Bitcoin (BTC) closed the dates of September 13 and 14 on a high note after the August US CPI (Consumer Price Index) data showed a moderate increase in consumer prices. With 97% of investors inclined to maintain the current target range of 5.25% – 5.50%, the data strengthened the possibility of a pause in interest rates at the FOMC meeting on September 20.

Current Data on BTC!

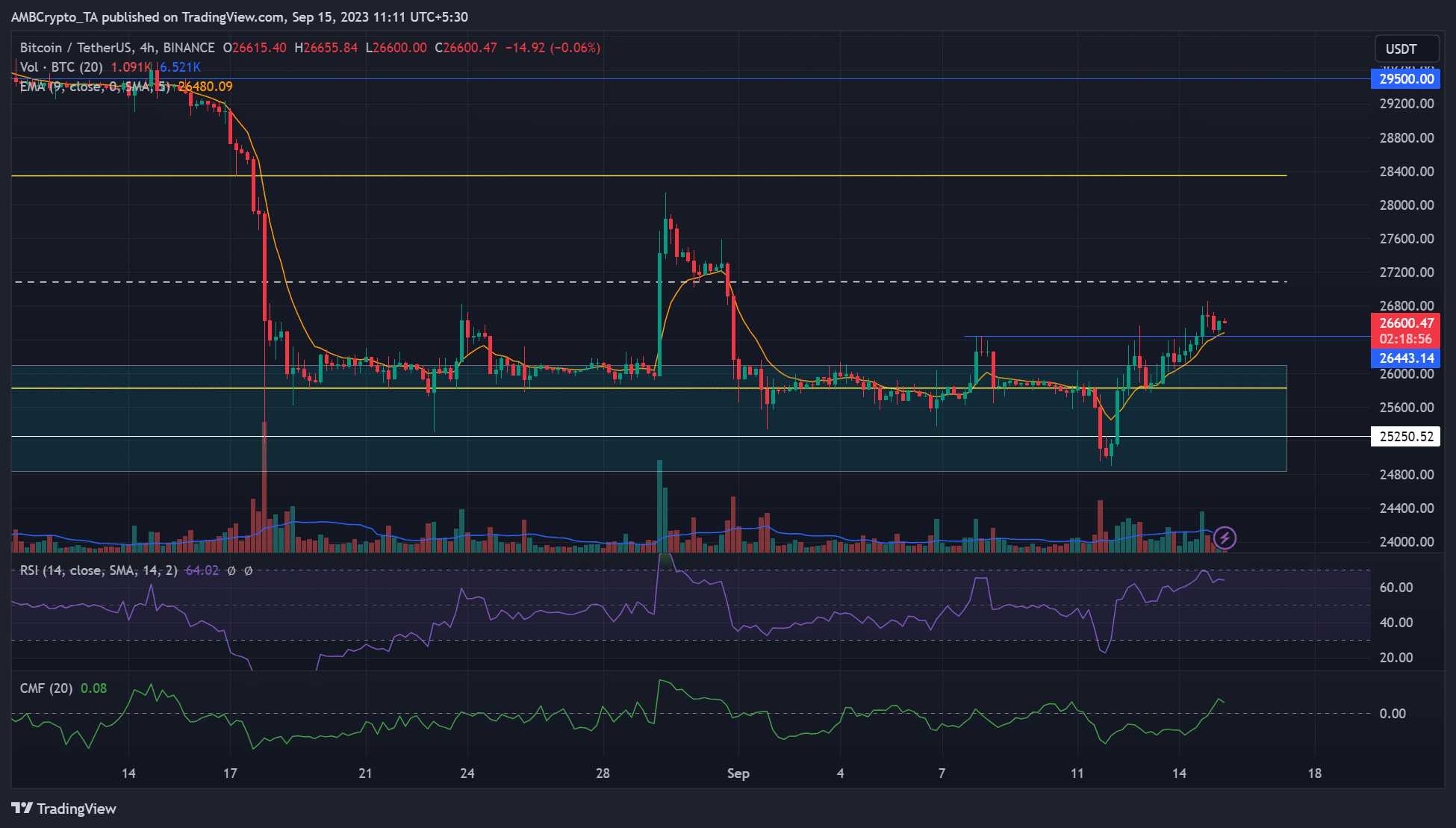

The expectation of a possible interest rate pause in September by the Fed caused BTC to rise above its previous high level of $26.4 thousand on the H4 chart, effectively turning the market structure bullish. Additionally, at the time of writing, the price movement was above the H4 50-EMA (exponential moving average) of $26.48 thousand. Despite the recent pullback, BTC may target the mid-range level around $27 thousand or the highest range.

However, sellers can take advantage of price rejection in the mid-range or push below $26.48 thousand and the H4 50-EMA. The weakness experienced may cause a return towards the lowest range around $25.8 thousand. Meanwhile, the RSI was rejected in the overbought zone but still remained in the upper range, indicating a slight easing of buying pressure. On the other hand, the CMF crossing zero highlighted an improvement in capital inflows in the past few hours.

“Increasing Demand in BTC!”

Open interest rose from $7.5 billion on September 11 to $8 billion at the time of writing, indicating an increase in demand for BTC. However, the cumulative volume delta (CVD) for spot only showed improvement starting from September 13. This could indicate when bulls gained market leverage.

Nevertheless, significant uptrends towards the end of the week may be limited due to the volatility in funding rates observed from September 14 onwards. Therefore, a return towards the mid-range cannot be ruled out. In conclusion, the increase in open interest indicates a rise in demand for BTC, but improvement in CVD spot was only seen starting from September 13. It is suggested that significant uptrends in BTC may be limited and a return towards the mid-range is possible following the volatility in funding rates.