As we approach the last quarter of the year, the price of Bitcoin is not delivering what investors want in August. This period of sideways movement is one of the most frustrating times in bear markets. Although it doesn’t cause as much pain as a decline, it leads investors to move away from the market. Low volatility, especially in futures trading, will cause many altcoins to disappear.

Will Crypto Rise This Week?

The FOMC Minutes will be released tomorrow, but unless there is a surprise detail, it is not expected to have a significant impact on the price. On the other hand, the Fed’s policy is clear, and the latest data indicates that the rapid decline in inflation may have ended. Due to the limited macroeconomic triggers, catalysts will need to come from elsewhere for a change. Whale movements, according to the data, are preparing Bitcoin for a major breakout.

The Bollinger Bands metric has not been as narrow since September 2016 and January 2023. If history repeats itself, Bitcoin’s price should initiate an upward movement during this period of high volatility. However, the same historical data suggests that September generally hosts declines. On the other hand, the delay in ETF approvals and the potential US Department of Justice case against Binance weaken investors’ appetite.

Experts’ Bitcoin and Altcoin Comments

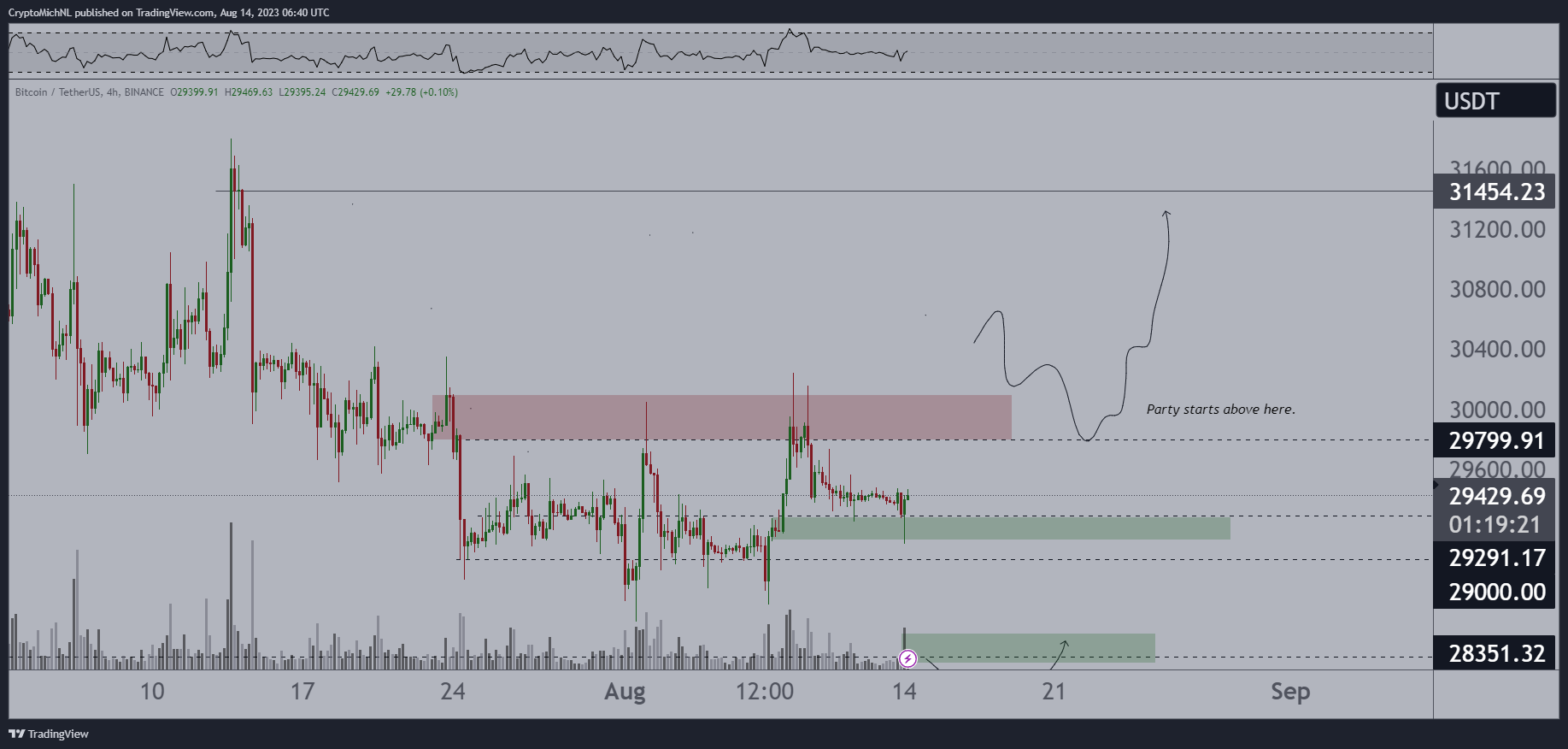

Poppe reiterated that bulls need to regain the level of $29,700. However, BTC did not see the levels of $29,700 and $29,951 except for short-term tests.

Over the weekend, Van de Poppe described the lack of volatility as “extremely surprising” in general.

Daan Crypto Trades also had a similar view on short-term movements and pointed out that even weekend conditions showed an unusually calm tilt towards extreme ends.

“It is dancing around the CME Closing price as expected. It has been a long time since we saw something different. This time the volatility was extremely low. Even for a weekend.”

Rekt Capital argued that the weekly closing should be above $29,250. In his evaluation on social media, he wrote the following:

“BTC moved towards the $30,200 region last week and in April 2023. However, if BTC can close the week above ~$29,250, this upward wick will not indicate a downward trend.”

The Bitcoin Historical Volatility Index (BVOL) is currently measured at 9.57 on a weekly time frame, rapidly retreating to the lowest levels of all time since the beginning of the year. Checkmate, Glassnode’s chief on-chain analyst, highlighted in a post on August 14th that the difference between the Upper and Lower Bollinger Bands for Bitcoin is only 2.9% and is the tightest it has ever been. According to him, this indicates an extremely crazy and significant movement coming.

Türkçe

Türkçe Español

Español