The current price is at $29,240 and BTC continues to trade in a tight range. Today’s data did not create much excitement. So what are the experts’ expectations with just a short time left until the weekend? Will we be able to see the expected rise in Bitcoin and altcoins? Here are the details.

Current Situation of US Data

US unemployment rates came in lower than expected at 3.5% compared to the estimated 3.6%, while the number of added jobs was less than anticipated. Financial commentator Holger Zschaepitz stated that the data “did not contain a clear message.” The Kobeissi Letter, in a section of its summary, said that despite rapid interest rate hikes, the job market continued to remain strong. It even went further to define it as the most resilient labor market in history.

As a result, while US stocks and Bitcoin managed to achieve modest gains, the US dollar felt the pressure that could help a more significant recovery in BTC prices. The US Dollar Index (DXY) fell by 0.6% to 101.8, reaching its lowest level in August.

Cryptocurrency Market Forecast

Michael Poppe, the founder and CEO of Eight, says there are reasons to believe that BTC/USD could recover in the next round of macroeconomic data releases. According to him, while DXY is falling, the Bitcoin price is waiting for the upcoming inflation data next week. However, the problem here was the possibility of a weakening of the decline in inflation due to increasing fuel and hourly wages.

Another popular crypto analyst, Skew, said that the ongoing period of low volatility is coming to an end. He said that the decrease in volumes over the weekend and the expectation of a slight decrease in July’s inflation data suggest that an increase in volatility in the next two days would be a surprise.

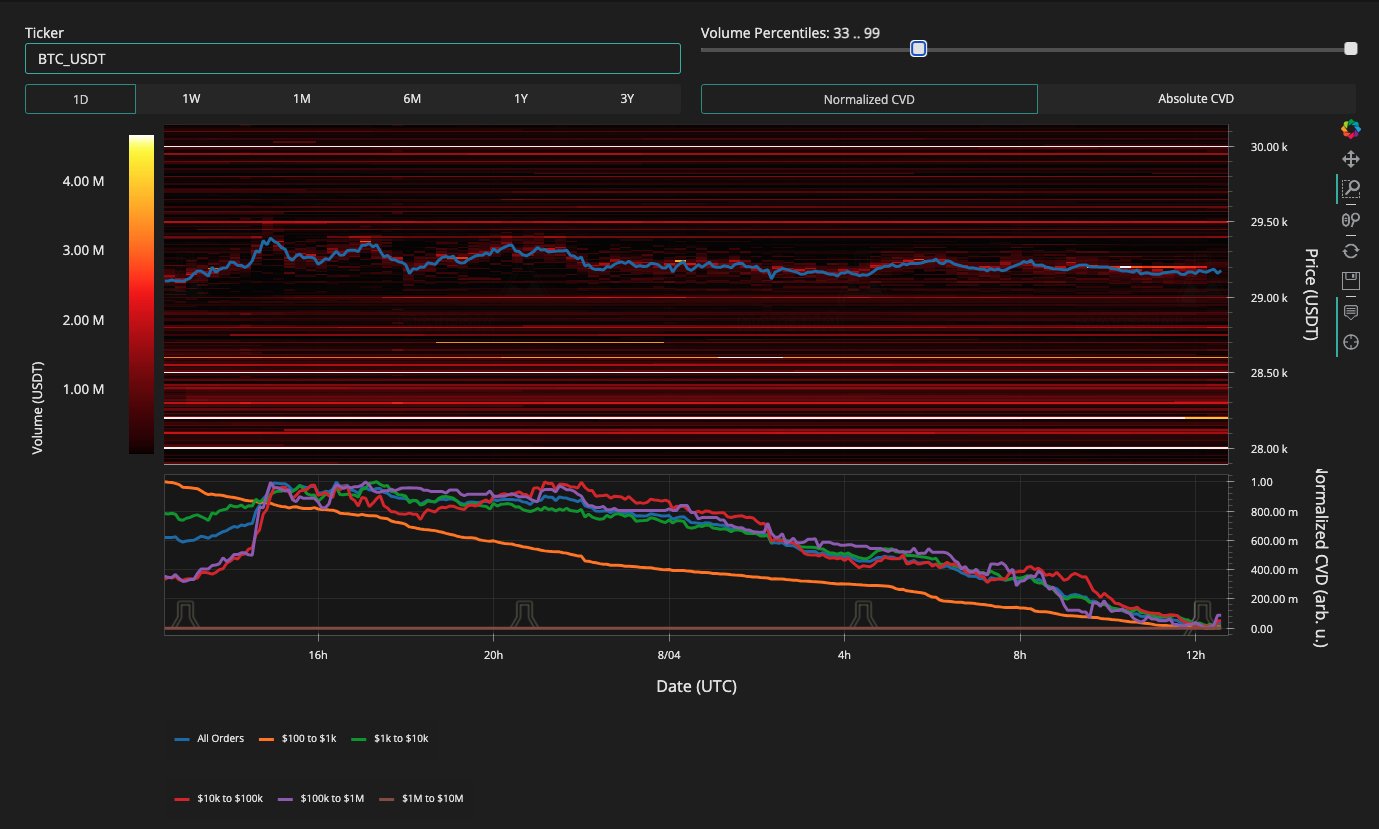

Material Indicators analyst Binance followed the changes in buying and selling liquidity in the BTC/USD order book.

“I feel that we will be stuck above this support zone for this weekend. For now, there is no entry as we are only sticking to the range.”

In summary, the volume-less market has created an environment where it cannot adequately respond to even significant macro developments. Time will tell how much longer this will continue. The weakness in volumes for the past 5 months continues to be the main reason why we have not seen an impressive price movement.

Finally, Crypto Tony predicts further decline.

Türkçe

Türkçe Español

Español

Dollar

My life