For crypto investors, the movements of professional traders and investment funds have always been important and worth considering. Therefore, in addition to fundamental and technical analysis, crypto whale wallet movements are closely monitored by investors. These managed wallets sometimes make buy/sell decisions based on their ability to accurately predict rises or falls. Of course, we cannot claim that they can see the future.

Ethereum Whale Movements

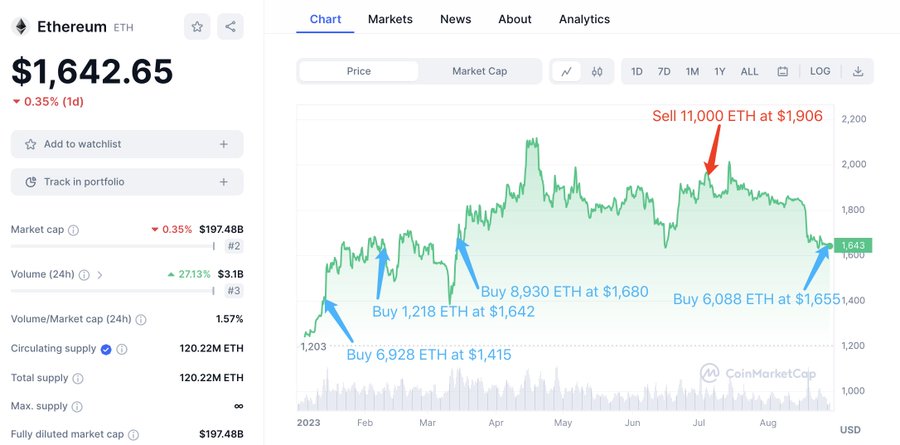

A crypto wallet belonging to 1inch Investment Fund recently made significant purchases of Ether in large amounts, shortly after converting its dollar-cost averaging (DCA) purchases made during the first quarter of 2023 into cash. The blockchain analysis account that follows and reports on experienced traders in the cryptocurrency field announced this.

The purchase move announced by Lookonchain is quite significant. The same account had previously reported on purchases that were leading indicators of the rise of PEPE Coin before June. According to the company, the wallet affiliated with 1inch purchased a total of 6,088 ETH at a price of $1,655, which means the company spent over $10 million for the purchase.

According to blockchain data, the wallet purchased approximately 17,000 Ether at an average price of $1,569 in three instances including January 13, February 9, and March 14. The company spent a total of approximately $26 million for these transactions.

When the price of Ether reached $1,906 on July 5, the wallet sold 11,000 ETH for a total of $21 million. This brings the wallet’s profit from Ether transactions alone to $3.7 million. The wallet currently holds various digital assets worth a total of $80 million.

Due to the continued BTC volatility and reluctant buyers, the ETH price continues to stay below $1,700.

1inch Coin Analysis

The overall lack of volume in the cryptocurrency markets has caused many altcoins, including 1inch Coin, to experience extreme sell-offs. As of the time of writing today, the price stands at $0.2439. After the steady decline from the resistance at $0.6 on July 17, the price has halved in about a month. It is not surprising in an environment where cumulative volume has dropped to $14 billion. Sellers who want to diversify their risk or need cash are causing the price to go even lower. However, the good news is that the amount of open trades in the Binance BTC/USDT order book is increasing. This creates expectations that things could turn around in the short and medium term.

Speaking of the 1inch Coin price, the critical support is at the $0.236 region. If the price breaks this level and closes below it, it could drop to its all-time low (ATL) level of $0.2. It wouldn’t be surprising as many altcoins are currently experiencing ATLs. On the other hand, a real turnaround requires closing above the $0.25-26 range.

Türkçe

Türkçe Español

Español