We are on the first day of a volatile week for crypto investors and the BTC price has exceeded $27,000 as of the time of writing. This is not so surprising because multiple experts last week mentioned that closing above $26,400 could target $27,200 and above. The recent rise was not surprising, even though it was limited, amid the expectation that there would be no interest rate hike.

What Will Happen to Crypto Currencies?

Our king crypto currency had a tough August and did not start September well either. However, the current outlook indicates that September, which is famous for its declines, could end with a rise after a long break.

So, what are the expectations of crypto currency experts regarding the price?

Credible Crypto

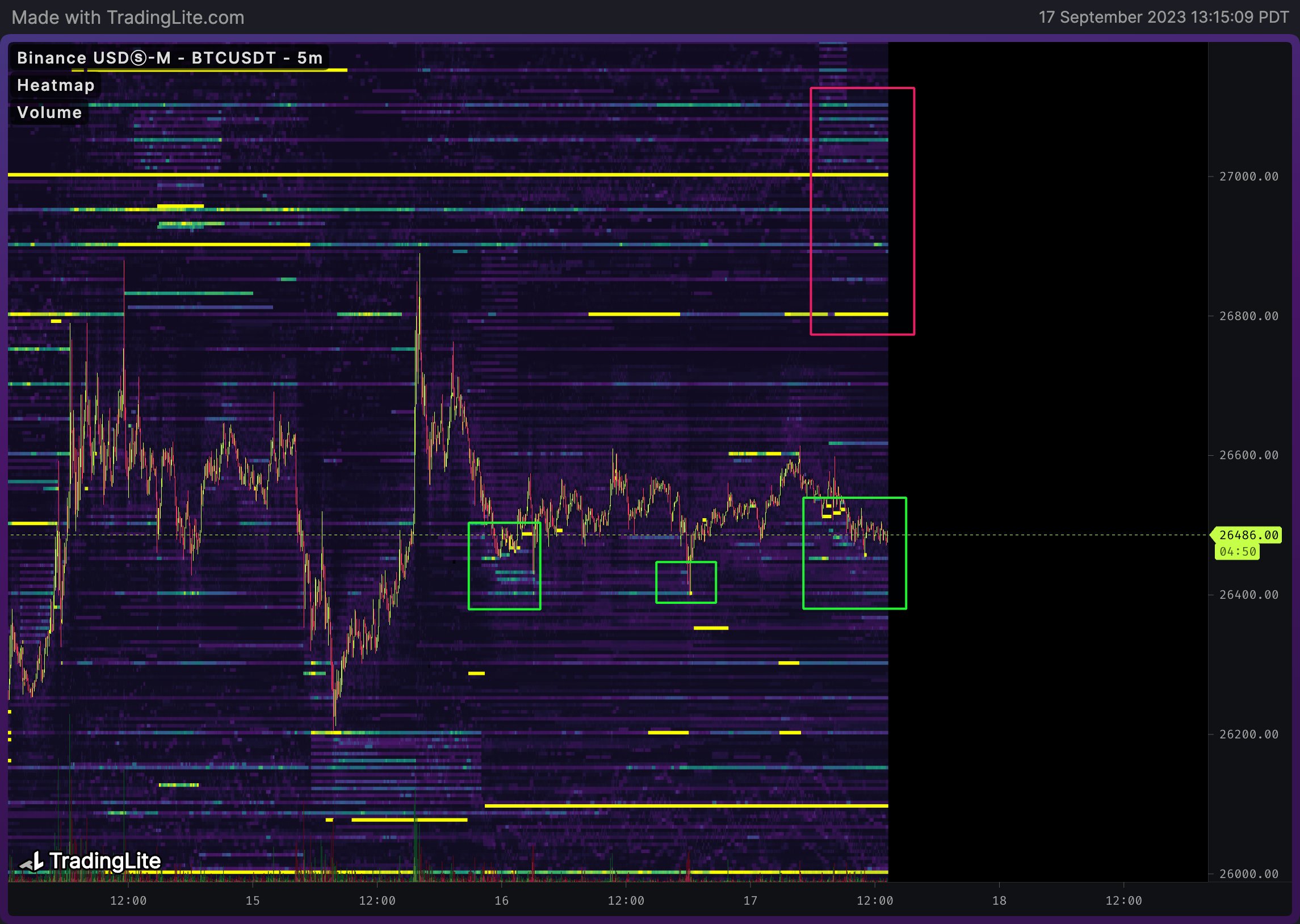

Credible Crypto is in the first place. The analyst believes that a local bottom could be formed around $26,000. The expert, who shared the Binance order book, had already shared his expectation of a rise by stating that buyers were starting to strengthen before the current rise began.

“This area continues to be defended and buyers are stepping in here once again. A local bottom is forming. We can stay above $27,000.”

Michael Poppe

Poppe, who focused on the weekly close, said that the 200-week exponential moving average (EMA) was an important support.

“Bitcoin is closing above the 200-week EMA, which is vital for the continuation of the rise. We should continue to do this next week, and the price will start to resemble the 2015/2016 cycle.”

An analyst shared a chart showing the interaction between the spot price since 2020 and the 200-week EMA, which is currently at the $25,700 level.

“The markets are consolidating with a weekly close well above the 200-week EMA for Bitcoin. The chance of the correction being completed is increasing day by day.”

Rekt Capital

The expert, who saw the big move last year, had also successfully anticipated the decline starting from $30,000. Rekt Capital, which warned especially about the losses that will occur in altcoins, reduced its positions before new ATL levels were seen.

So, what is he saying now?

“The long-term outlook is bullish. In the medium term? Over the next 7 months, we may or may not experience another major correction. Will this happen? If it does, it would be wise to be prepared at least.”

The Kobeissi Letter

According to the expert, what will be announced on Wednesday and the Fed’s stance will largely determine the direction of the market until the end of 2023.

“The Fed’s guidance on Wednesday will determine the course of the next few meetings. We expect to see a lot of volatility this week. There will be no interest rate hike at the FOMC meeting on September 20. Fed Funds futures are also pricing this in. And they have been very consistent about this for a long time. The fact that the latest inflation figures did not go exactly in the right direction did not change anything in this regard.”

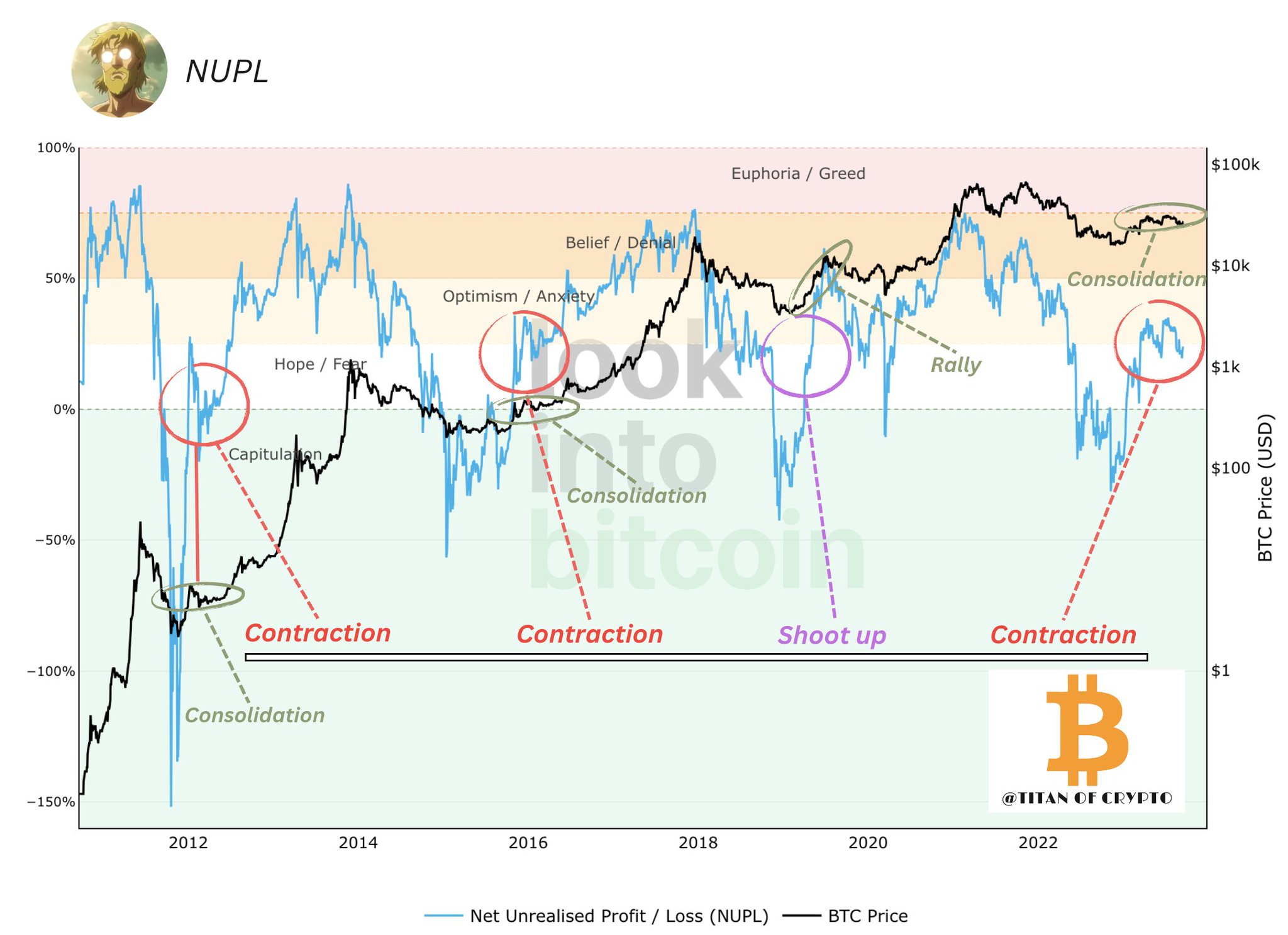

Titan of Crypto

The popular trader, who often analyzes the net unrealized profit and loss data between BTC supply, said that there is a “striking correlation” between this year’s environment and the environment seen in previous Bitcoin bull runs.

If the analyst’s chart is working correctly, the bull season may have started.