Many cryptocurrencies have been giving oversold signals for a long time, but the negative trend of BTC is discouraging investors. However, there are those who do not care about the general sentiment. These are whale investors who have been making significant purchases in a popular cryptocurrency for a while. We mentioned yesterday that the same thing was done by XRP Coin whales.

Polygon (MATIC) Coin Analysis

Polygon (MATIC) price is hovering around its lowest level in 2023, around $0.55. However, on-chain readings and the movements of whale investors indicate that something big is being prepared. On August 28, Polygon Co-Founder Sandeep Nailwal published a crucial update about a “technical upgrade” to a new “POL” token from MATIC. The events that followed indicate that whale investors have reacted positively to this update.

On August 28, Nailwal made a post explaining the process and the potential benefits that users could gain from transitioning to the proposed POL Token. Within 24 hours after the post, MATIC whales went into an accumulation frenzy, ignoring the prevailing downtrend in price.

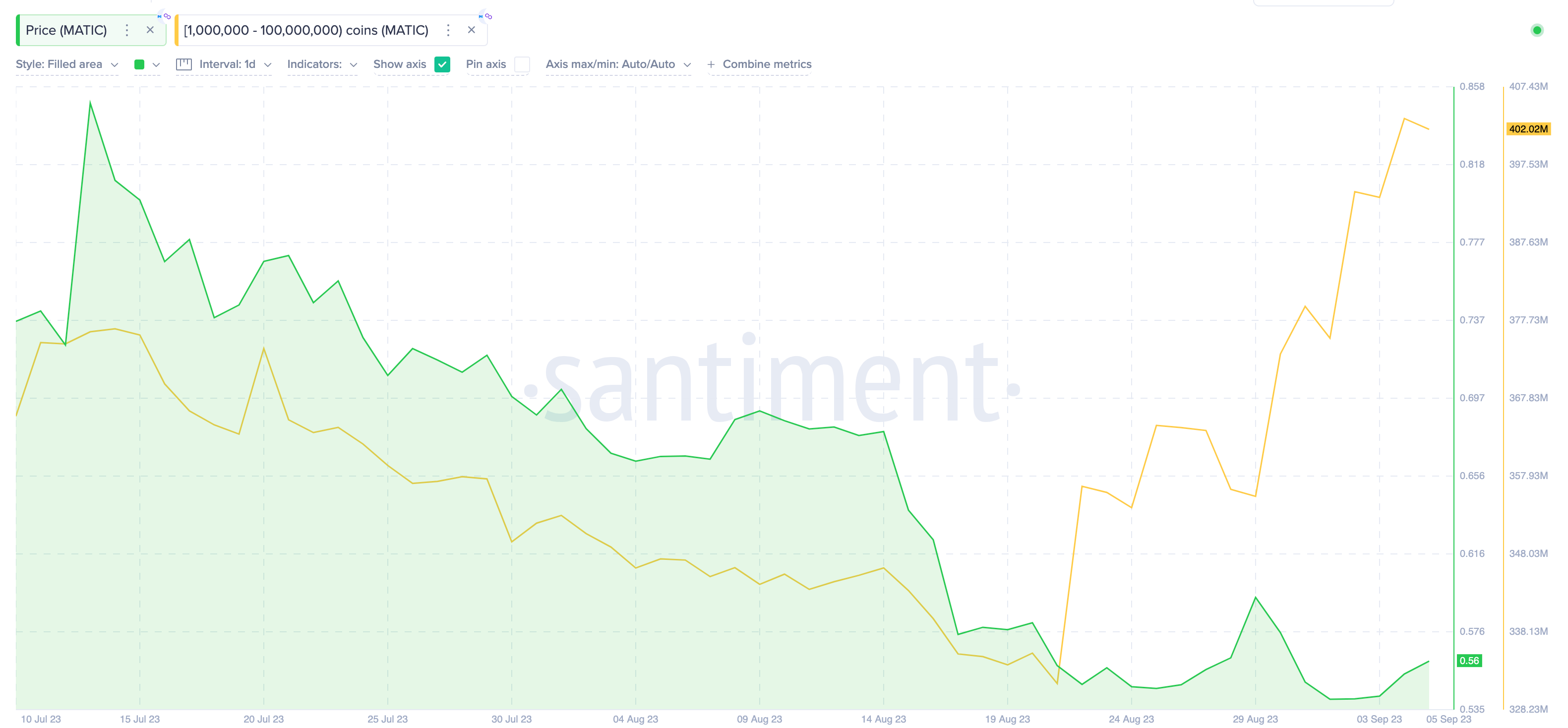

The chart below clearly shows this trend. According to Santiment data, a group of crypto whales with balances between 1 million and 100 million started buying on August 29. In particular, they added 47 million MATIC to their reserves between August 29 and September 4.

Should You Buy MATIC Coin?

The newly acquired 47 million MATIC is worth approximately $25.85 million. The increasing balances of whale wallets indicate that large institutional investors are taking bullish positions on MATIC. The timing of this buying frenzy also suggests that Nailwal’s latest update on the POL token migration may have increased the confidence of their whales.

In particular, with the recent buying frenzy, whales have increased their cumulative wallet balances to an all-time high of 402 million MATIC. However, it remains uncertain whether individual investors will join this rush.

Daily active addresses data indicates that individuals are not participating in this rush. The Glassnode chart shows that Polygon reached 1,989 Active Addresses on August 17 and continues to decline to new lows. As of September 4, only 1,499 wallet addresses interacted on the Polygon network. In the past, Polygon’s price movement was closely related to the movements in Daily Active Addresses. Therefore, if the whales’ bullish stance does not affect individual investors, the MATIC price may continue to decline.