The expected halving scenario has occurred, which has greatly supported the decline in BTC price. Kryptocurrency investors are looking for signs of recovery after the recent drop. Not every drop may be an opportunity for buying, but we have seen in the past that many similar extreme sales have brought gains. So, what do the current data indicate for LTC?

Litecoin (LTC)

The price of Litecoin (LTC) dropped by 24% on August 17, reaching $56, the lowest level of 2023. The third halving had the same result as the previous two. It is not surprising for old investors that the price, which recently exceeded $100, has now dropped by 50%. On-chain data provides clear signals about previous halving periods. If the continuation of previous halving periods occurs, similar to the decline, LTC can provide a profit opportunity.

The price of Litecoin (LTC) experienced a double-digit decline on August 17, completing the unwanted trilogy of collapses after the halving events that extended until 2015. Historical data trends indicate that there could be light at the end of the tunnel for LTC holders in the coming months.

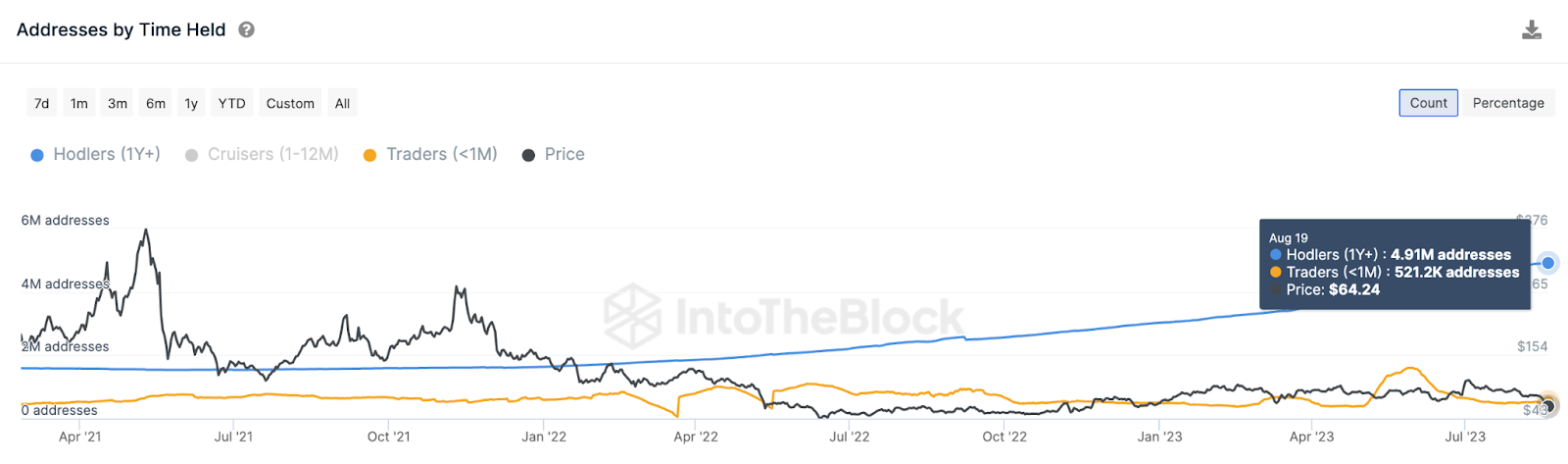

In the Litecoin network, numerous signals of decline have emerged since the Halving event on August 2, from the decrease in whale transaction volumes due to miner sales. The most significant of these stands out in LTC long-term investor addresses.

In context, when the Litecoin price reached its lowest levels in July 2021 and June 2022, the number of Litecoin long-term holders increased by 100,000 and 870,000 addresses, respectively. In both cases, this resulted in a price recovery of 32% by the end of 2021 and a 60% recovery for 2022.

According to data compiled by IntoTheBlock, a similar trend appears to have emerged after the Litecoin price crash last week.

LTC Coin Price Predictions

Although the price dropped to $56, the lowest level of 2023, Litecoin long-term investors once again showed resistance instead of abandoning the ship. As mentioned above, the number of long-term investor addresses increased by around 10,000. Accordingly, we may see a new rise supported by the long-term investor group.

Mathematically, if the number of long-term investors continues to increase, a rapid recovery can be observed as seen after LTC reached its lowest levels in 2021 and 2022. This indicates that the price can reach $100 again.