Blockchain data analytics platform IntoTheBlock announced on Tuesday that the total locked value (TVL) in Ethereum DeFi protocols has dropped by $3.55 billion since Sunday following the Curve Finance hack. The decrease may also be attributed to the sale of CRV tokens by Michael Egorov, the founder of Curve Finance, in order to prevent the liquidation of his debt in the Aave protocol. According to the agreement behind the token sales, investors are required to lock their CRV tokens. They may start selling the tokens once the price reaches the $0.8 level.

$15.8 Million Worth of CRV Sold

The 8% decrease in total locked assets came at a time when Curve Finance founder Michael Egorov sold his CRV tokens to prevent the liquidation of his collateralized loan in Aave, a major DeFi lending institution.

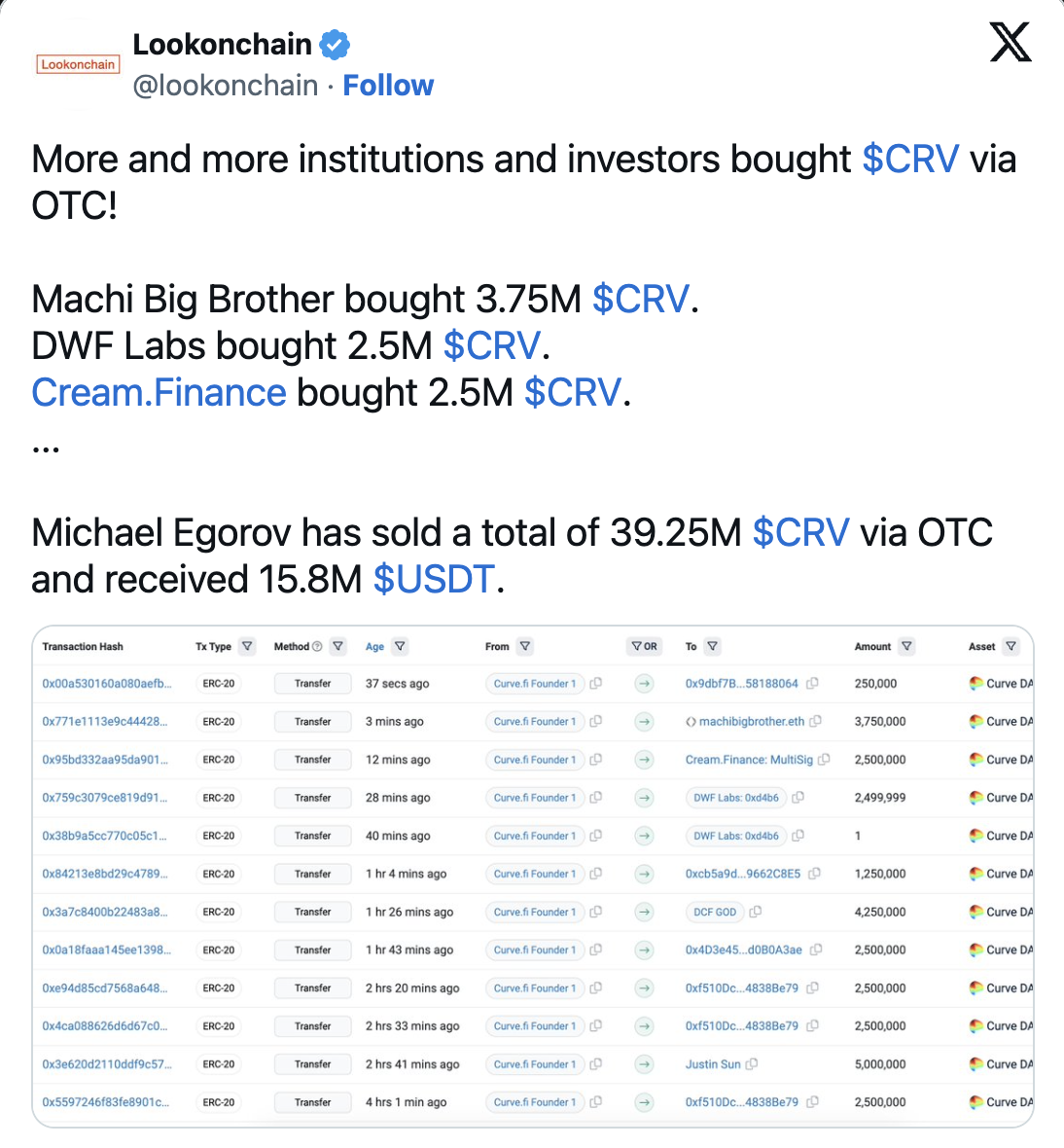

According to DeFi data analytics platform LookOnChain, Michael Egorov, the founder of Curve, sold 39.25 million CRV tokens for 15.8 million USDT. The transactions were reported to be part of over-the-counter (OTC) agreements made with investors such as Justin Sun, the founder of Tron, DFW Labs, DCFGod, and DeFi platform Cream Finance.

Reports indicate that Egorov and the buyers agreed on lock-up periods ranging from three to six months. These investors can sell their tokens if the CRV price reaches the $0.80 level.

Reason for the Sale and Agreement Terms

It is claimed that Egorov’s OTC agreements were an effort to secure his $60 million in Aave with $175 million worth of CRV tokens. The liquidation of Egorov’s Aave loan could trigger a domino effect of bad debt in several DeFi lending services and potentially disrupt the decentralized lending ecosystem.

This scenario can only occur if the price of CRV significantly drops below $0.3, resulting in the liquidation of Egorov’s massive Aave loan. Concerns about this possibility arose after the exploit of factory pools in Curve Finance’s liquidity pools and the subsequent drop in CRV price.

Türkçe

Türkçe Español

Español