After a legal victory against the US Securities and Exchange Commission (SEC) in July, XRP (XRP) experienced a turbulent journey, losing all its previous gains and undergoing a sharp decline.

XRP’s Future and Innovations

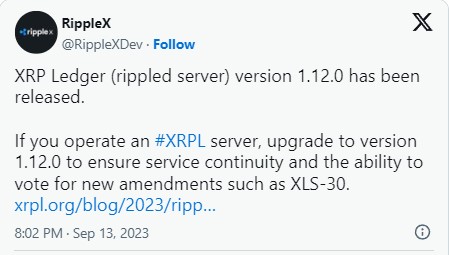

However, on Thursday, September 14, the cryptocurrency showed a noticeable recovery, reflecting the positive sentiment derived from the recent developments in Ripple‘s XRPLedger (XRPL). Ripple released a new version of XRPLedger on Wednesday, September 13, inviting all server operators to upgrade to the latest version to vote for the changes.

The 1.12.0 version of XRPL showcased a series of new features and bug fixes. Most notably, the upgrade introduced three new changes, including automatic market making (AMM), Clawback, and fixReducedOffersV1.

These three new features are currently open for voting with the support of over 80% of validators for protocol changes, achieved after a two-week period.

Among these changes, the AMM protocol has garnered the most attention. Launched on XRPL’s decentralized exchange (DEX), AMM enables users to trade crypto assets without a counterparty. It utilizes algorithmic systems to facilitate individual investors’ buying and selling of cryptocurrencies without the need to directly transact with other users.

Secondly, the clawback change allows users to recover or ‘clawback’ previously issued tokens through the “Allow Clawback” option. Finally, the fixReducedOffersV1 change is designed to reduce the formation of order books hindered by reduced offers.

XRP Price Analysis

As of the time of writing, XRP was trading at $0.49, experiencing a 1% increase in the past 24 hours. The crypto token suffered a loss of approximately $7 billion in market value, dropping by more than 2.3% last week and over 22% within the month.

The recent recovery in XRP’s price can be interpreted as a sign of increased buying pressure on the altcoin fueled by the positive sentiment brought about by the new XRPL changes, particularly the AMM feature.

Currently, XRP finds support at $0.45, indicating a historically strong level of buying interest. On the other hand, the cryptocurrency faces a strong resistance at $0.50, which has historically been a significant hurdle for price advancements.