Jan Happel and Yann Allemann, co-founders of the crypto data analysis platform Glassnode, stated that Bitcoin (BTC) could hit rock bottom if one of these two scenarios occurs after the market decline.

The Quest for Bitcoin’s Bottom by the Duo

Jan Happel and Yann Allemann, co-founders of Glassnode using the name Negentropic, said they are working on two scenarios for Bitcoin to hit bottom. According to the co-founders of the crypto data analysis platform, Bitcoin may gradually decline to the range of $25,000 or face a significant liquidation before hitting bottom:

There are two possible scenarios in the short term for Bitcoin. The first scenario is a slow decline to the range of $24,800 to $25,000. The second scenario is a rapid drop with quick buying resulting in a long wick. In both cases, we will hit bottom shortly after one of them occurs. In the past, when the Risk Signal for BTC reached 100, we saw one of these two scenarios come true.

When looking at the Bitcoin chart shared by the duo, it can be observed that whenever the Risk Signal reaches 100, Bitcoin tends to make a corrective move.

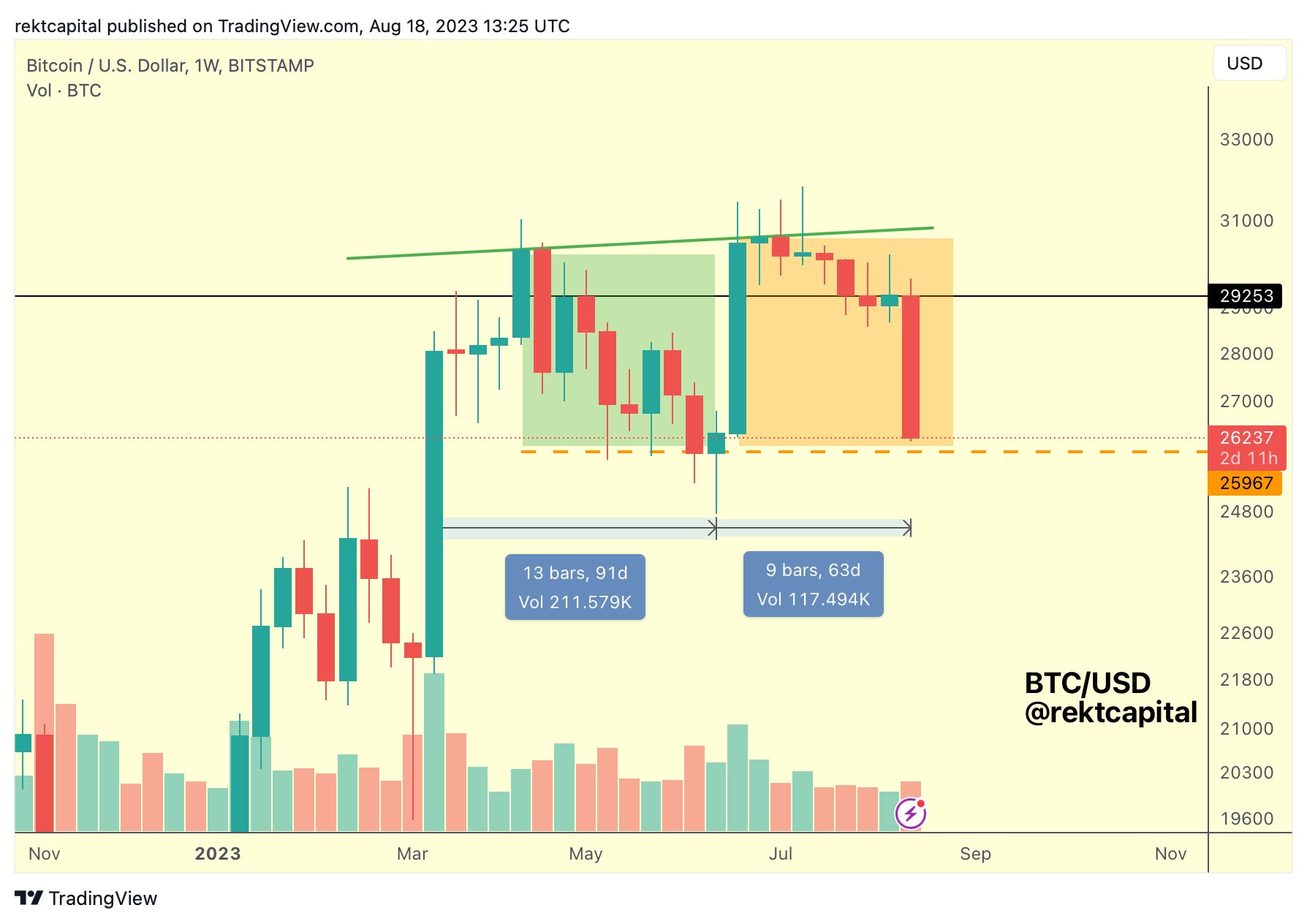

According to Rekt Capital, Buyers Can Continue to Suppress the Price

Anonymous crypto analyst and strategist Rekt Capital also focuses on BTC. The analyst highlights that Bitcoin appears weak after forming a double top pattern. “It took 91 days for BTC to form the first half of the double top. It only took 63 days to form the second half. What conclusion can be drawn from this? The price gradually decreased and respected the supports in the first half but eventually broke them (green box). This recent drop was a drop that did not care about any support on the way down (orange box). It did not react to any support. The orange-boxed area shows how weak the buying pressure is. Buyers are not ready or strong enough to change the course of price movement. Current volume levels also indicate that the selling pressure has not yet reached its peak,” he said.

BTC is currently trading just above $26,000, down 0.91% in the last 24 hours, according to this article. According to the data, the largest cryptocurrency has dropped 10.98% in the last 7 days and 11.74% in the last 30 days.

Türkçe

Türkçe Español

Español