China’s indebted real estate company, Evergrande Group, has filed for bankruptcy in the US, causing concerns about its effects on the global economy and cryptocurrency. This situation represents one of the largest debt crises in the world and will have significant consequences.

However, the news of Evergrande’s collapse has also raised concerns in the crypto space, which is not surprising. Many fear that Evergrande’s downfall will have a cascading effect on already vulnerable crypto assets in the financial markets, while the increased crypto volatility may offer a glimmer of hope for investors.

Market Uncertainty and Volatility

The collapse of a major financial player like Evergrande can create uncertainty and volatility in all asset classes, including cryptocurrencies, and it is undeniable that the crypto market is volatile. This applies even to Bitcoin, as concerns about China have led to a decline in crypto assets, and leading analysts report that the downturn in the crypto market is not a major concern. However, investors are still rushing to liquidate their crypto funds, likely due to fears of China’s crisis disrupting the world’s largest financial balance.

Investors may turn to crypto assets as a hedge against traditional markets or sell their crypto holdings to offset losses elsewhere. Additionally, volatility is used by professional investors to profit by selling during recoveries and buying at dip levels. Bitcoin miners, despite the increasing difficulty of mining, continue to hold their funds.

Liquidity Crunch

If Evergrande’s collapse leads to a tightening of credit markets, liquidity may become scarce. The mass liquidation of crypto assets to cover losses or meet margin calls can temporarily cause a price drop. The allegation that a portion of Tether‘s support will be in Evergrande commercial paper is not encouraging for one of the most valuable stablecoin companies in the market.

Tether is highly active in Asia, and there are concerns that some of its assets may be tied to Evergrande’s commercial paper. Therefore, Evergrande’s collapse would be bad news for Tether and the market as a whole. Although Tether recently issued a statement stating that it does not hold any Evergrande paper, it does not mean it is completely immune to Evergrande-related risks. Ultimately, this situation can lead to a wider liquidity crisis in the industry.

China’s Impact on the Crypto Market

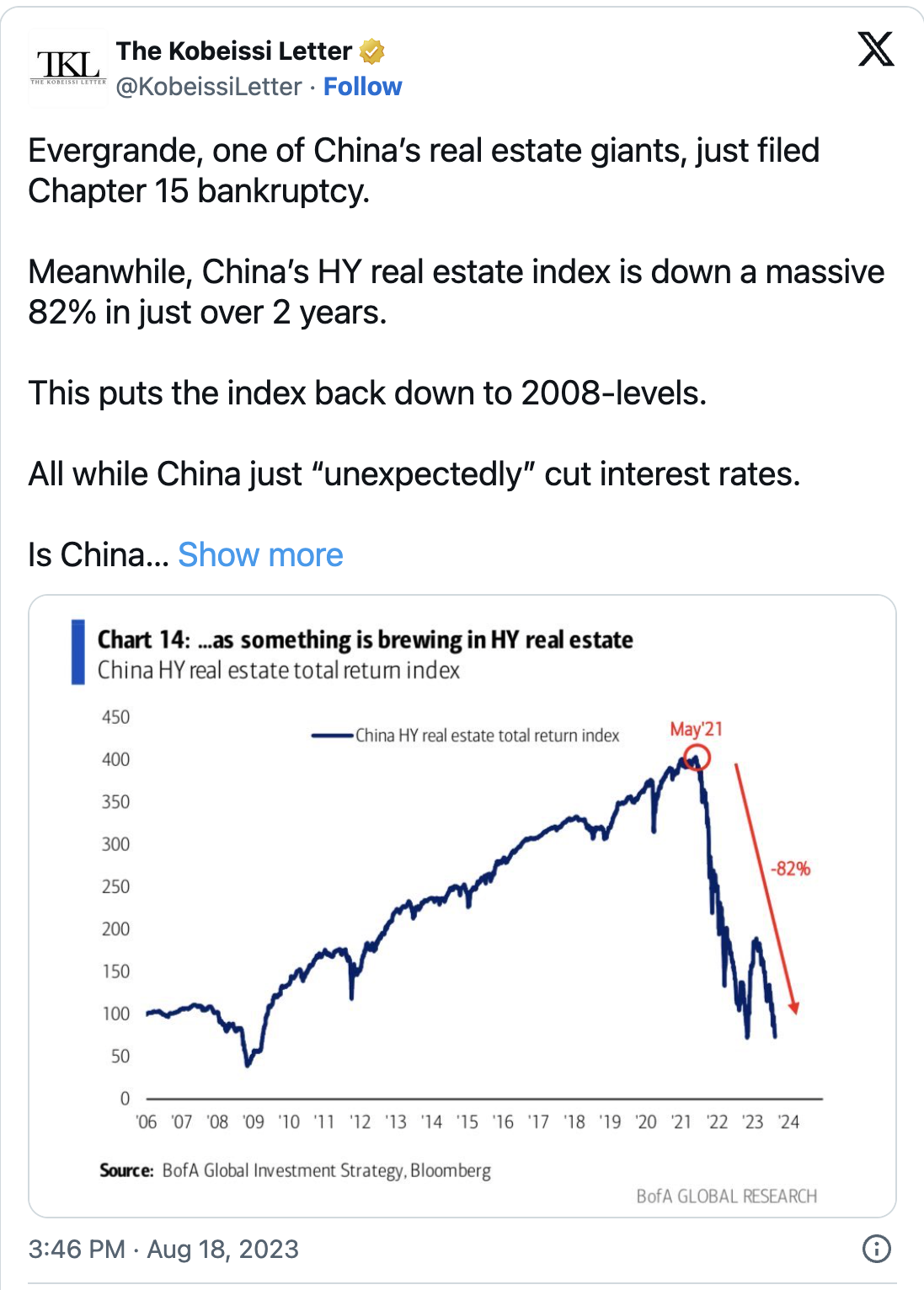

It is undeniable that Evergrande’s collapse comes at a sensitive time for the Chinese economy. The impact of the collapse has already affected banks, small suppliers, and global markets exposed to Evergrande’s debt. Considering Evergrande is a Chinese company, its collapse may have specific effects on the crypto market in China.

These effects stem from concerns about Tether’s assets and the vulnerability of crypto in broader market downturns. Given China’s complex relationship with cryptocurrencies, any financial instability can lead to regulatory changes affecting the adoption or trading of cryptocurrencies within the country. It is evident that the challenges faced by Evergrande are part of a much larger set of problems, including the global sell-off of Chinese stocks.

Macroeconomic Assessment

Evergrande’s collapse is more than just about the company itself. China is one of the world’s leading economies, and Evergrande is one of the largest companies in the Chinese economy. Therefore, the collapse has significant macroeconomic implications. If there is a broader economic downturn, cryptocurrencies can provide a “safe haven” asset. Due to their limited supply and independence from national governments, crypto assets can be crucial during times of crisis.

In other words, in times of desperation, leaders and developers are encouraged to think outside the box and come up with effective and unique solutions. For example, Bitcoin emerged after a crisis, and the crypto market was developed as an alternative to the traditional economy. It is difficult to say whether events in the overall economy will truly threaten the crypto markets. A global economic slowdown should not significantly affect the price of cryptocurrencies, and they should be seen as a speculative asset.

Therefore, Evergrande’s collapse could be an opportunity for the crypto market. The collapse of traditional structures and the encouragement of a distinction between traditional and crypto economies can accelerate interest in decentralized financial solutions.

Türkçe

Türkçe Español

Español