Crypto analyst Cowen expects the popular peer-to-peer payment network Litecoin (LTC) to drop after the recent block reward halving, while evaluating the current outlook for the largest cryptocurrency Bitcoin (BTC). Here’s what the analyst had to say about both LTC and BTC.

Warning of “Block Reward Halving Drop” for Litecoin

Crypto analyst Cowen expects the popular peer-to-peer payment network Litecoin to drop after the recent block reward halving, where the block reward given to miners per block decreased by 50%. The analyst stated, “LTC tends to peak in the months of June/July of the block reward halving year, and then fades away during the post-halving period. Past block reward halvings indicate that expectations for LTC should be kept low until 2025.”

Cowen’s analysis, based on historical data for Litecoin, suggests a typical pattern of rising before a block reward halving, followed by a year-long decline and subsequent rise in the following year.

After Litecoin, Cowen shifted his focus to Bitcoin, highlighting the theory that the current rise in the price of the largest cryptocurrency is primarily due to liquidity flowing from altcoins to Bitcoin. Cowen emphasized the fact that while altcoin prices are falling, Bitcoin’s price is rising, which is consistent with the trend observed in previous years before block reward halvings. According to this trend, liquidity continues to flow into Bitcoin until it reaches a point where it is no longer sufficient to sustain the rally in altcoins.

Expecting a Sharp Pullback in Bitcoin

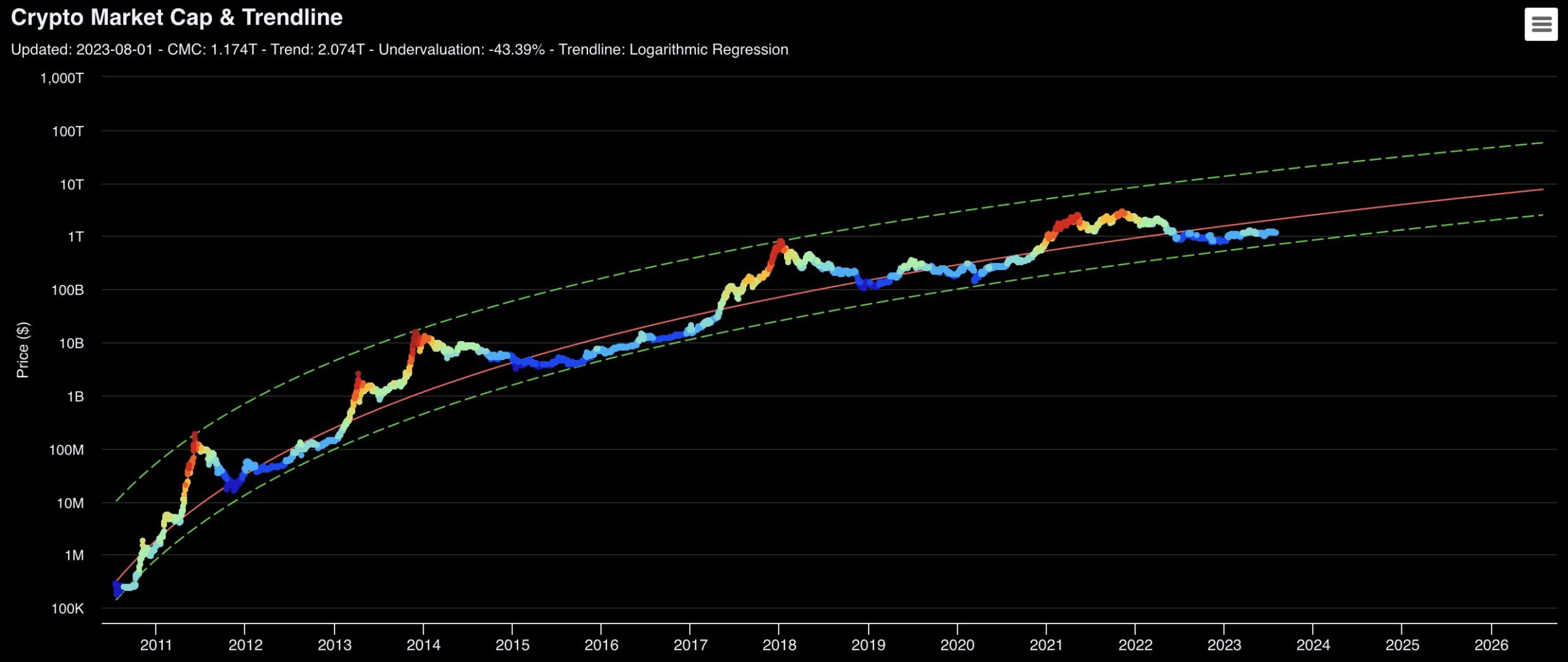

Cowen pointed to two indicators to support his theory: the decrease in the total market value of altcoins (TOTAL3) and the increase in Bitcoin dominance (BTC.D). The analyst stated, “The total market value of altcoins remained flat because most altcoins fell while BTC rose. During this period, BTC’s dominance increased from 39% to 49%.”

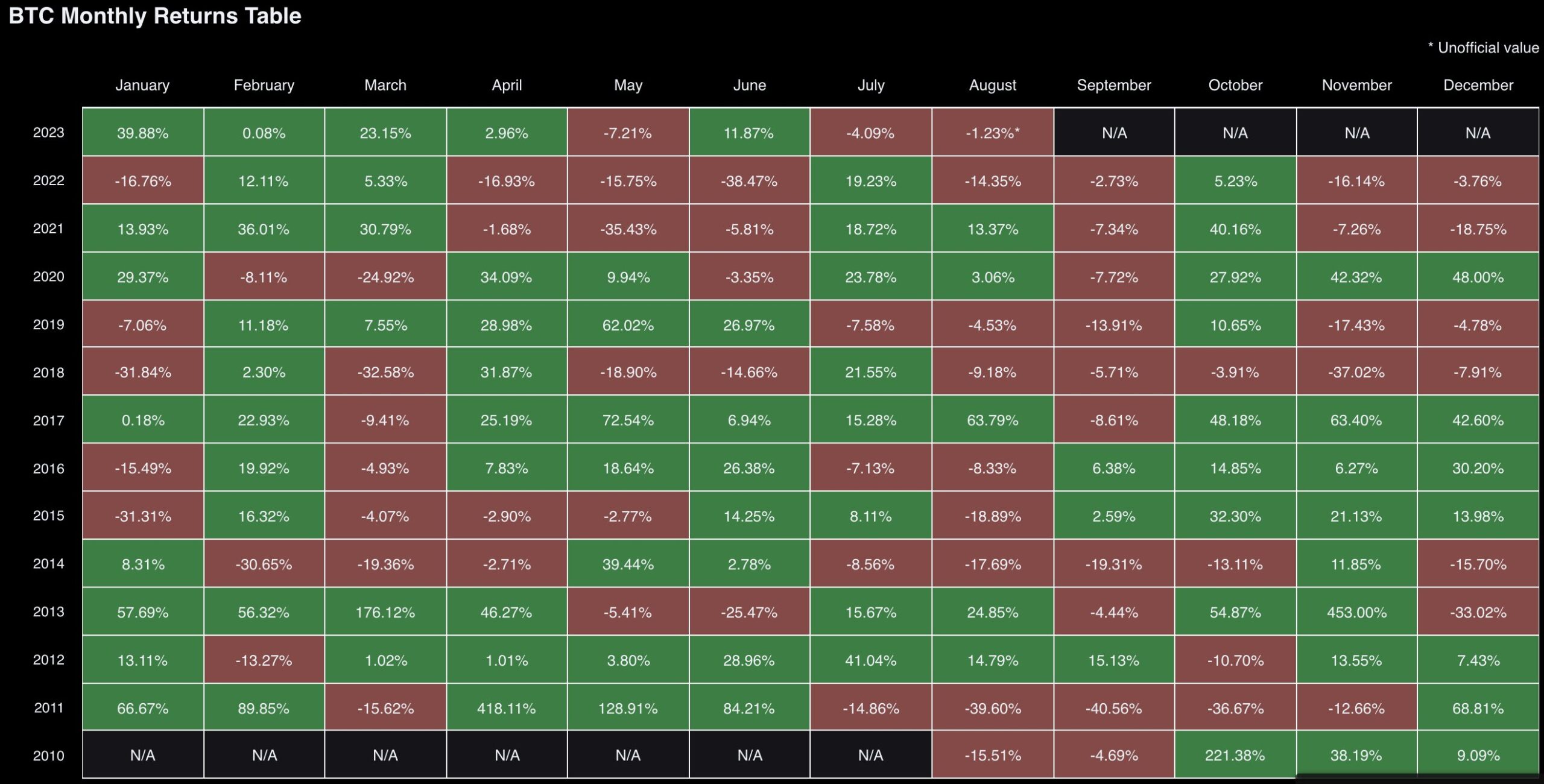

Cowen also predicts a decline in Bitcoin based on the historical price movement observed in previous years before block reward halvings. The analyst noted that in the past three years before block reward halvings, Bitcoin has shown a tendency to fall below the support band of the bull market in August/September. He believes a similar decline is likely to occur this year.

The potential decline in Bitcoin’s price is further supported by the historical average return on investment (ROI) in the years leading up to block reward halvings. Cowen mentioned that in July of those years, Bitcoin’s ROI was negative 4.74%, while the return in July for BTC was negative 4.09%. Based on these figures, he added that it appears likely that Bitcoin could lose more than 20% of its value if it follows the historical trend of August.

Türkçe

Türkçe Español

Español

Nice