Optimism (OP) recently experienced a surge and gained profits in the past 24 hours. However, the good days may not last long as OP witnesses an increase in circulating supply. The latest tweet from Token Unlocks revealed that millions of dollars worth of OP were released into the market on July 30, 2023. According to experts, as the circulating supply increases, the likelihood of the upward rally of OP coming to an end is high.

Price Surge Accelerates in OP!

After a week of price decline, the token price suddenly gained momentum. According to CoinMarketCap, OP increased by more than 4% in the past 24 hours. At the time of writing, it was trading at $1.56 with a market capitalization exceeding $1 billion. However, the price increase trend was accompanied by a double-digit decrease in trading volume, which is usually a bearish signal. Things could worsen in the short term when 24 million OP, valued at over $36 million, are released into the market. According to Token Unlocks, the newly unlocked tokens accounted for 3.56% of Optimism’s supply.

Currently, 16% of Optimism’s total supply has been released into the market. In simple terms, as supply increases, demand decreases, which can cause a decline in the price of an asset. Therefore, according to experts, the chances of the bull rally of OP coming to a halt are likely. Additionally, the on-chain metrics of the token showed a downward trend despite the recent price increases.

Consequences of High Supply in OP

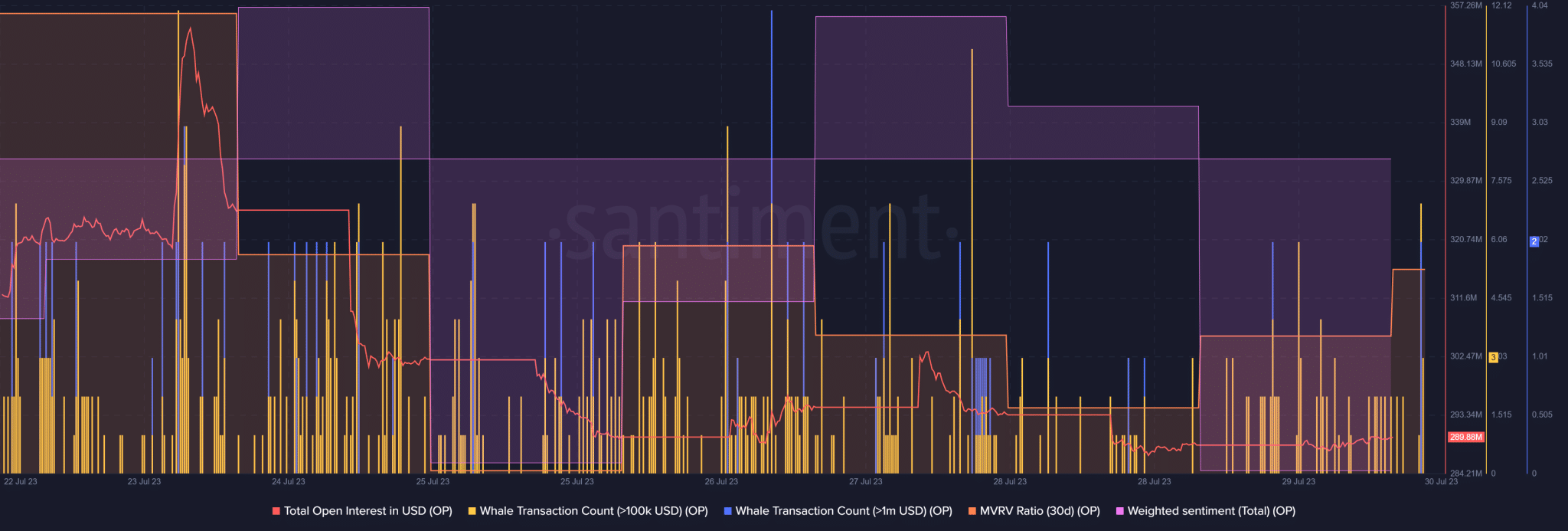

For instance, the MVRV ratio sharply declined last week. As evident from its weighted sensitivity, negative sentiment prevailed around OP in the market. The number of whale transactions decreased, reflecting less interest from whales in token trading. Additionally, Optimism’s open interest declined.

A decrease in this metric can often indicate a reversal of a trend and increase the chances of the upward trend of OP coming to an end. The Exponential Moving Average (EMA) showed an upward trend as the 20-day EMA crossed above the 55-day EMA. The Relative Strength Index (RSI) of OP is rising. The Money Flow Index (MFI) following the same trend could provide hope for the continuation of price increase. Furthermore, the Chaikin Money Flow (CMF) continued its downward trend as it remained below the neutral 0 mark.

Türkçe

Türkçe Español

Español