In the bull season of 2021, PlanB was undoubtedly the best crypto analyst. However, he fell out of favor later on. This is not surprising because he believed that the bull season would continue. Capo, the favorite of the bear season, took his place. Now, we see PlanB’s name shining again as Capo starts to be forgotten.

The Best Crypto Analyst

When we reached the second half of last year, PlanB was an unsuccessful analyst who was mocked by many famous figures. He failed in his prediction of $100,000 for Bitcoin and everyone, including Vitalik Buterin, made fun of him. Meanwhile, everyone was talking about Capo being a great crypto analyst. Yes, things are turning around now. This time, as Capo is forgotten, PlanB’s star is shining. Moreover, the recent market predictions look exciting for investors.

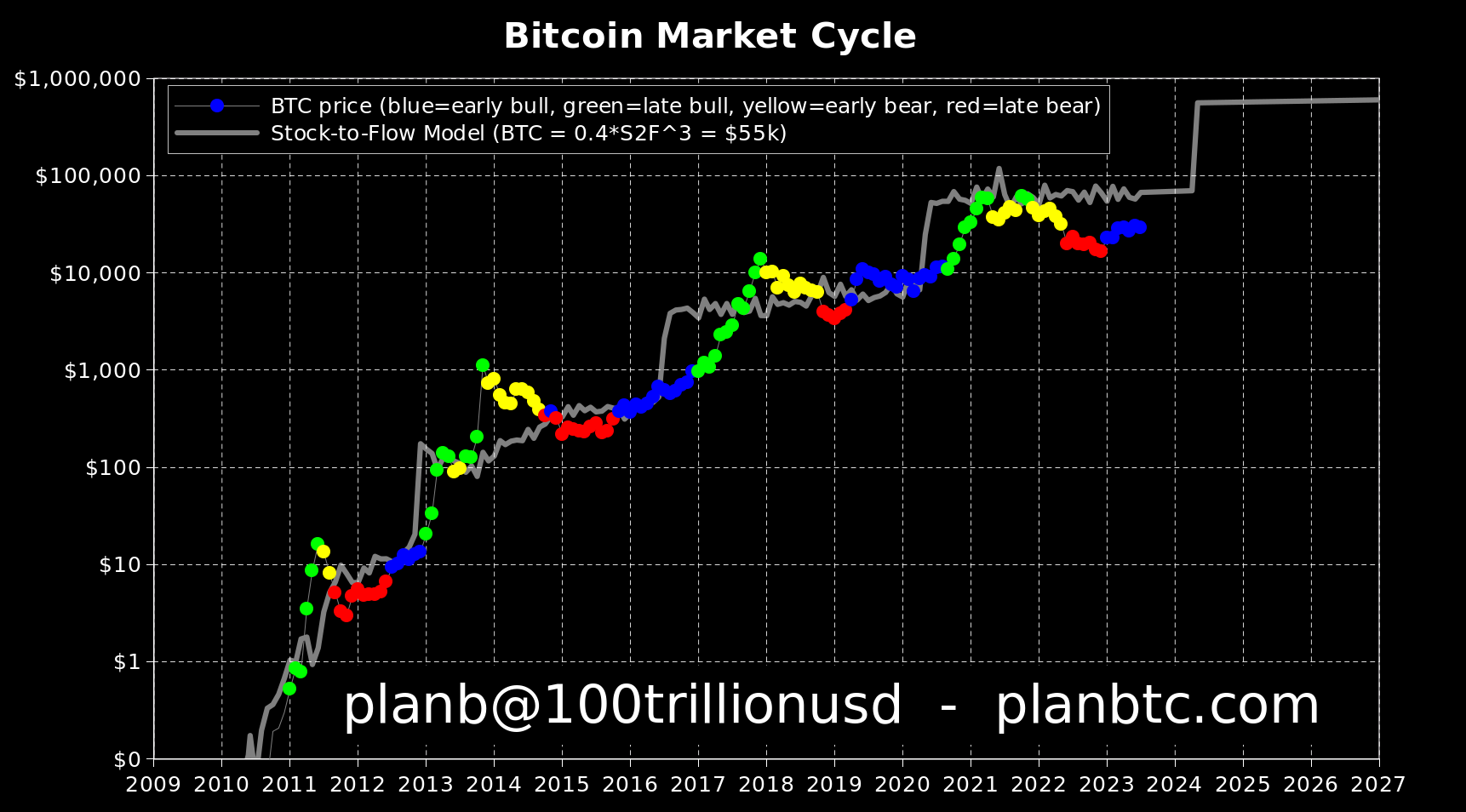

PlanB, one of the most popular analysts in the industry followed by approximately 2 million crypto investors, says that Bitcoin is currently in the early stages of a bull market and that major players like BlackRock could accumulate BTC at lower prices.

How Much Will Bitcoin Be Worth?

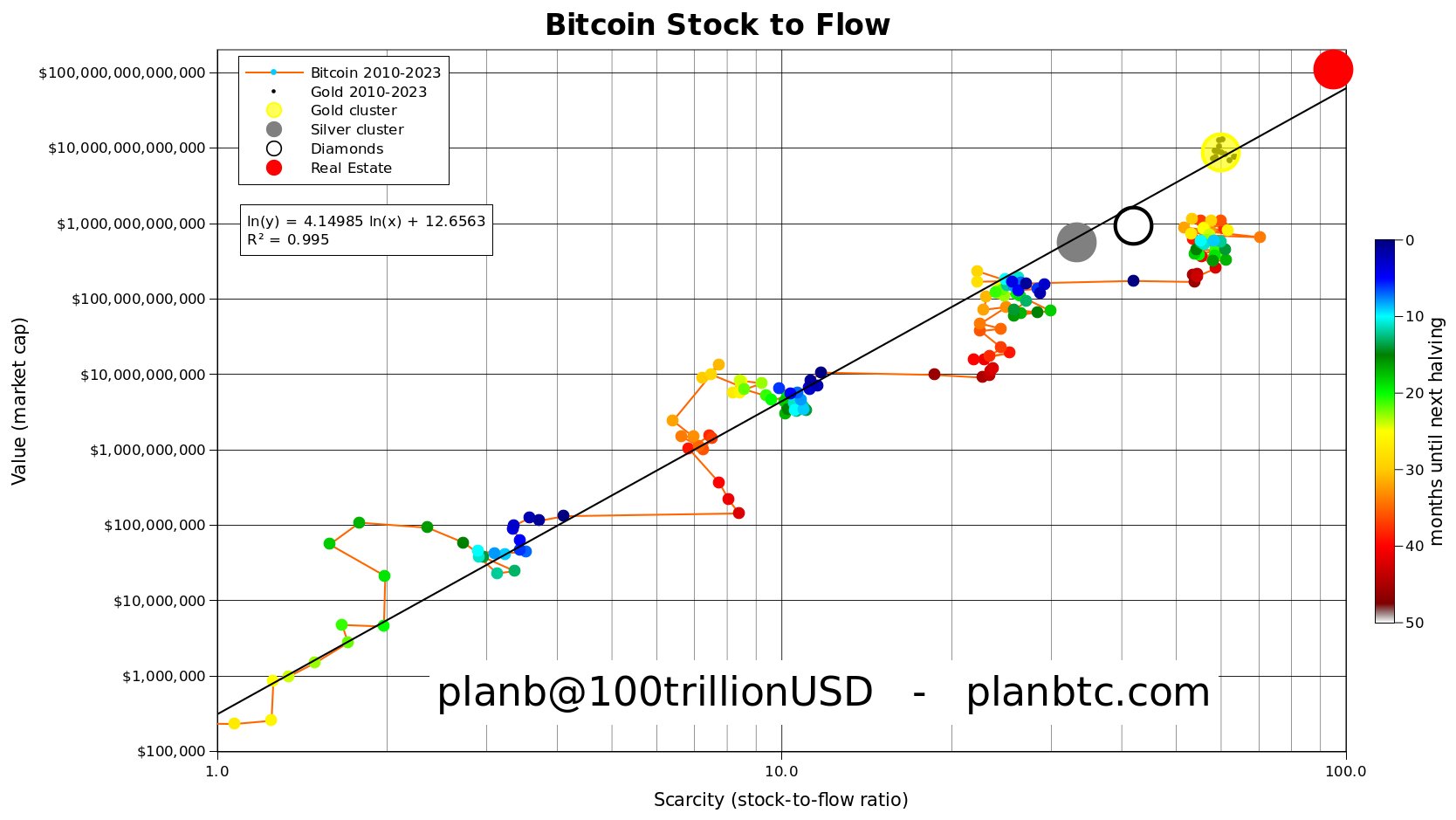

PlanB became famous with his stock-to-flow (S2F) model, which aims to measure the new supply of an asset being printed over time compared to the existing supply. Also known as the stock-to-flow chart, the S2F takes into account Bitcoin production by miners and the increase in demand to make price predictions. According to his model, demand should constantly increase, and since block rewards decrease with halvings, the price should continue to rise.

PlanB claims that the king of cryptos, Bitcoin, will eventually become scarcer than real estate and will have extremely low value compared to other commodities such as gold, silver, and diamonds.

“Bitcoin (S2F 58, market cap $400 billion), gold (S2F ~60, market cap ~$10 trillion), diamonds (S2F ~40, market cap ~$1 trillion)”

In a recent strategy session, PlanB revealed that he expects the price to rise to $50,000 as Bitcoin approaches the next halving.

“The real question is, what will happen to the price of Bitcoin at the halving in April 2024? We can only attempt to predict this from the 200-week moving average…”

The 200-week moving average is currently increasing by about $500 per month, so nine times $500 is $4,500, and the 200-week moving average for Bitcoin is currently just below $28,000, which is $28,000 plus $4,000. Therefore, the 200-day moving average during the halving period will be $32,000. And Bitcoin will be above this, usually about 50% above, indicating that Bitcoin will be in the range of $40,000 to $50,000.”