Bitcoin at various price ranges, demonstrating the resilience of the accumulation process against price fluctuations.

Significantly, the number has further increased and currently stands at an impressive 1,009,950 addresses, reaching an all-time high. Examining the total number of holders is crucial to truly grasp the impact of Bitcoin holders and volumes. The Santiment chart highlighted this growth since January, indicating a significant upward trend.

The number of holders has increased by approximately 5 million since the beginning of the year, providing a comprehensive perspective. What is even more remarkable is the recent increase with an additional 300,000 holders joining the Bitcoin community from the beginning of July. Taking a broader look at the chart, it is evident that the period between April and June witnessed a rapid acceleration in the number of holders. This increase occurred while the price range was around $27,000, creating an interesting correlation between price movement and holder growth.

Glassnode Data!

Bitcoin was trading around $30,300 in a daily time frame and was showing resistance in maintaining this price range. This occurred despite small losses, both below 1%, in previous and ongoing trading sessions. Since entering the $30,000 range around June 21, Bitcoin has managed to maintain this level despite occasional setbacks. A notable observation was that Bitcoin was trading above its short Moving Average, which could indicate the potential formation of a new support level. This coincided with an increasing accumulation period based on the total holder count metric provided by Santiment. Although there is no distinct upward trend identified, the current trend continues to maintain a bullish bias.

Türkçe

Türkçe Español

Español