Some altcoin projects are not affected by the bear market. One of these altcoin projects is Unibot (UNIBOT), which has experienced a surge in popularity due to the rise of Telegram-based cryptocurrency exchanges in recent months. According to Dune Analytics data, Unibot’s revenue and user count have significantly increased last month and this month, while the market value of the platform’s utility token UNIBOT has increased by approximately 200 times.

Telegram-Based Crypto Bot’s Utility Token Soared

The utility token UNIBOT of the Telegram-based decentralized cryptocurrency exchange bot Unibot has seen an over 200-fold increase in the initial capital of its first investors. Furthermore, the price of UNIBOT has risen by 40% in the past 24 hours, reaching $200, and the altcoin’s price has increased by over three times since the beginning of July. Currently, the altcoin project has a market value of $180 million.

Investor interest in UNIBOT is quite inspiring and stems from the fact that Unibot, which offers advanced on-chain trading opportunities, allows token holders to make payments with Ethereum (ETH) based on the revenue generated through the platform. For those unfamiliar, the Unibot platform connects user wallets to the decentralized cryptocurrency exchange Uniswap and enables them to easily trade altcoins using Telegram-based tools, as easy as sending messages to each other in the popular messaging application.

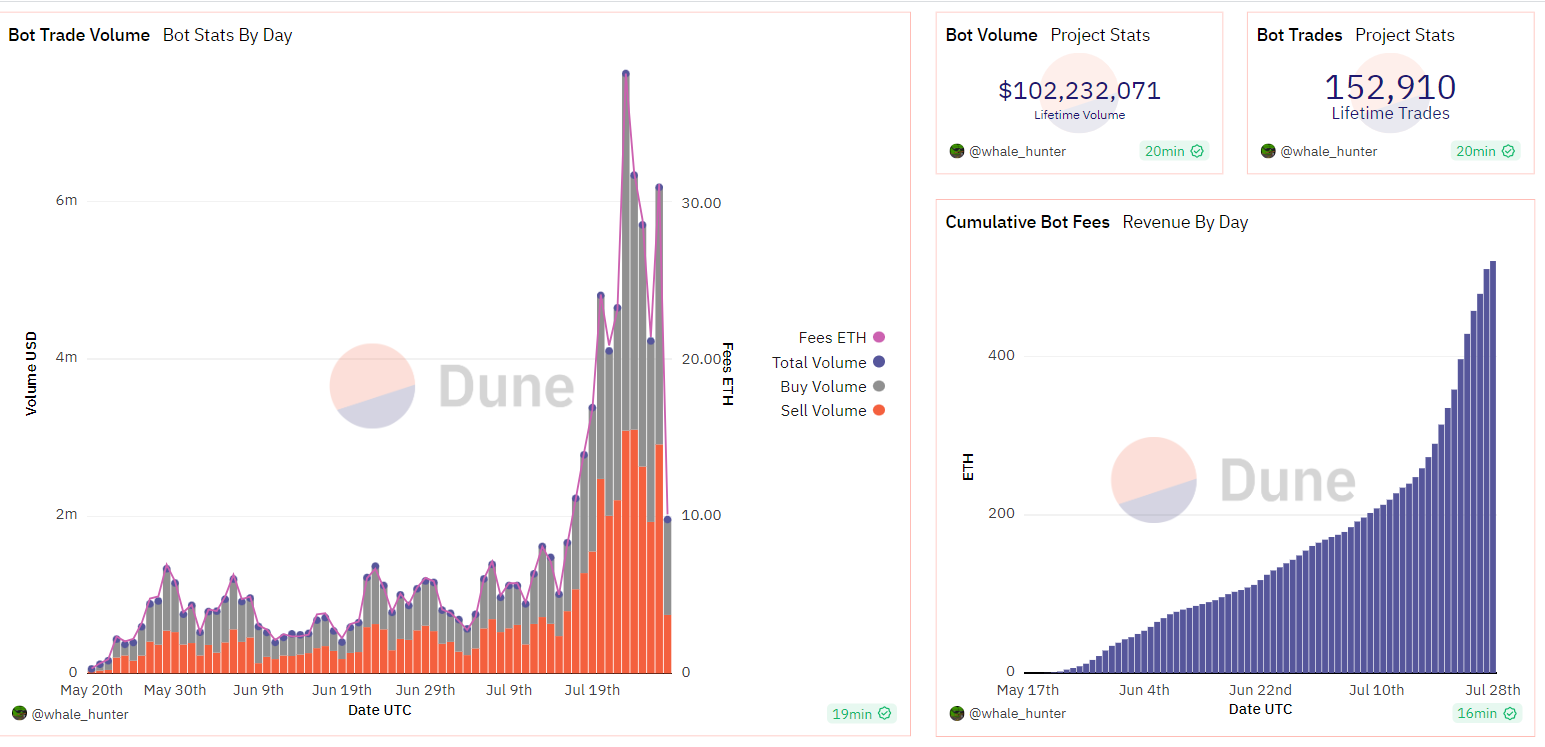

On-chain data shows that Unibot has collected 3,600 ETH in transaction fees since the platform’s launch in May and has directly paid a portion of it to token holders. The platform’s user count, which was just over 2,000 at the end of June, has steadily increased and reached 6,500 on July 27.

Data shows that the average daily trading volume on Unibot is slightly above $5.5 million. This figure is significantly lower than the $900 million trading volume generated in a daily timeframe on the market-leading decentralized cryptocurrency exchange Uniswap, as expected.

The Appeal of UNIBOT

The appeal of such products comes from the ease of use compared to decentralized cryptocurrency exchanges like Uniswap, where users constantly have to log into their wallets, verify the accuracy of all token information, and pay high transaction fees to ensure the execution of their transactions.

The convergence of such benefits and ease of use, along with the sharing of collected transaction fees, is rapidly increasing the demand for UNIBOT, especially under conditions where investors are seeking projects that offer passive payments.