The halving event for the popular cryptocurrency, Litecoin (LTC), took place at the beginning of this month, marking the completion of its third block reward reduction. As a result, LTC miners now receive 50% less reward, leading to a proportional decrease in the speed of new supply entering circulation. So, how did the previous halving event affect the price of LTC and what are the expectations for its future?

Litecoin (LTC) 2019 Halving

Known as the silver to Bitcoin‘s gold, Litecoin has completed a significant halving event, paving the way for further growth and adoption. This event, which occurs every four years and halves the block reward for miners, has raised hopes that the scarcity of LTC will increase demand for the cryptocurrency.

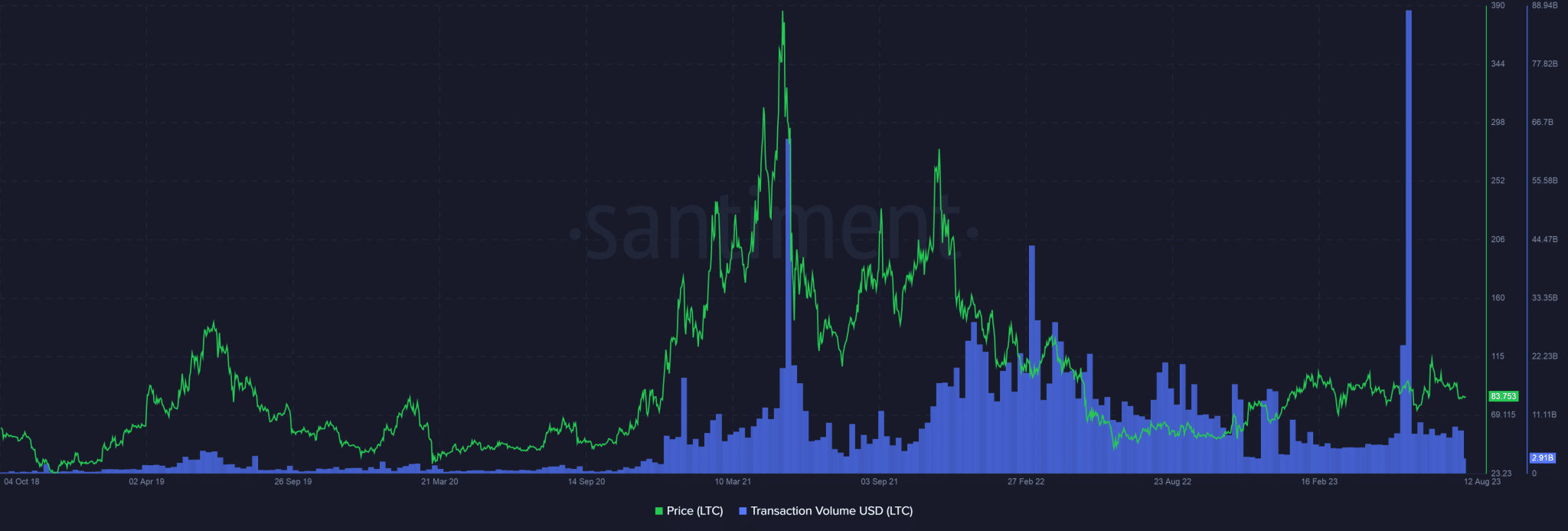

Since the last halving event on August 5, 2019, LTC has come a long way. A recent post on X compared the network’s transaction volume in 2019 with the present, revealing a five-fold increase. These findings are supported by popular on-chain research firm Santiment, which also indicates a significant decrease in the daily volume of LTC coins flowing through the network after the 2019 halving. Despite the ups and downs of the volatile crypto market, LTC has withstood the challenges and gained broader mainstream adoption. As a result, transaction volume has increased over the years.

LTC 2023-2024 Price Predictions

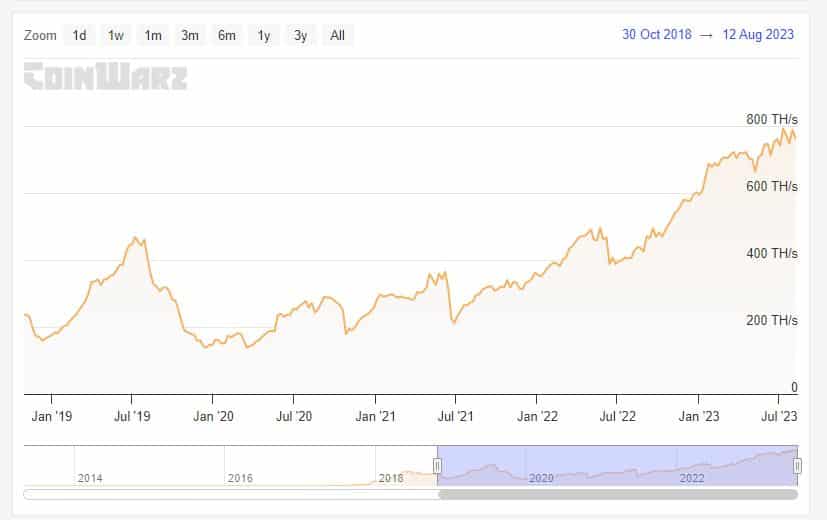

It is evident that LTC has not reached the highest levels witnessed during the 2021 bull market, where daily figures in the double-digit billions were recorded. The increase in transaction volume was driven by a surge in overall transaction count, indicating a growing interest in LTC among individuals. Naturally, mining activity needs to be increased to meet the demand for buying and selling LTC. Consequently, another important variable, the hash rate, has also increased significantly since the last halving event.

Data from Coinwarz highlights that the hash rate jumped from an average of 300 TeraHash per second (TH/s) during the halving year to approximately 783 TH/s at the time of writing this article.

On the other hand, larger investors continue to accumulate LTC, expecting further price increases in the long term. While the price performance has been negative in the medium term after the halving, previous halving events have shown steady network growth. This suggests that the price could rise further in the long run. In conclusion, it is likely that LTC will embark on a new ATH (All-Time High) journey as overall market sentiment improves next year. However, investors will need to see LTC surpass the $120 and $180 levels on a sustained basis.

Türkçe

Türkçe Español

Español