The cryptocurrency market value is currently declining due to the disruption caused by the US Securities and Exchange Commission (SEC) this week. The SEC’s decision to postpone Bitcoin ETF applications resulted in a 3.7% drop in the cryptocurrency market. While Bitcoin lost 4.5% of its value, the liquidation of long positions had an impact. The strengthening of the US dollar also negatively affects the cryptocurrency market. However, technical analysis indicates potential recovery in September.

SEC Delays Bitcoin ETF Applications

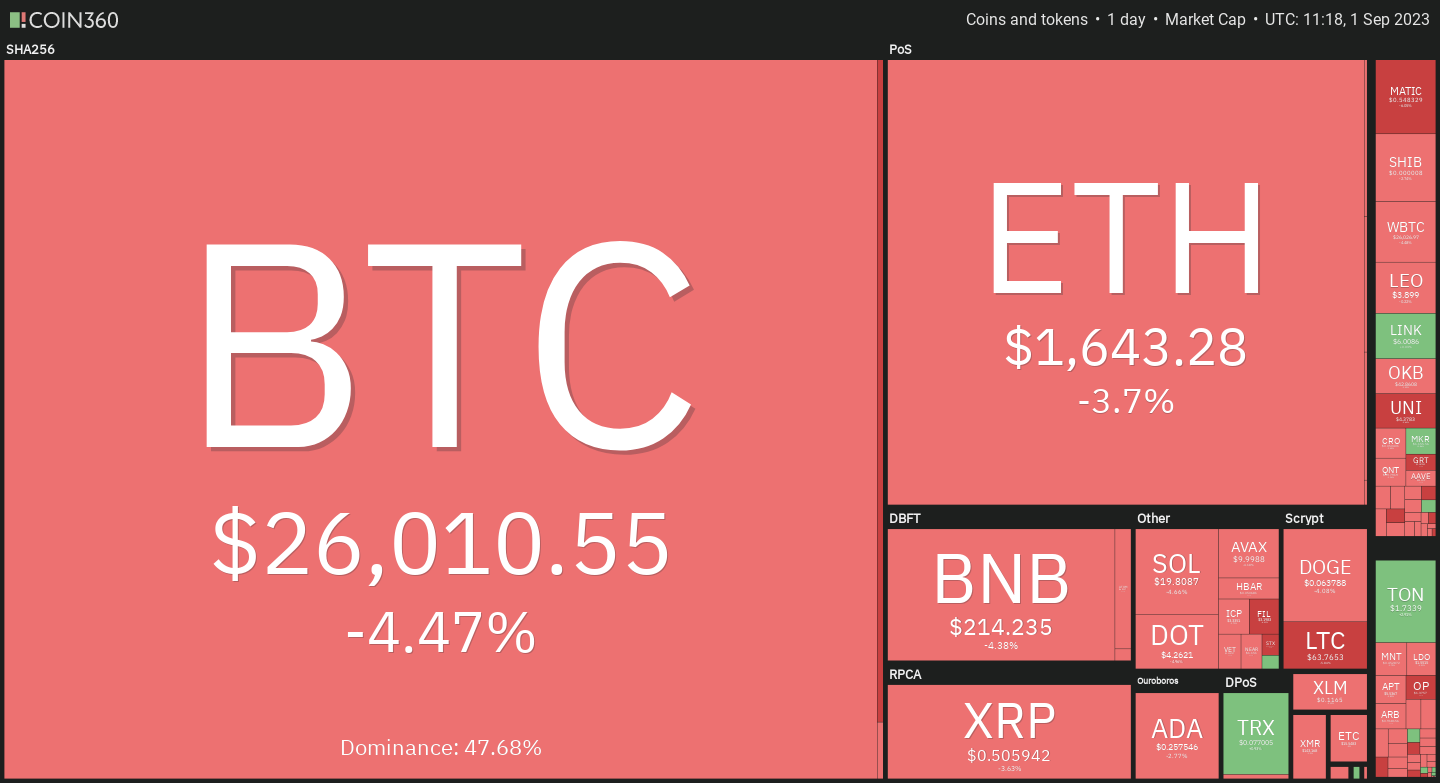

The total value of all cryptocurrencies decreased by 3.7% in the last 24 hours, reaching $1.02 trillion on September 1st. Bitcoin, which constitutes almost half of the cryptocurrency market, lost 4.5% of its value in the last 24 hours. The sell-off began after the SEC postponed its decision on six spot Bitcoin ETF applications, including BlackRock’s, until October. The losses continued as Bitwise, one of the Bitcoin ETF applicants, withdrew its application following the SEC’s delay.

The cryptocurrency market was eagerly awaiting the SEC’s approval of a Bitcoin ETF in the US, as it was expected to attract institutional investors and bring more capital to the crypto sector. On August 29th, after a federal court directed the SEC to reconsider the application of Grayscale Investments, a crypto asset manager, to launch a Bitcoin ETF, the crypto market and BTC price increased by over 5%. These gains have now been erased.

Long Liquidations Have a Greater Impact

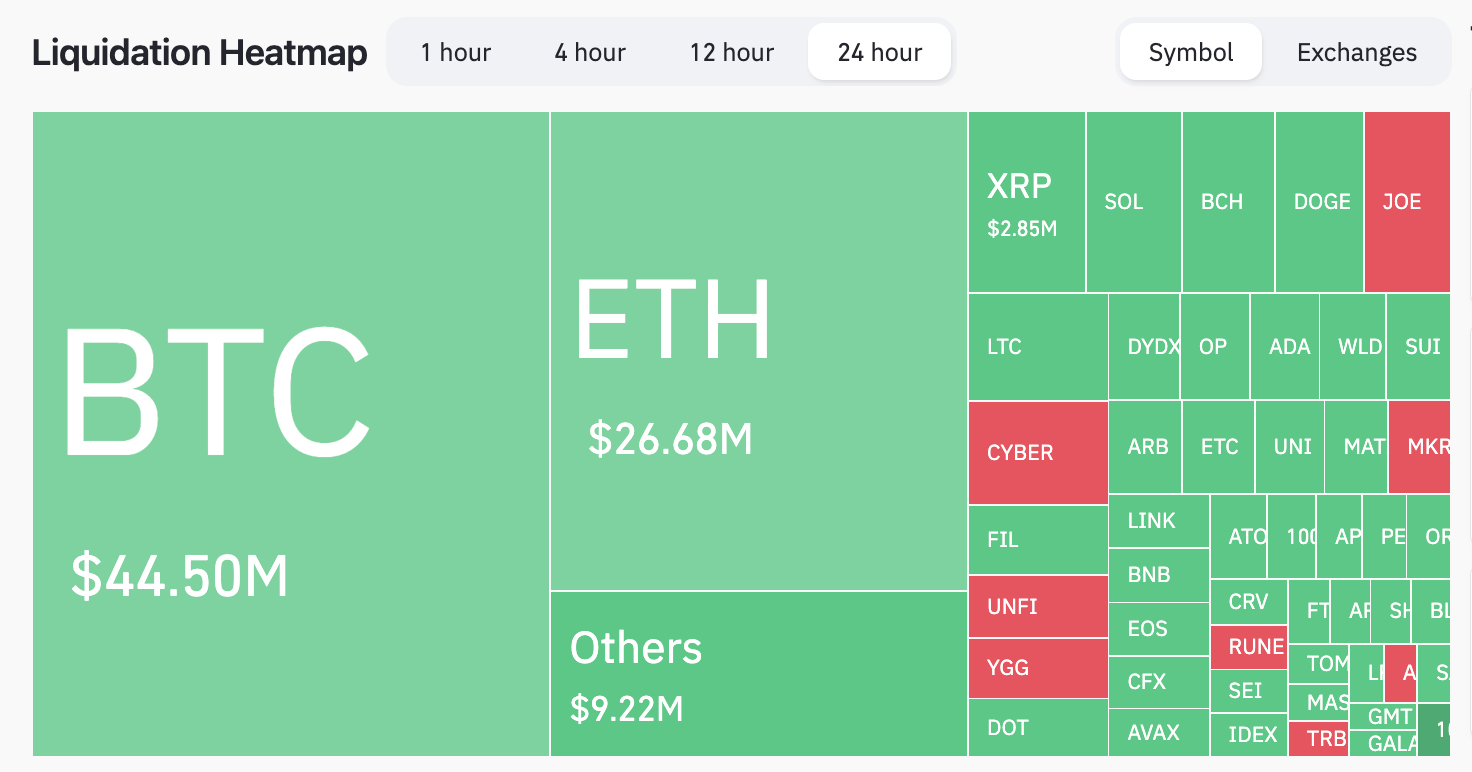

Bitcoin’s losses in the past 24 hours coincide with significant long liquidations during the same period. Specifically, the crypto futures market closed long positions worth $106.32 million in the last 24 hours. In contrast, only approximately $16 million worth of short liquidations occurred during the same period.

Long liquidations involve exchanges selling initial margin to traders to prevent them from losing borrowed funds. Simply put, they sell Bitcoin to cover the borrowed amount, increasing selling pressure in the process.

Dollar Recovery Suppresses Crypto

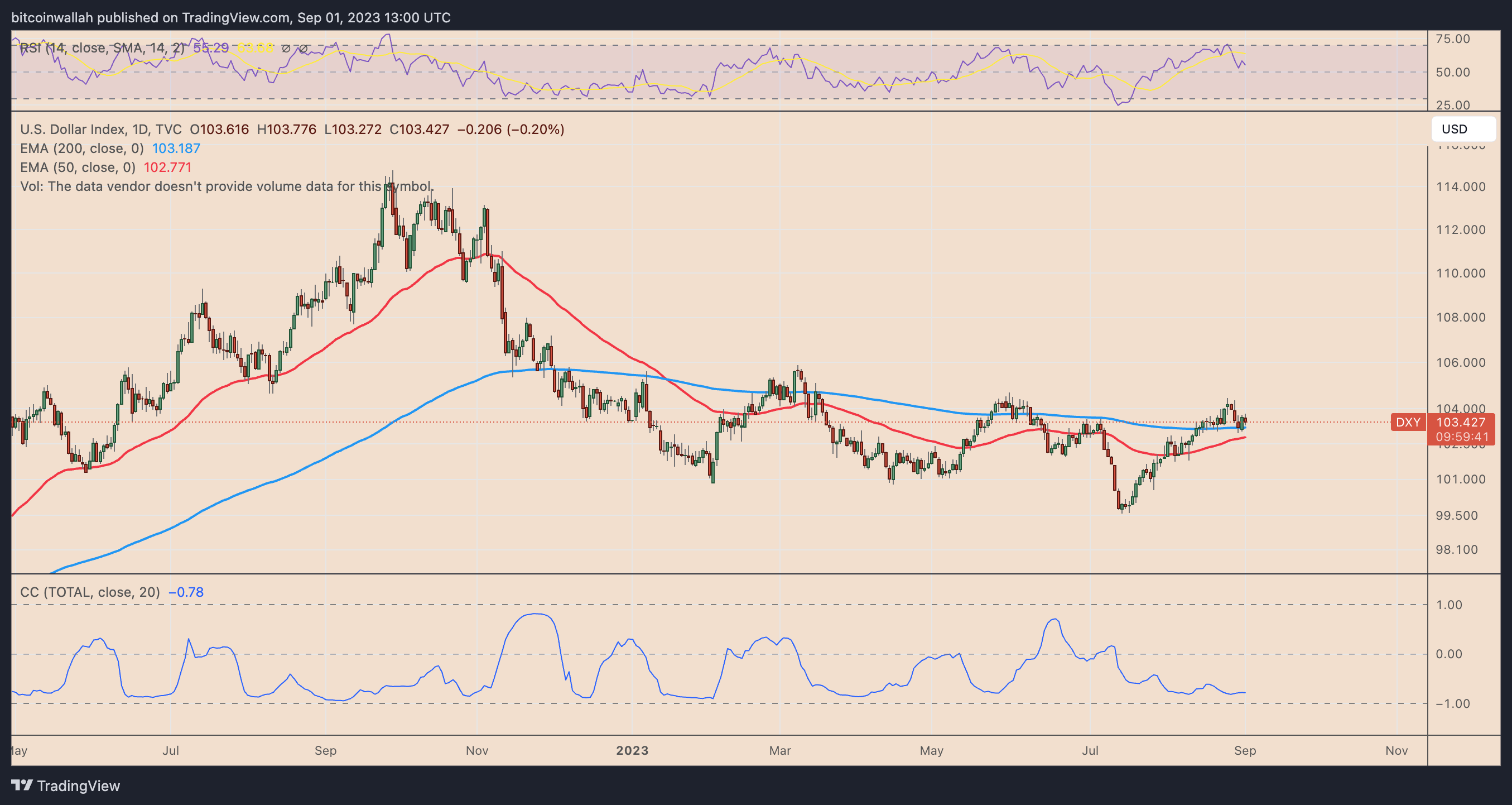

A stronger US dollar emerges as a major factor in the decline of the cryptocurrency market, thanks to its consistent negative correlation with various foreign currencies in 2023. In particular, the US dollar index (DXY), which measures the strength of the dollar against the weights of major foreign currencies, has risen by 0.75% since August 31st.

Meanwhile, the daily correlation coefficient with the cryptocurrency market is hovering near -0.78. DXY has been on an upward trend since early July, indicating Bitcoin’s annual high of around $31,000.

Crypto Market Outlook for September

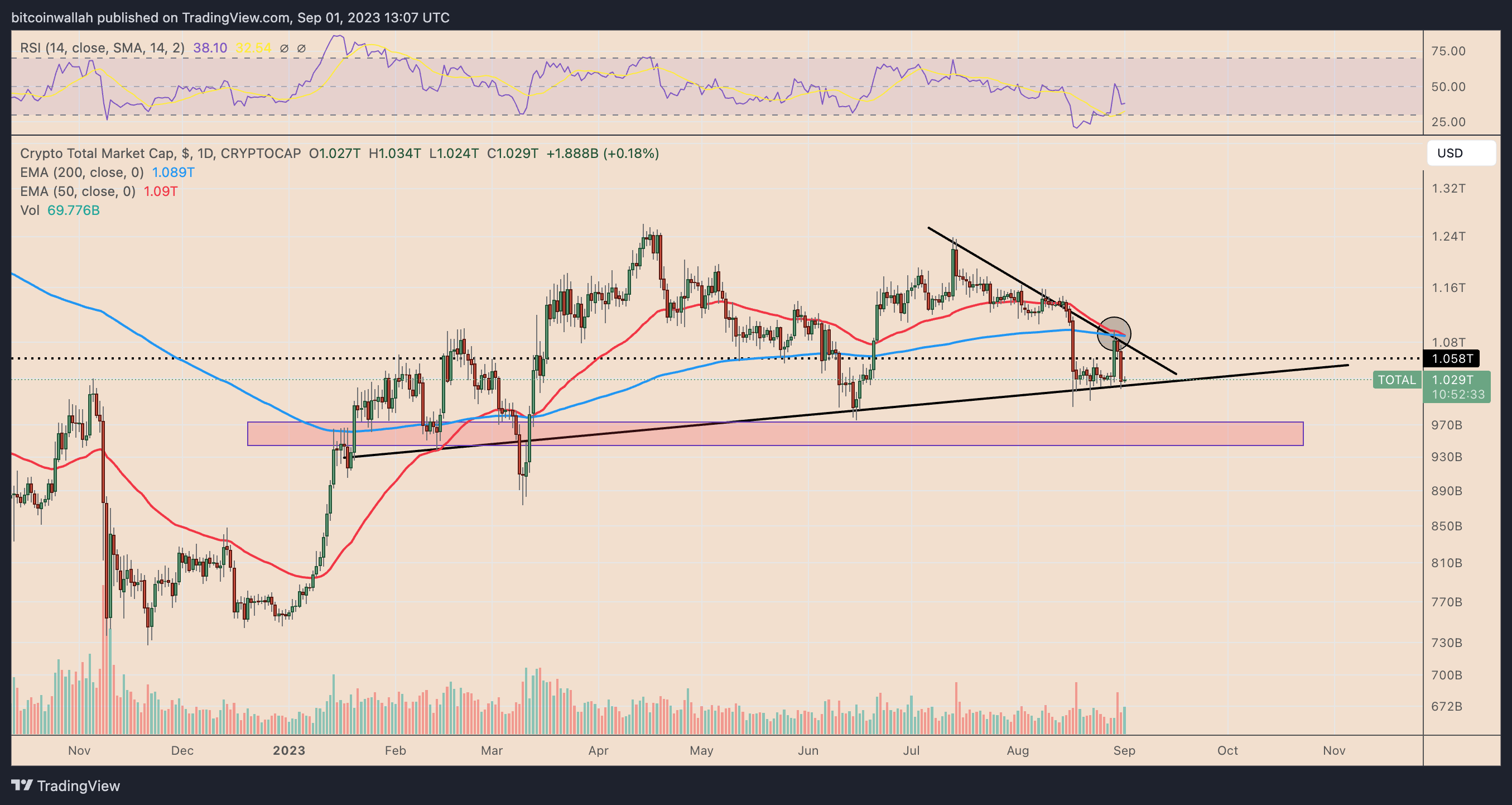

From a technical perspective, the cryptocurrency market is currently trading near the long-term rising trendline support and expects a recovery towards $1.058 trillion in September.

The recovery target aligns with the May-June 2023 support line and the descending trendline resistance. Conversely, a decisive break below the rising trendline support could push the cryptocurrency market valuation towards the $950-975 billion range (red bar in the above chart).

Türkçe

Türkçe Español

Español