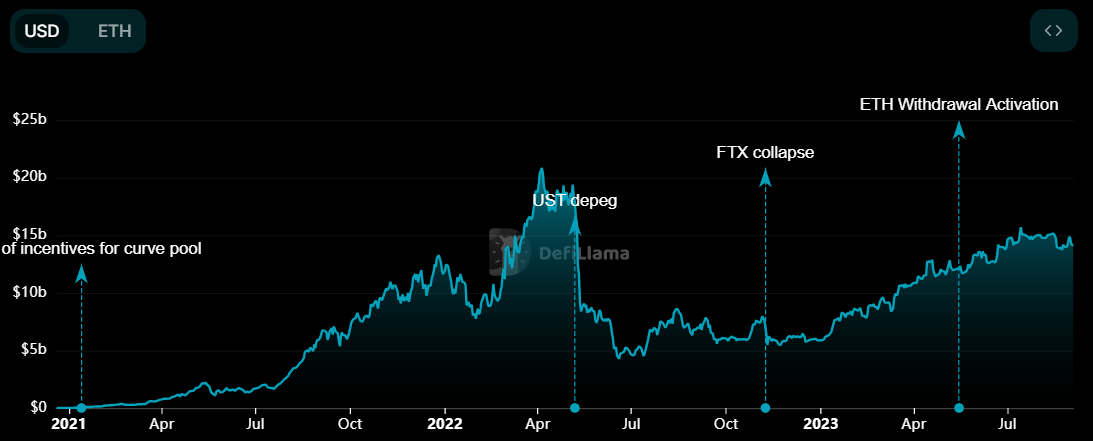

The crypto winter has had a chilling effect on the DeFi ecosystem, causing the total value locked (TVL) in the space to plummet to its lowest level in over two years. According to DeFillama data, following a series of price drops in recent weeks, DeFi TVL has dropped to $37.7 billion. This is the lowest level in the industry since February 9, 2021, when TVL was at $37.172 billion.

Decline in DeFi TVLs!

The decline represents a significant drop from the $175 billion peak recorded in November 2021. At that time, most altcoins were trading at peak prices. Many cryptocurrencies, including ETH, have experienced a decline of more than 60% from their peak prices, causing TVL to collapse. However, other factors have also contributed to the decline of DeFi. According to Defillama data, almost every performance metric has taken a hit.

By the end of 2021 and the beginning of 2022, daily trading volumes averaged around $4 billion. However, in the past few months, this average has significantly dropped to around $1.5 billion, indicating a notable decrease in crypto activity. Despite the decline, Lido, Ethereum‘s liquid staking platform, continues to be the largest project, accounting for $14.10 billion of TVL.

A Turning Point for ETH!

Lido has seen consistent growth in TVL since its launch, with the exception of a brief dip during the Terra UST depegging. Even the Shappella upgrade, which allowed for the withdrawal of stacked ETH, failed to hinder the protocol’s growth. On August 31st, the platform reached a historic milestone with 8.61 million ETH locked.

Meanwhile, MakerDAO has the second-highest TVL with $5.07 billion. Both the dollar and ETH TVL have experienced significant drops. The same holds true for other lending and decentralized exchange protocols such as Aave, JustLend, Uniswap, and Curve Finance. Compound Finance, once a leading DeFi protocol in terms of TVL, has slipped to 11th place after a 17.87% drop in TVL last month.

Türkçe

Türkçe Español

Español