The leading cryptocurrency Bitcoin (BTC) has maintained its silence and continued to consolidate in light of the upcoming interest rate hike and other critical data from the United States. The leading crypto currency, which dropped below $30,000 at the beginning of this week, continues to trade at the $29,400 level. The prediction of a famous analyst for the leading crypto currency is the answer to many questions that investors are curious about.

The Current Status for LINK

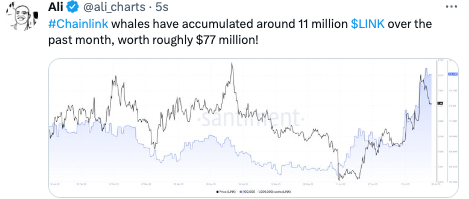

Ali Charts, who gained fame in the industry with his successful predictions during the 2019 bull run, made statements regarding BTC and altcoins once again. The first cryptocurrency analyzed by the analyst was Chainlink (LINK). The analyst stated that whales have recently bought $77 million worth of LINK, which seems to imply something silently.

Although it can be seen that the analyst avoids giving a price here, it is known that such significant purchases have the potential to push the price upwards.

Although it can be seen that the analyst avoids giving a price here, it is known that such significant purchases have the potential to push the price upwards.

Don’t Be Fooled by BTC Price

The famous figure spoke more clearly about BTC. The analyst stated that even if the price of BTC falls below $30,000, the current SOPR data actually shows that those who sell are those who make a profit. SOPR reveals whether the selling wallets made a profit or loss by looking at when they purchased these cryptocurrencies. With the visual and information he published about the topic, Ali reveals that those who are selling now are doing it for profit realization, not out of fear.

By saying not to let short-term price movements affect you, Ali gave a clear signal of a rise. The statements made by the analyst for BTC were the opposite of what he said for LTC.

Things Are Going Bad for Litecoin

The situation is not very promising for Litecoin (LTC), which will soon experience a block reward halving. Although LTC recently experienced some price movement, it is now officially dead! The analyst emphasized in his statement that network activity remained the same throughout the last month and there was no increase in the number of new or active LTC addresses. The analyst pointed out that this indicates decreasing interest, demand, and trading activity, giving a silent but profound warning for LTC.

The price of LTC continues to decline.

Türkçe

Türkçe Español

Español