September started off fast and the concerns for cryptocurrencies are not as terrifying as expected. But what about Ethereum? Despite significant developments, there hasn’t been an impressive movement in its price. The king of altcoins has taken its share from the overall market stagnation and continues to remain in a narrow range for a while.

Ethereum Price Analysis

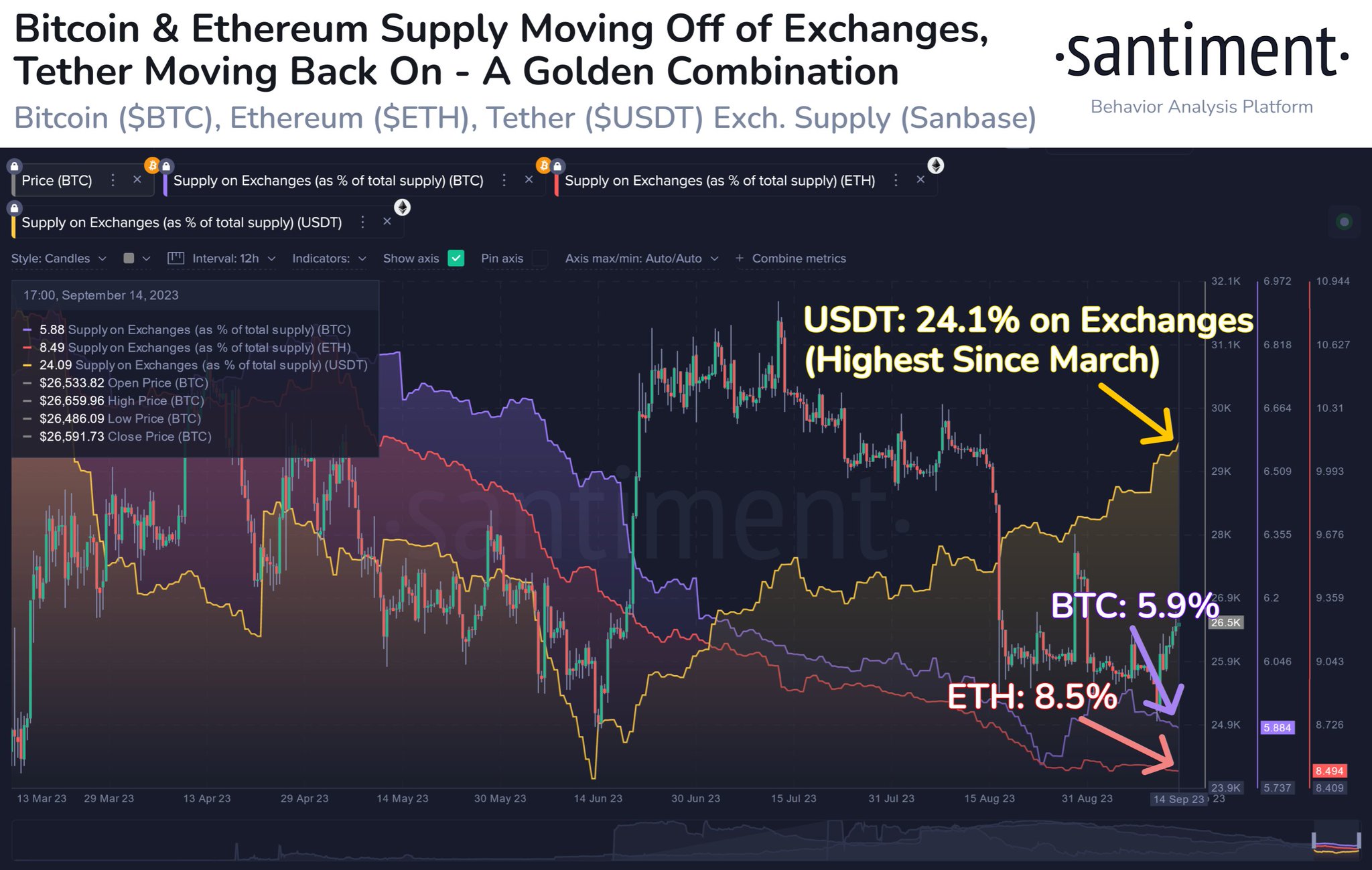

The prolonged shallow volatility has become frustrating for ETH investors. However, the increasing buying pressure reflected in on-chain data can yield positive results for the price. If the accumulation starts to show its effects, the altcoin king could soon target $1,800. Santiment’s evaluation shared on September 15 drew attention to an optimistic development indicating increased volatility in the crypto market.

It has been reported that Ethereum’s exchange supply continues to decrease. This is a positive development as it indicates that investors are less willing to sell. Tether‘s increased exchange supply accompanied this development. The increase in Tether’s supply could potentially further increase investors’ accumulation, hence a positive outcome.

ETH Price Predictions

A closer look at ETH’s on-chain performance reveals that investors have started accumulating tokens in the hope of a price increase in the near future. According to CryptoQuant, both ETH’s exchange reserves and net deposits on exchanges are decreasing. Taking into account the accumulation of whales, all these developments could be a leading signal for an upcoming price increase.

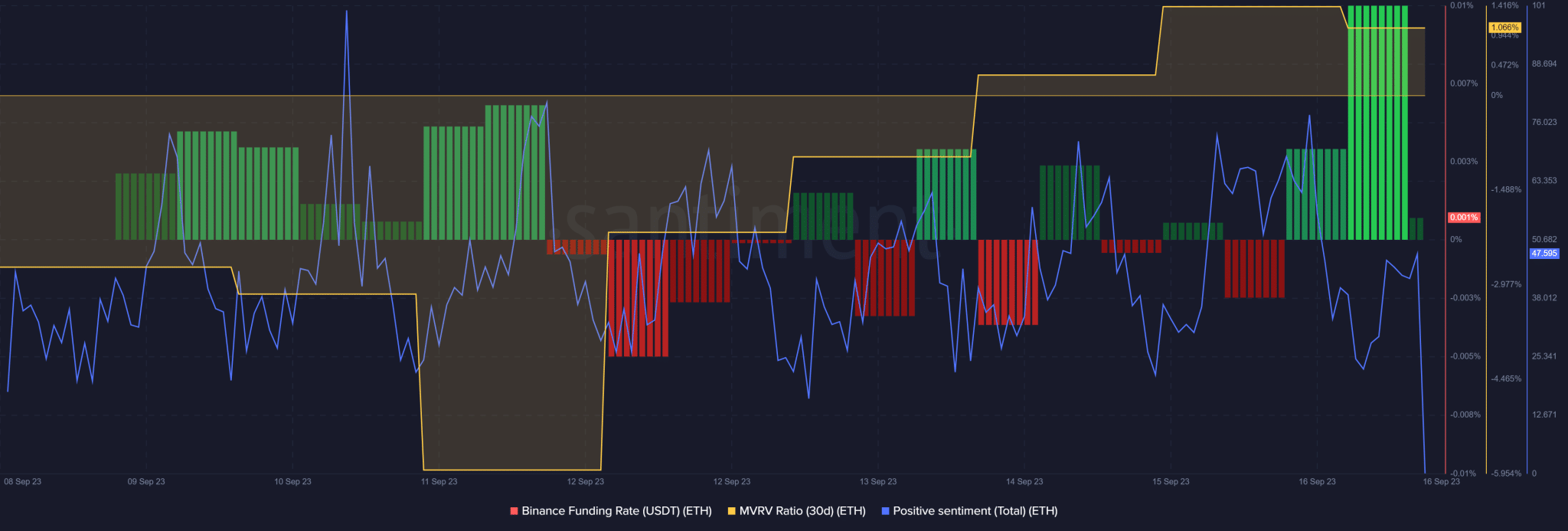

When Ethereum’s metrics are examined, these are not the only data that feed optimism. For example, last week Ethereum’s funding rate turned green, indicating an increase in demand in the derivatives market. The positive sentiment surrounding the token also remained relatively high, and the MVRV ratio indicated an improvement, signaling a potential price increase.

However, the CMF and RSI suggest that the price could continue to decline. According to the Bollinger Bands, Ethereum’s price has been in a less volatile range, reducing the chances of a price increase in the near future.

In the coming days, the statements from the Fed will be decisive for the market. However, approaching the end of the summer and with about 2 quarters left until the halving, we may experience a significant recovery towards the end of the year.

Türkçe

Türkçe Español

Español