Bitcoin (BTC), which has been moving horizontally in a narrow range for a while, suddenly dropped sharply, causing many cryptocurrency investors to liquidate their positions. In the midst of these liquidations, an unidentified investor or commercial institution lost $55 million in a single transaction on the cryptocurrency exchange Binance.

Loss of $55 Million as Ethereum’s Price Drops to $1,434

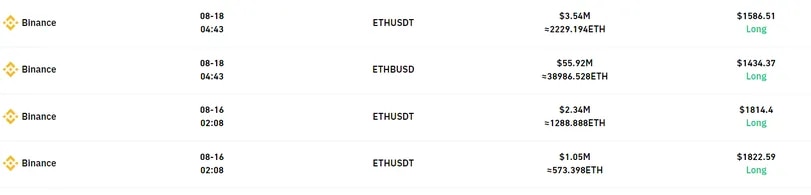

According to Coinglass data, the drop of 10% recorded on August 17th in the overall cryptocurrency market shook many investors, resulting in over $1 billion in forced liquidations. An unknown investor or commercial institution lost $55.92 million in Ethereum (ETH), the king of altcoins, against Binance USD (BUSD) on the Binance cryptocurrency exchange.

The investor’s position size was 38,986 ETH, and the position was liquidated due to Ethereum’s price dropping to $1,434. According to the data, this amount represents approximately 30% of the positions liquidated in futures trading on Binance. This high amount for a single investor indicates that a large company or a major ETH holder suffered a severe blow during yesterday’s sharp drop.

The Fallout from the August 17th Drop Exceeded the Fallout from FTX’s Collapse

As a result of the cryptocurrency market, led by Bitcoin, turning downwards on August 17th, the drop that shook the market as a whole saw Ethereum, the largest altcoin, drop from $1,780 to $1,560, while the trading volume across exchanges exceeded $20 billion from $6 billion. As instability in ETH prices occurred between cryptocurrency exchanges, Binance’s futures market dropped to $1,430.

Immediately after the sharp drop in price, Ethereum’s price partially recovered due to news flow that the U.S. Securities and Exchange Commission (SEC) plans to approve Ethereum ETFs in the country. With the latest data, ETH is trading at $1,680, representing a 6.05% decrease in the past 24 hours.

This drop in ETH price came amidst the largest futures liquidations in over a year. Moreover, the size of these liquidations exceeded the fallout from FTX’s collapse.

Data shows that the sharp drop, which deepened due to false rumors of Elon Musk’s SpaceX selling its BTC assets, resulted in the rapid liquidation of high-leverage long positions in the futures markets or positions opened with the expectation of rising prices. It was later revealed that the allegations of SpaceX selling its BTC assets were unfounded and that the company had only reduced the book value of its assets, which was interpreted by market participants as a sell-off.

Türkçe

Türkçe Español

Español