The collapse of FTX, which undermined the trust of cryptocurrency investors in centralized exchanges, is still not fully clarified. SBF, which used customer assets for trading, admitted to selling synthetic cryptocurrencies to users. Now, former executive Salame is becoming an informant for more details.

Current Status of the FTX Case

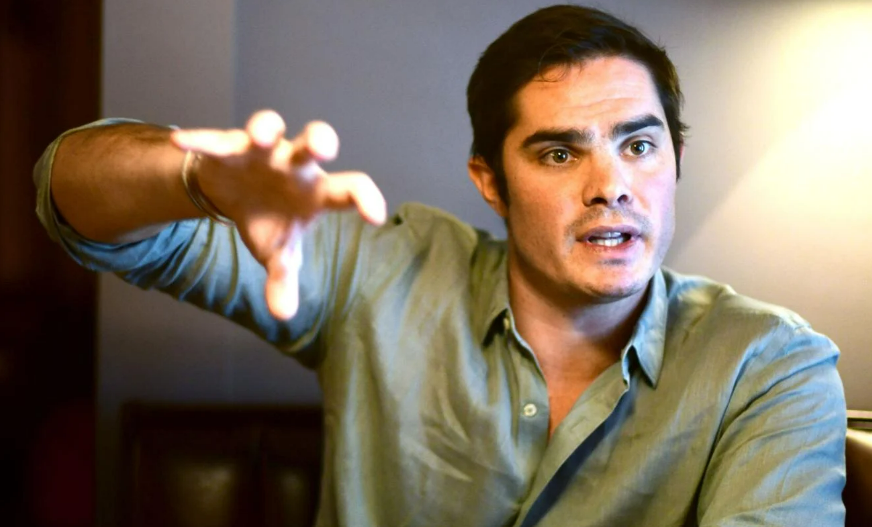

Ryan Salame, the former co-general manager of FTX Digital Markets, is reportedly meeting with prosecutors to become an informant following the collapse of the cryptocurrency exchange. According to individuals familiar with the case who do not want their names disclosed because the discussions are not public, he may admit to various crimes, including campaign finance law violations.

It is still unclear whether Salame will sign a cooperation agreement with prosecutors and testify against Sam Bankman-Fried, the co-founder of FTX. Salame’s former colleagues, Gary Wang, Caroline Ellison, and Nishad Singh, have already admitted their guilt in the alleged multi-billion dollar fraud in the now bankrupt crypto empire and will be present as key witnesses in the government’s case against SBF.

The Nightmare of Cryptocurrencies: FTX

Prosecutors are meticulously working on the FTX case, which they consider one of the largest financial frauds in the history of the United States. Salame played a key role in numerous critical matters during his time at FTX, from million-dollar political donations to the purchase of private jets. SBF, the founder of FTX known for his proximity to Democrats, also has politically influential parents. It is highly likely that his political connections prevented him from being scrutinized by regulators for a long time.

Sam, who was given a prominent position in many hearings on crypto regulations in the US Congress, now emerges as the person responsible for the government declaring war on cryptocurrencies. The SEC stated that chain reaction lawsuits would begin in 2023, openly threatening the industry, following the FTX collapse in November. The regulatory agency that filed lawsuits against Coinbase and Binance exchanges in June caused major companies to flee from crypto in the US jurisdiction.

Many major companies, including Jump Crypto and other massive market makers, have suspended their crypto operations due to regulatory pressure and uncertainty.

Türkçe

Türkçe Español

Español