The sales pressure encountered in August and affecting the overall market resulted in a significant drop in the price of Terra Classic (LUNC). However, developers have signaled the smooth continuation of development operations on the Terra Luna Classic network by introducing a new development proposal to apply dynamic minimum commissions for validators to protect against potential security vulnerabilities. Nevertheless, the potential trajectory of LUNC’s price remains a subject of curiosity.

Weak Support for Terra Classic’s Price?

The market value of LUNC has fallen by around $100 million in the past 30 days, dropping below $400 million and currently standing at around $350 million. This indicates a decline in interest in the altcoin, which could further lower its price. Blastoise, a cryptocurrency analyst and supporter of LUNC, pointed out that the nearest significant support level for LUNC against USDT is around $0.000055, with a resistance level of approximately $0.000068.

In his commentary on LUNC, Blastoise said, “The price is currently around the support level, which is a positive sign. If it can hold above the support level, it could signal an upward movement.” However, according to the analyst, a drop below the support level could indicate a continuation of the downward trend.

Could LUNC’s Price Fall Below $0.000055?

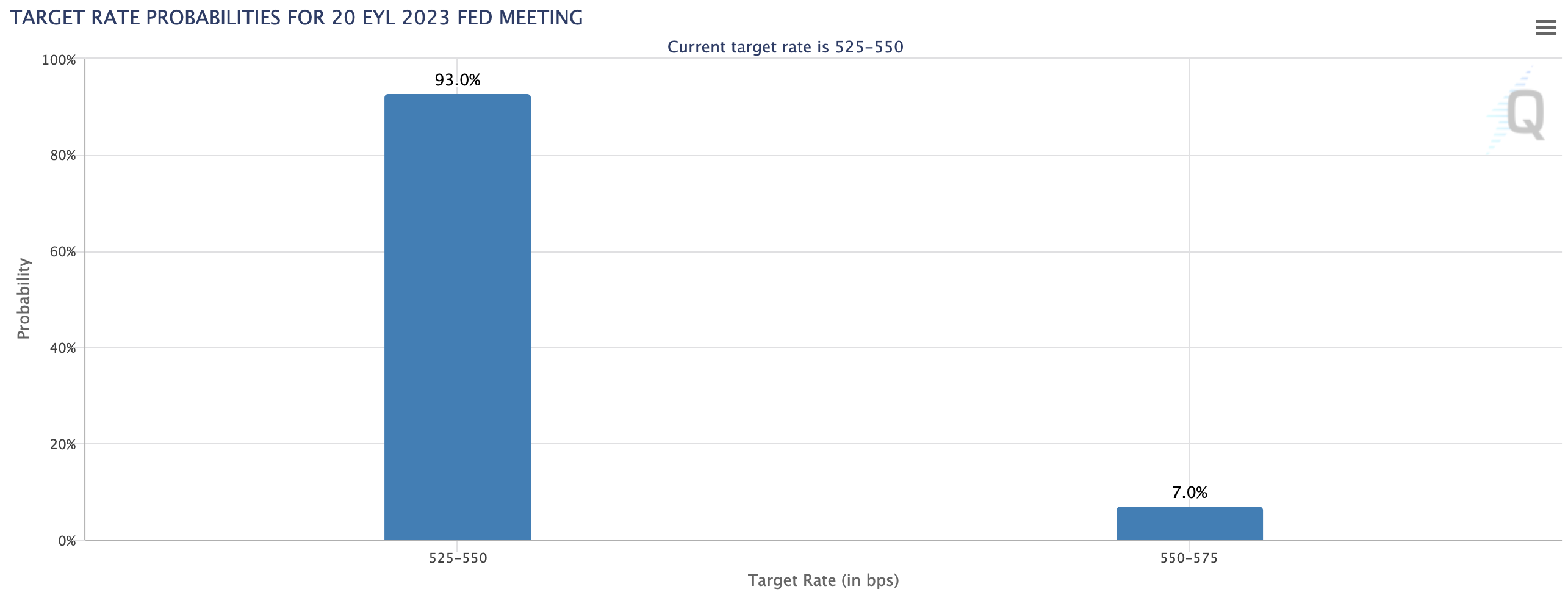

Experts warn of potential volatility in the cryptocurrency market ahead of the Federal Open Market Committee (FOMC) meeting, where the US Federal Reserve will make its next interest rate decision, scheduled for September 19-20, 2023. A potential negative pricing for the overall market could also affect the price of Terra Classic.

According to the data provided by the CME FedWatch Tool, there is a 93% probability that the Fed will keep the interest rate unchanged at the next FOMC meeting, maintaining it within the range of 525-550 basis points. The data indicates a 7% probability of a 25 basis point increase in the interest rate.

Türkçe

Türkçe Español

Español