The recent announcement of the Ethereum (ETH) ETF application has generated significant interest in the past 24 hours. Has this increased attention had a noticeable impact on performance metrics?

Ethereum ETF Frenzy!

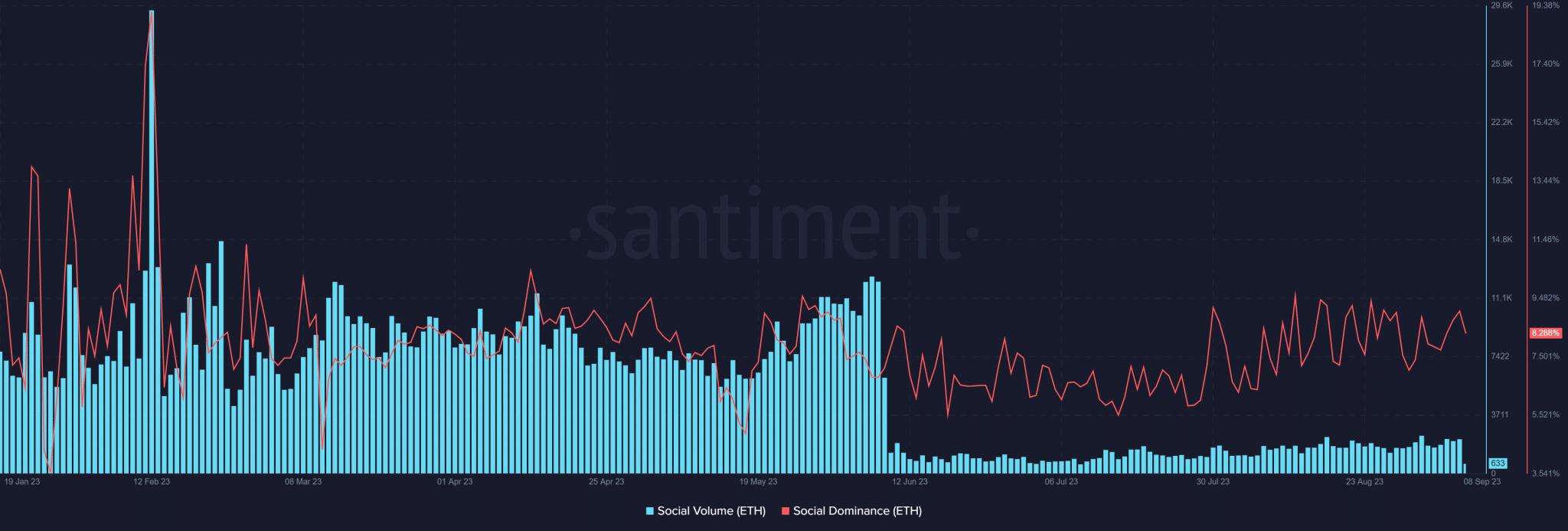

A report by Santiment on September 8 revealed that Ethereum has taken the top spot in the cryptocurrency trend. This development came after the news of the spot ETF application reported on September 7. The ETF application, presented by Ark Investment and 21 Shares, could potentially provide more users with access to Ethereum and subsequently increase its liquidity and price. This development has led to significant speculation in the market and pushed ETH into a trend position it has not held since last year’s halving.

However, as of the time of writing this article, this trend has diminished. Additionally, ETH has slipped to the ninth position on the trend chart with a 24-hour social volume of approximately 481. When examining Ethereum’s social volume, it is clear that there has not been a significant increase in response to the ETF application news. Instead, the graph shows a significant decrease in social volume since June.

At the time of writing, the average social volume was around 10,000. However, at the time of writing this article, the social volume had dropped to 633. Furthermore, a closer look at the social dominance metric revealed a slight increase above 9% on September 7. But at the time of writing this article, this rate had dropped to approximately 7%.

Latest Data on ETH from Glassnode!

According to the new address metric provided by Glassnode, there has been an impact from the ETF news. The metric showed a slight increase in new Ethereum addresses on September 6, followed by a small decrease on September 7. At the time of writing, the number of new addresses exceeded 73,000. Additionally, when considering Santiment’s seven-day active addresses metric, a slight increase was observed on September 7. This measurement rose from approximately 2.7 million addresses to around 2.8 million.

The most notable increase in optimism resulting from the ETF application was reflected in Ethereum’s funding rate on Coinglass. Specifically, on September 7, ETH’s funding rate reached its highest level since August 18, at 0.0082. Subsequently, at the time of writing this article, the funding rate decreased but remained in the positive zone. This indicated that investors have confidence in the future price increase of ETH.