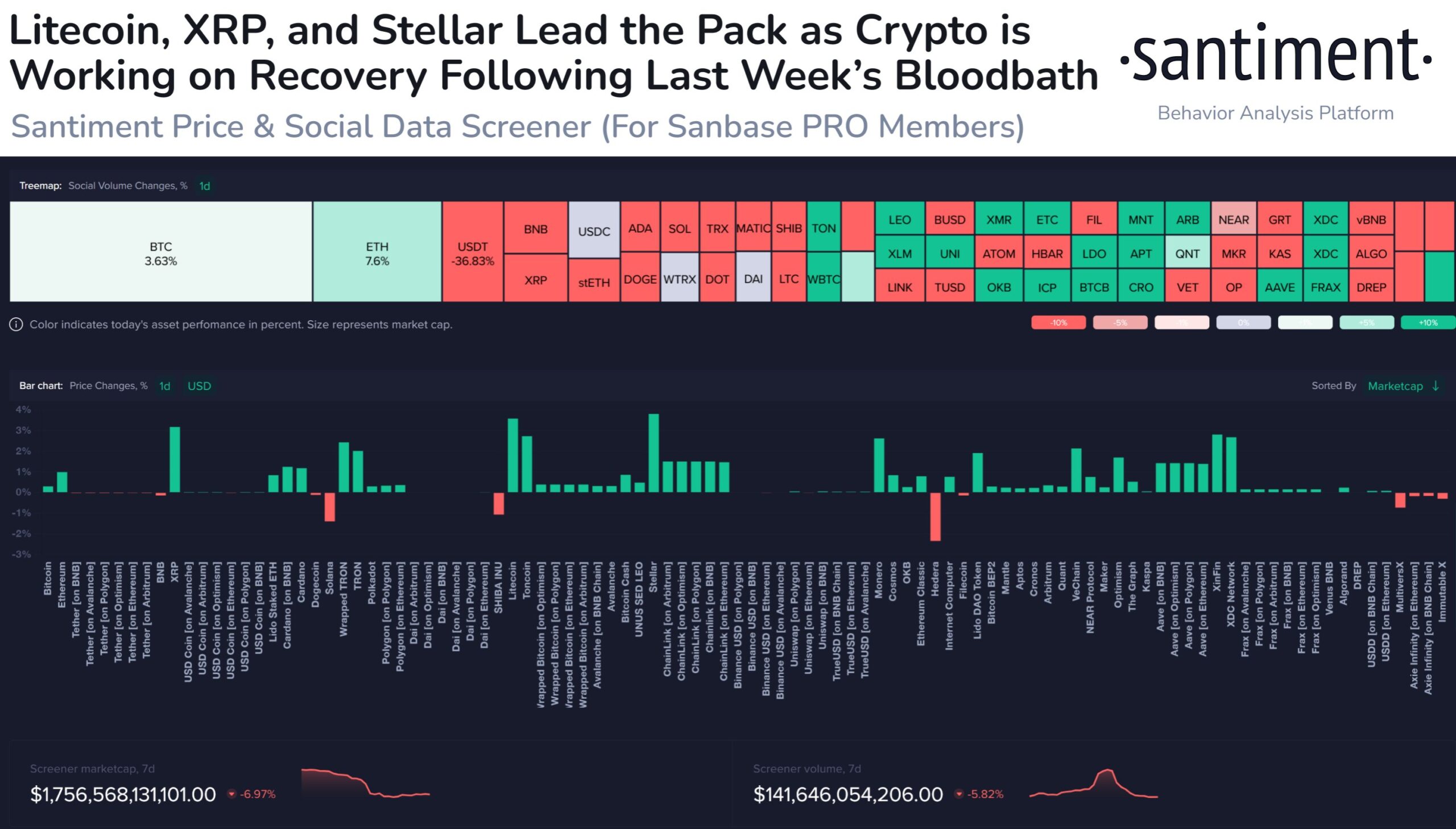

Crypto data analysis platform Santiment reported that after a turbulent week in the cryptocurrency market, XRP, Litecoin (LTC), and Stellar (XLM) showed potential signs of recovery, leading some altcoins.

XRP, LTC, and XLM Give Signals of Upside Potential

Santiment, a cryptocurrency data analysis platform, recently shared on its official X account that XRP, LTC, and XLM showed promising signs of a comeback despite the recent market-wide downturn. Metrics measuring the difference between market value and realized value indicate significant losses for investors, suggesting that the current downtrend may continue but there is a glimmer of hope for some altcoins.

In the past seven days, XRP dropped by 16.2%, but it recorded a growth of 1.9% in the last 24 hours. Despite the overall market decline, this recent uptick indicates some optimism for the altcoin. A similar situation applies to LTC and XLM. Bitcoin (BTC) and Ethereum (ETH), the two leading cryptocurrencies, also experienced respective drops of 11.2% and 9% last week. Binance‘s service token, Binance Coin (BNB), also dropped by over 10% during the same period.

The cryptocurrency market is known for its rapid price changes and significant movements. Factors such as regulatory changes or macroeconomic events can greatly impact the industry. At this point, the ongoing legal intervention by the U.S. Securities and Exchange Commission (SEC) takes center stage.

Recently, the SEC appealed the July court ruling that stated Ripple’s XRP sales on the secondary markets did not lead investors to expect profits based on the efforts of others and that XRP distributions for services offered were not securities. While the appeal focuses on the offers and sales of XRP, it argues that the altcoin clearly falls under the security classification.

An Intense Week Begins for the Crypto Market

Meanwhile, the cryptocurrency market is starting an intense week. Important decisions regarding the spot Bitcoin ETF are expected to be announced throughout the week. Nate Geraci, the president of consultancy firm The ETF Store, mentioned in his recent personal X account post that the court could announce its decision on Grayscale’s appealed spot Bitcoin ETF around August 22nd at around 6:00 PM, and there could be developments regarding the upcoming decisions on numerous spot Bitcoin ETF applications, including the spot Bitcoin ETF application made by BlackRock.

Especially with the appeals court’s decision coming before SEC’s pending spot Bitcoin ETF applications, it indicates that the most significant development of the week will be the Grayscale ruling by the court.

Türkçe

Türkçe Español

Español