After reaching its annual peak, the price of Bitcoin has been trading sideways and started a slightly boring descent. This has been the general trend for the past 7-8 months. Boring and shallow volatility followed by sudden drops or surprising price increases. Eventually, investors realized that sideways movements were not as bad as they seemed. This pattern has been repeating for a long time now and is starting to pose a serious threat to altcoins.

Binance Coin (BNB)

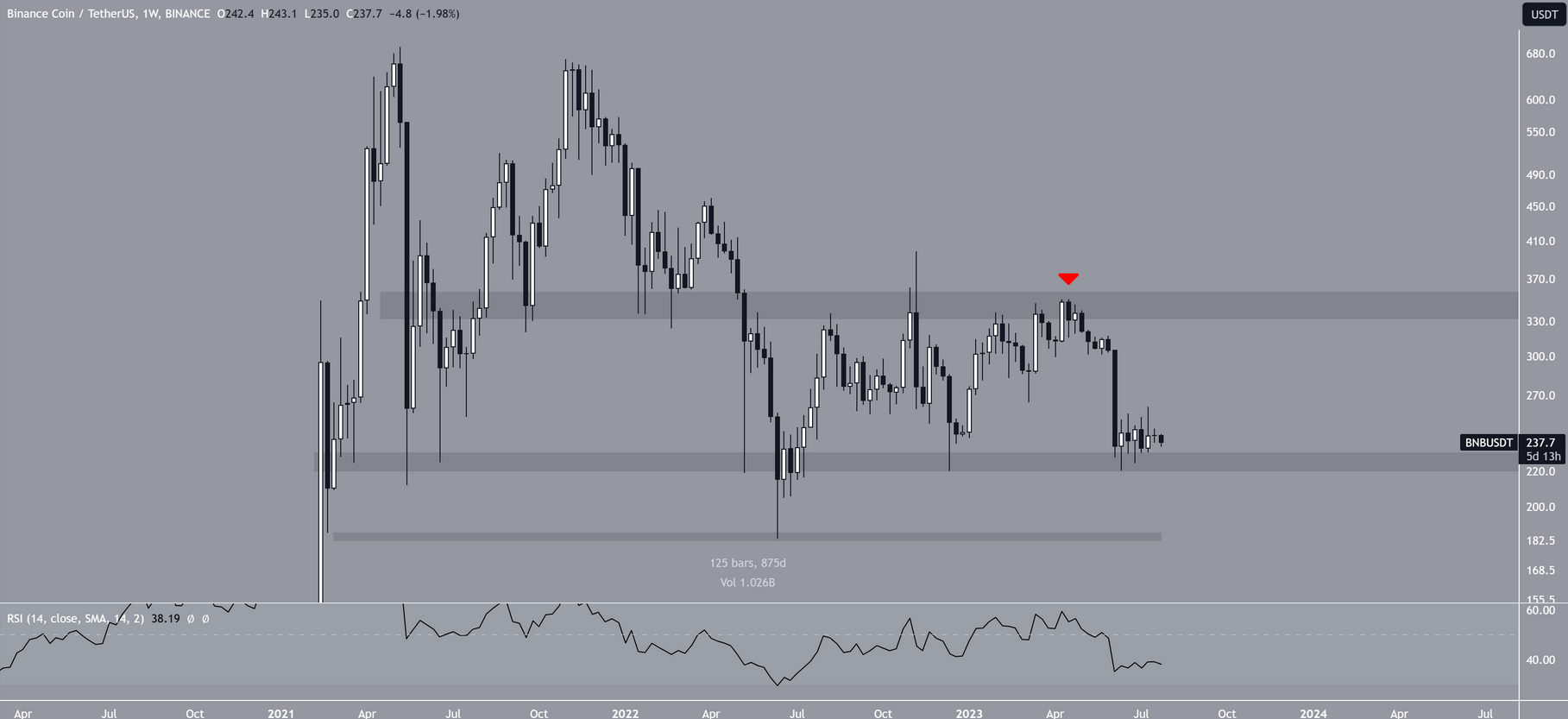

The price of BNB has been trading within a support area that has been in place for 875 days. This structure is critical for maintaining the upward trend but appears to be at risk. The BNB Coin chart entering a short-term corrective structure strengthens the possibility of a downward break from this region.

Since May 2022, the BNB price has been trading in a range between $225 and $350. During this period, the upper and lower boundaries of the range have been touched multiple times, confirming the validity of the range. The latest rejection occurred in April 2023, leading to a continuation of the downward trend towards the lower range. BNB reached the lowest level of the range in June 2023. The price then experienced a slight bounce, but has not initiated a significant upward movement yet.

Potential Crash for BNB Coin Price

Since the support area has been in place for 875 days, a potential break in this area could lead to a rapid loss in value for the price. The weekly RSI supports the downward trend. On a macro level, the recession anticipated by Bloomberg and the signals expected from the Federal Reserve for further tightening are concerning for BNB Coin investors.

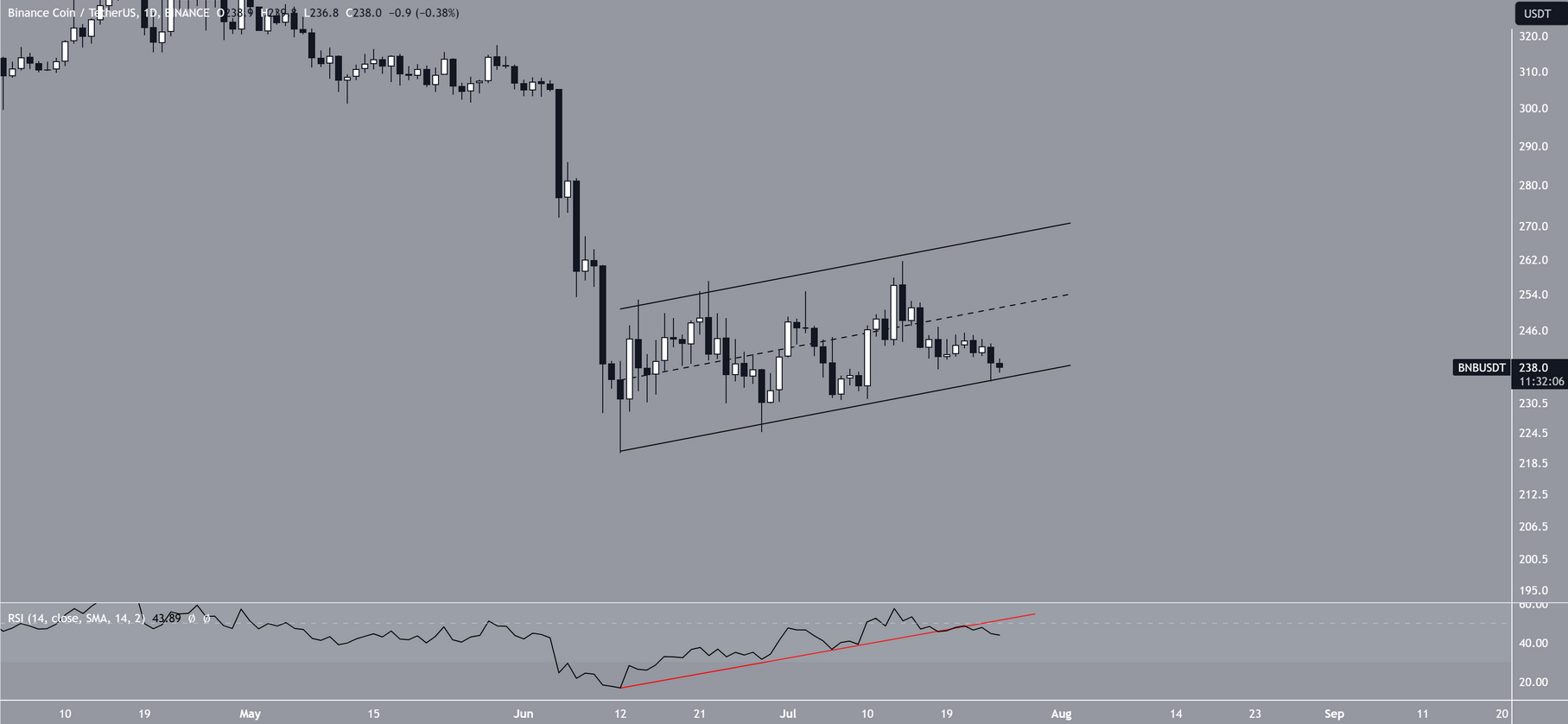

Readings on the daily chart support the possibility of a decline. Since the bottom level on June 10th, the BNB Coin price has been trading within a rising parallel channel. This is considered a bearish formation, often leading to breakouts. The fact that the price is trading at the lower end of the channel further supports this possibility. If a downward breakout occurs, the critical support level at $220 could be tested. Below this region, a much deeper dip is possible with triggered liquidations.

However, if the BNB price bounces off the support line of the channel and rises above the midline, it could rebound towards the resistance line of the channel. This could potentially result in a rapid rise to $270.