According to Token Unlocks by Coin Turk, Layer 1 protocol Aptos (APT), founded by former Facebook employees, will release 20 million APT tokens into the market in November. This has led investors and traders to predominantly open short positions, anticipating a decrease in APT’s price.

Preparing for a Major Unlock in APT

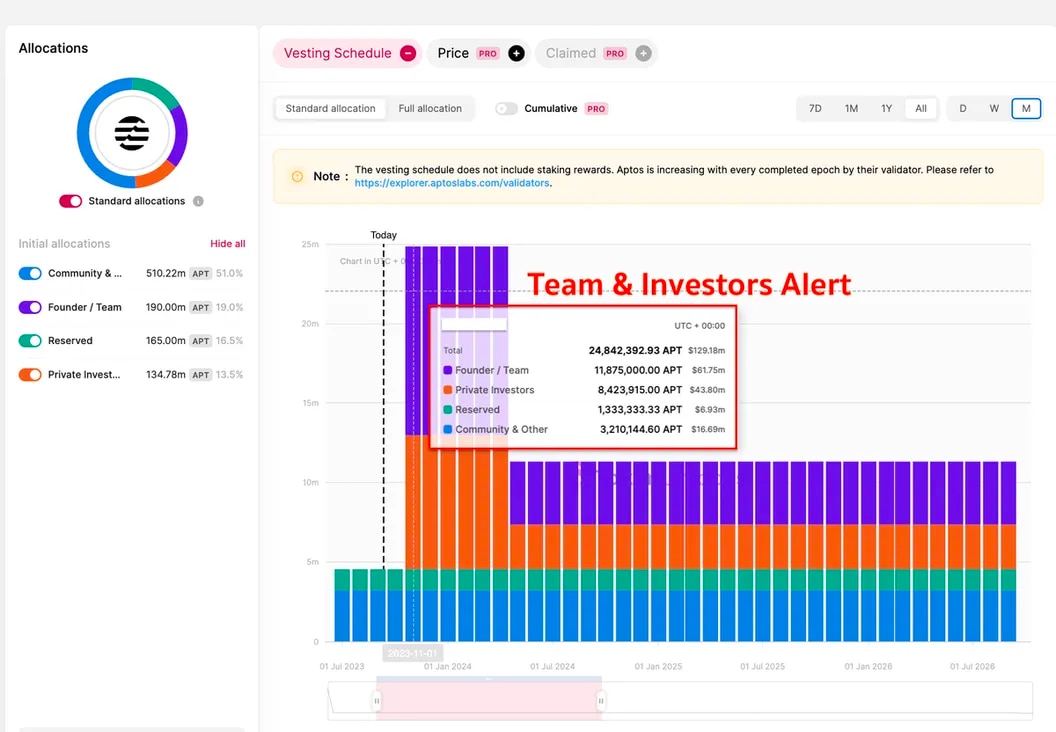

The upcoming unlock of a large amount of APT (24.84 million APT) translates to $103 million at the current market price of $5.15 per altcoin. This accounts for more than 8.5% of APT’s circulating supply of 235.02 million. Coins or tokens are usually locked to prevent large investors (early investors and project team members) from selling their holdings all at once, as it would cause a significant drop in market value.

Research firm The Tie has warned that a significant amount of liquidity will be released with the unlock in November. In their weekly newsletter published on September 13, The Tie stated, “A significant token unlock will take place on November 11 for investors and contributors. The total of 20 million unlocked APT tokens represents 112% of the average daily trading volume in the past 30 days.”

The newsletter also mentioned, “These unlocks will occur monthly and will coincide with the unlocking of monthly staking rewards (which will increase to 5.83 million APT in December, equivalent to 32% of the daily average volume). Additionally, 4.62 million APT tokens have been unlocked since last year for community and foundation purposes.”

Earlier this year, the research firm reported that unlocks that release liquidity or exceed 100% of the average daily volume tend to exert downward pressure on prices.

Predictions of APT’s Price Drop in Futures Trading

Recent data from the perpetual futures market associated with APT shows that crypto investors and traders are taking positions expecting a decline in the altcoin. The open interest funding rates are at their most negative level since February. Such a negative rate indicates that those opening short positions anticipating a price decline have to pay those opening long positions to keep their positions open.

The token-denominated open interest, representing the number of active contracts, reached 5.33 million APT on September 13, the highest level since August 17. Alongside the negative funding rates, this increase in open interest suggests that leverage is pointing towards a price decline.

Türkçe

Türkçe Español

Español