The king of cryptocurrencies is trying to consolidate its position around $26,500, making this week crucial for the markets. Investors are exhausted from the prolonged period of selling pressure, and BTC is on the verge of a price breakout. So, what do the current data tell investors?

Bitcoin (BTC) Comments

BTC has reached the end of an exciting week that indicates the return of volatility. We are about to enter a week where the Fed meeting will take place. Investors started the year with hope and excitement, and although they did not achieve their desired results, they still made significant gains. However, apart from the recovery in the first quarter, we have not seen a strong price performance for most of the days leading up to the end of the year. Despite almost reaching the end of the year, the price has mostly moved within a narrow range.

Hope is rising again these days as the bulls return to Bitcoin, renewing optimism and excitement. However, there is an important development that could hinder BTC’s upward movement and even erase its recent gains.

Fed Meeting and Cryptocurrencies

The announcement of the Fed’s new interest rate decision is expected to be made at 9:00 PM on Wednesday. There are concerns that inflation will continue to rise, along with the increase in fuel prices. As you may recall, we mentioned months ago that we needed to stay around $68 per barrel for the decrease in inflation to continue. However, the price exceeded $90 with a huge increase because Russia and Saudi Arabia decided to continue production cuts.

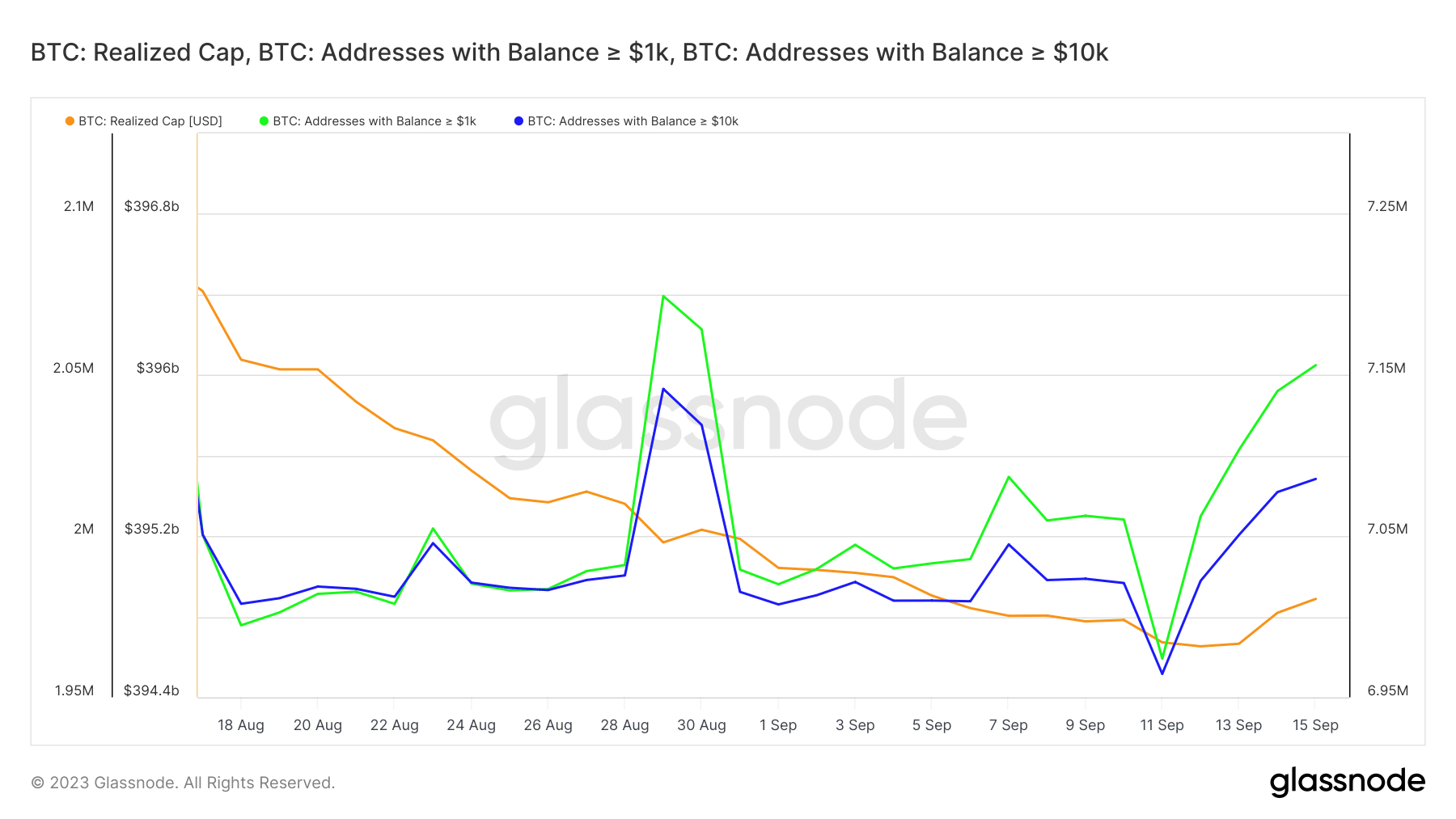

So, what are the expectations of major investors? Whales holding 1,000 to 10,000 BTC have started increasing their holdings despite contributing to the recent decline.

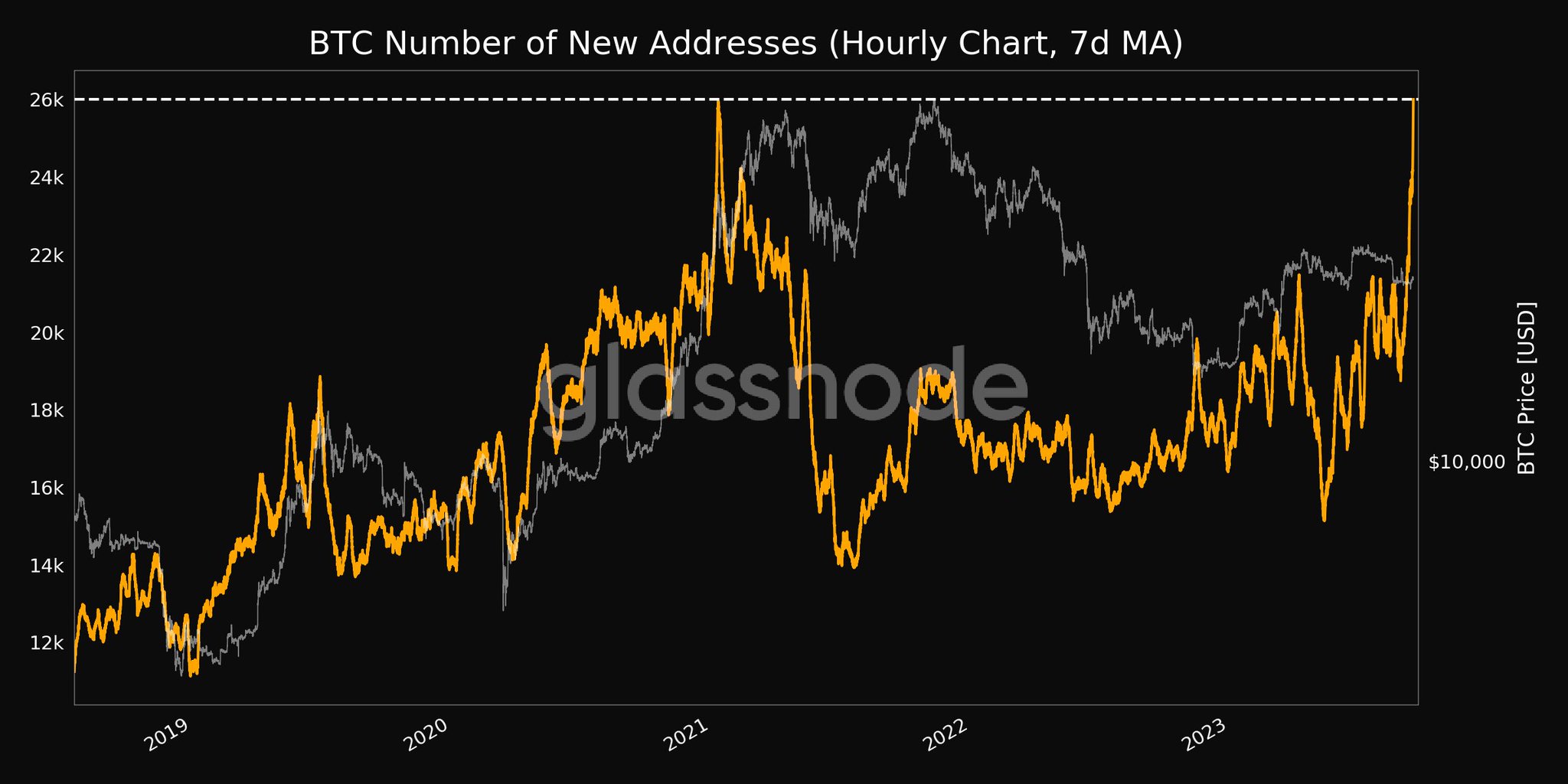

Despite whale accumulation, the realized ceiling continues to remain low, meaning that the majority of buyers who purchased BTC in the last 30 days are still not in profit. In other words, there is not much incentive to sell, so potential downside could be limited. The number of new Bitcoin addresses reached the peak of 2018 this week, which is promising for the future of the market.

If there is no Fed meeting next week that will push whales to sell at a loss, the market could continue its recovery. Considering that the Fed has already moved policy close to excessive tightening and may not take inflation driven by fuel prices as seriously as feared, Powell’s statements at 9:30 PM are important in this regard.

In conclusion, in an environment where the Fed does not announce anything new and does not adopt an excessively hawkish stance, recovery is expected to continue in the crypto market next week.

Türkçe

Türkçe Español

Español

I am so happy