San Francisco-based Sofi Bank announced in its second quarter earnings report that it held $170 million worth of crypto assets in its balance sheet. The bank, which serves more than 6 million customers in the United States, saw a significant increase in its crypto holdings compared to the previous quarter.

Banking Services Surprised

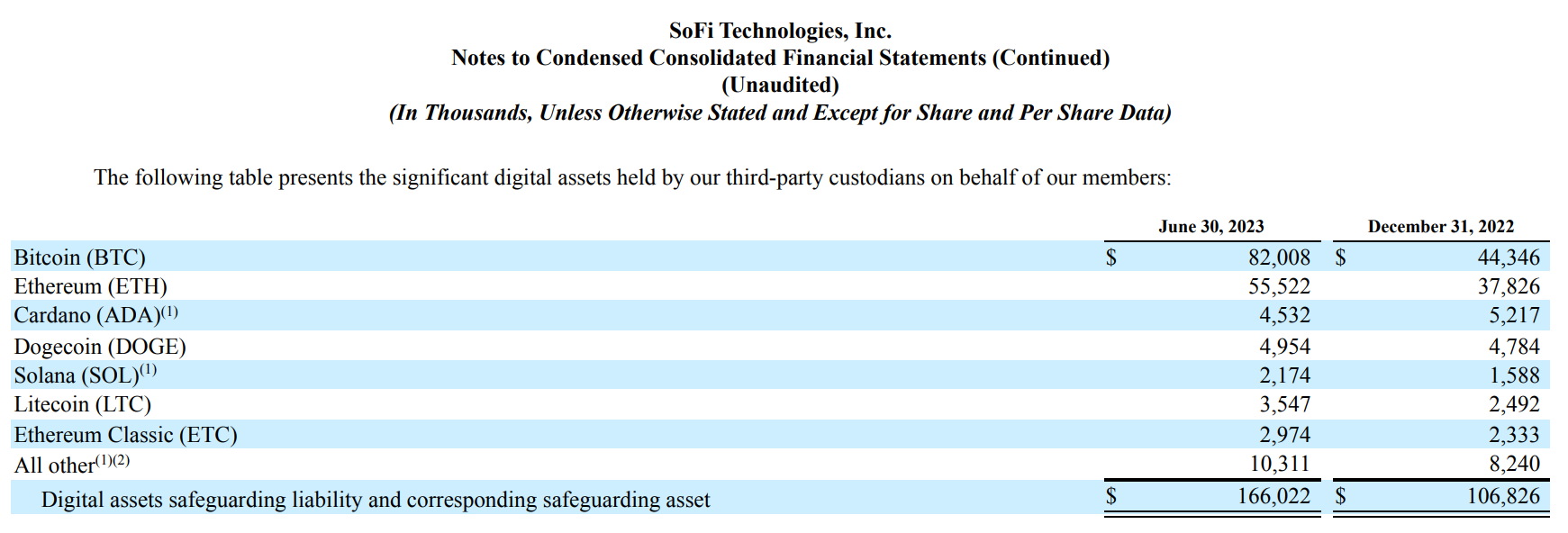

According to the disclosed report, the bank holds Bitcoin, Ethereum, Litecoin, Cardano, Solana, Dogecoin, and Ethereum Classic. Of the total $170 million investment, $82 million is in Bitcoin, $55 million is in Ethereum, DOGE ranks third with $5 million, and ADA ranks fourth with $4.5 million. An investor presentation also revealed that SoFi has onboarded over 500,000 customers and currently supports trading for more than 22 cryptocurrencies.

Sofi Bank not only holds crypto assets but also allows customers to buy and sell various cryptocurrencies, although it does not offer any stake services. The US bank started offering crypto services with Coinbase crypto exchange in September 2019. When it first started offering crypto services, it was not a bank, but it obtained a license in February 2022, making it one of the few fully licensed banks offering crypto services.

Banking Crypto Services

Sofi Bank’s crypto asset service has not been well received by the Federal Reserve and lawmakers. In November 2022, a US Senate committee questioned Sofi’s compliance with banking laws and also mentioned the date of January 2024. US lawmakers rushed to contain the damage and protect customer funds, but regulators blamed the collapse of the bank on the crypto sector, which definitely put a dent in future partnerships of this kind.

The association of crypto with mainstream banking is seen as a crucial step towards mass adoption. However, the collapse of crypto-friendly banks following the collapse of several crypto giants has raised doubts about the future of such associations.