The price of Bitcoin has dropped to $29,150, and the LTC price has fallen below $80. So what’s next? The excitement around halving has led to the idea that this time it could be an exception. However, in the previous two block reward halvings, we witnessed a similar steady decline in price. The price, which recently approached the $100 limit, has now fallen below $80.

Why is LTC Coin Falling?

On August 16, the LTC price fell by over 1.5% to $78.25. While most cryptocurrencies dropped by 0.6%, what it experienced was a complete negative divergence. The downward movement came as part of a broader pullback that began at the beginning of July. Moreover, the previous two halvings already indicated that the price would fall. The “buy the rumor, sell the news” case is a common occurrence in the crypto market.

Litecoin correction was supported by the overbought RSI and weakening buyers after August 2. The demand weakness that has been ongoing for a few weeks has turned into a reality as warned by many analysts. Experts insisted that if there is going to be a rise during the halving period, the price should reach its peak at least 1 month before the halving.

LTC Coin Analysis

Since surpassing the overbought threshold of 70 in RSI, the LTC price has dropped by over 30%. Meanwhile, the price has eroded by 16.5% after the halving. Data tracking addresses holding Litecoin for more than 155 days shows a sense of sustained accumulation. In particular, the monthly Hodler Net Position Change metric turned positive on July 23 and has remained the same since then. In other words, the most loyal investors of Litecoin have demonstrated their upward tendencies towards the market by accumulating LTC tokens before and after the halving.

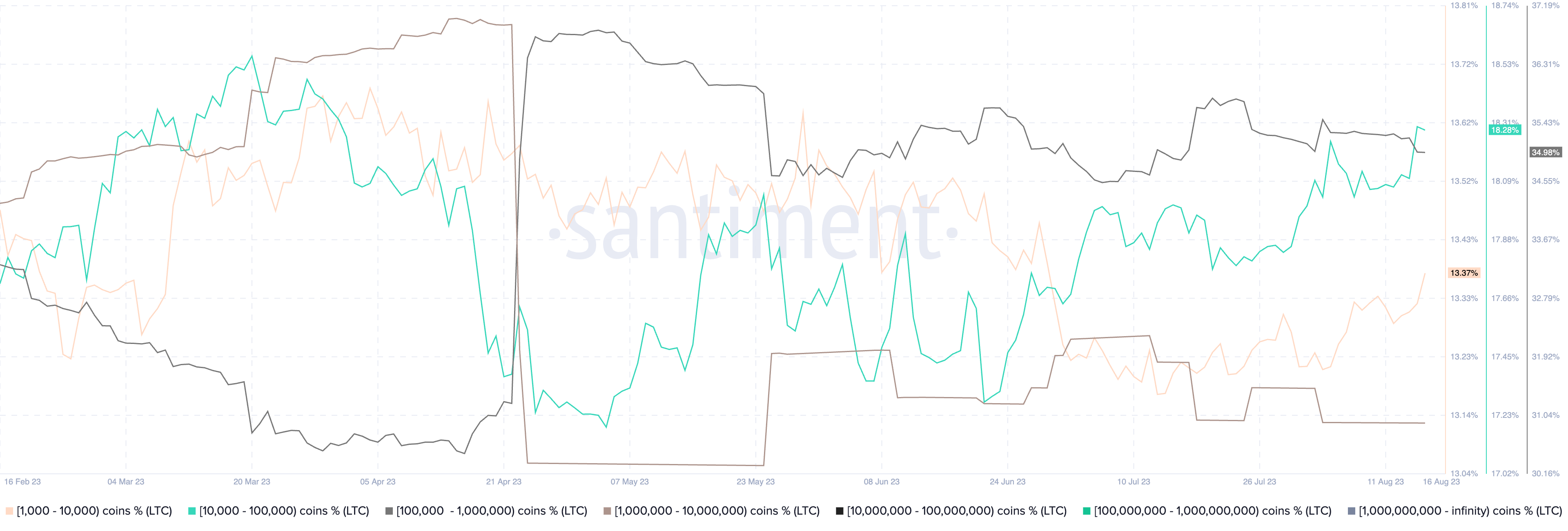

So who made the sales? According to Santiment data, the largest group of Litecoin investors is at the forefront of LTC sales. For example, the Litecoin supply held by addresses with balances between 1 million and 10 million LTC decreased by 0.5%.

Independent market analysts like Rekt Capital were not surprised by the recent drop. According to him, this typical event was bound to happen. However, in the end, the price will discover a period called the “accumulation range” and embark on a new record.

Historically, LTC has experienced a pullback of between -73% and -83% to establish a new Accumulation Range after the Halving event,” he said and added;

“So far, LTC has pulled back by as much as -31% after the last Halving.”

In other words, if the historical cycle repeats itself, Litecoin will retreat towards $40 with a roughly 50% drop from its current price levels in the coming months.

Türkçe

Türkçe Español

Español