The king of cryptocurrencies started the new week strong and continues to rise on Monday. Although the upward movement is weak, it is promising. Crypto markets have experienced exhausting sideways movements and bearish days, especially in the last few months. After a rapid recovery in the first quarter of 2023, the market has been moving back and forth for the rest of the year.

Bitcoin and the Fed Meeting

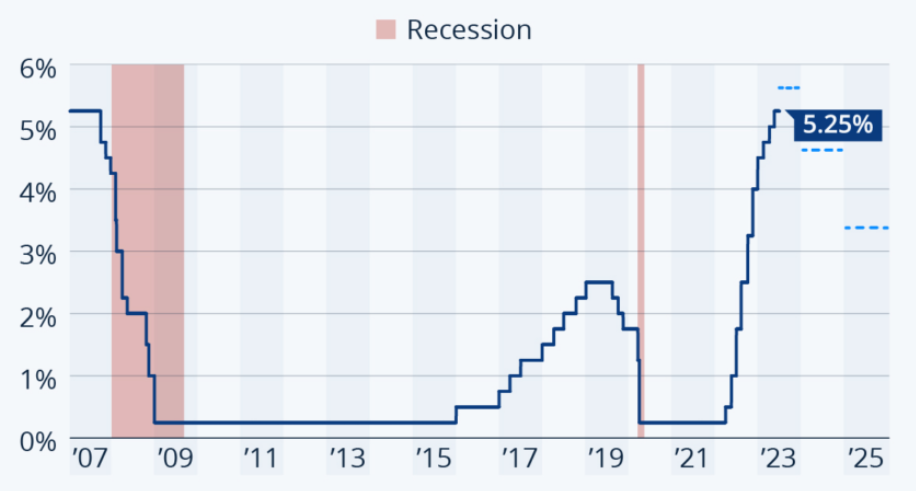

Since the first quarter of 2022, Federal Open Market Committee (FOMC) meetings with interest rate hikes have gained special importance for cryptocurrency investors. We have been closely following every meeting for almost 2 years, and every detail coming out of Powell’s mouth has been discussed for days. Those were tough times, and we are not yet at the end of it. What we remember before each Fed meeting is the increase in price volatility, and investors should be extra cautious during these days.

The expectation for the Fed meeting is that the interest rate hike will be temporarily postponed. It would not be surprising for the markets to continue their upward trend until the meeting hour approaches, as there is a ban on speeches by members before the meeting and no new data will be released.

Fed Interest Rate Predictions

It is not expected that the central bank will change its stance on interest rate policy. Furthermore, it is not expected to make a definitive statement about the near-term outlook in this week’s policy meeting. This month’s meeting should be more like a repetition of previous statements, as Powell has already made an early speech about this meeting during the Jackson Hole speech. It would be a surprise if an announcement regarding the interest rate ceiling is made, and if it points to the November 1 meeting, the markets could relax a bit.

Moreover, the focus will be on the Federal Reserve’s Summary of Economic Projections (SEP), which includes economic forecasts. The Fed will release its three-year interest rate predictions, shedding light on many aspects, from short-term to long-term policy. These predictions are not exact targets, but they reflect the views of the members. The Kobeissi Letter stated that this week could set the tone for the rest of the year.

“The Fed’s guidance on Wednesday will determine the tone of the next few meetings. We expect to see a lot of volatility this week.”

According to reports, the Fed may lower its core inflation forecast from 3.9% to 3.7%. Economists, according to MarketWatch, agree that the Fed could increase its long-term neutral interest rate forecast. Central bank officials had previously stated their intention to keep the benchmark interest rate high in order to continue to bring down inflation. This situation will continue to harm households drowning in debt as personal interest payments reach record levels.

Türkçe

Türkçe Español

Español