The volatile trend in the price of Bitcoin continues, and we are in the early hours of Tuesday. This important detail can give you a peace of mind. Fed is suffering losses. This situation has the potential to generate significant positive results for risk markets, including cryptocurrencies. So how is Fed suffering losses?

The Federal Reserve is Suffering Losses

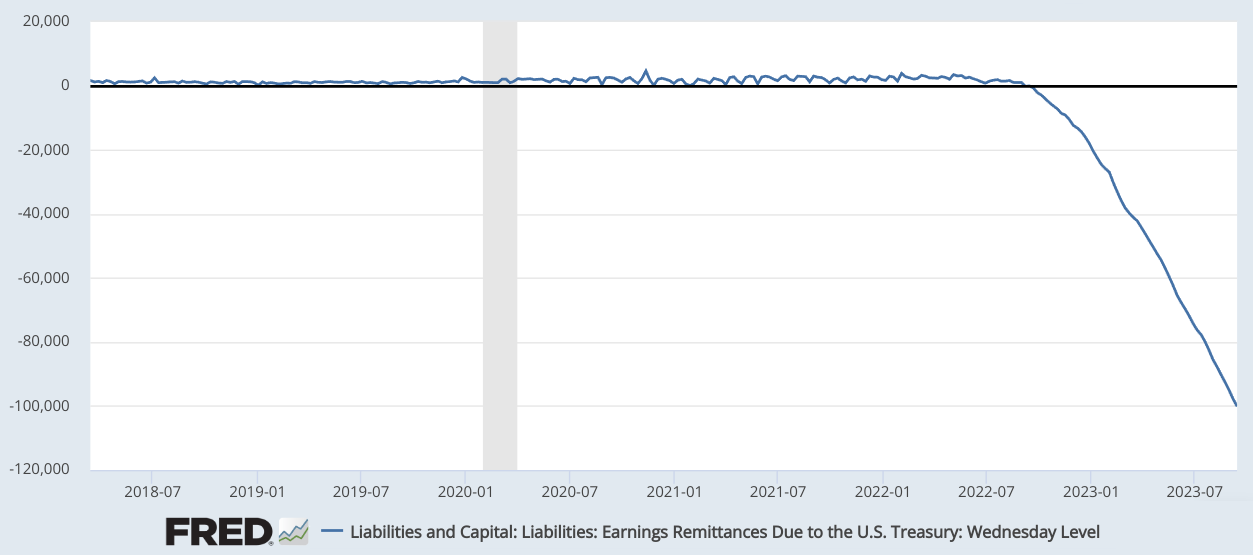

According to the announcement dated September 14, the Federal Reserve (Fed) is reporting a $100 billion loss for this year. Reuters expects this situation to worsen further and become difficult to overcome. The current situation of the Fed can be a good price catalyst for risk markets, including cryptocurrencies, indirectly.

So how is Fed suffering losses? The main reason behind this financial downturn is that the interest payments on Fed’s debt exceed the gains from its assets and the services it provides to the financial sector. As a result of this development, investors are now trying to understand how it will affect interest rates and the demand for verifiably scarce assets like BTC.

The Future of Cryptocurrencies and the Fed

According to analysts, the Fed’s losses could climb to $200 billion by the beginning of next year. The central bank classifies these negative data as “deferred assets” and argues that there is no urgent need to meet them. In the past, the Fed did not record such losses, but it is difficult to predict at which stage these losses will become unmanageable. Moreover, these losses may not immediately force Powell and his team to change their policies.

Fed, which has been shaken by rapid interest rate hikes, raised interest rates to 5.25% for the first time at such a fast pace. An article published in Barron’s discusses the current situation as follows;

“The losses of Fed banks do not increase the federal budget deficit. However, the large profits they used to send to the Treasury and now no longer exist have helped reduce the deficit, which has been $1.6 trillion so far in this fiscal year…”

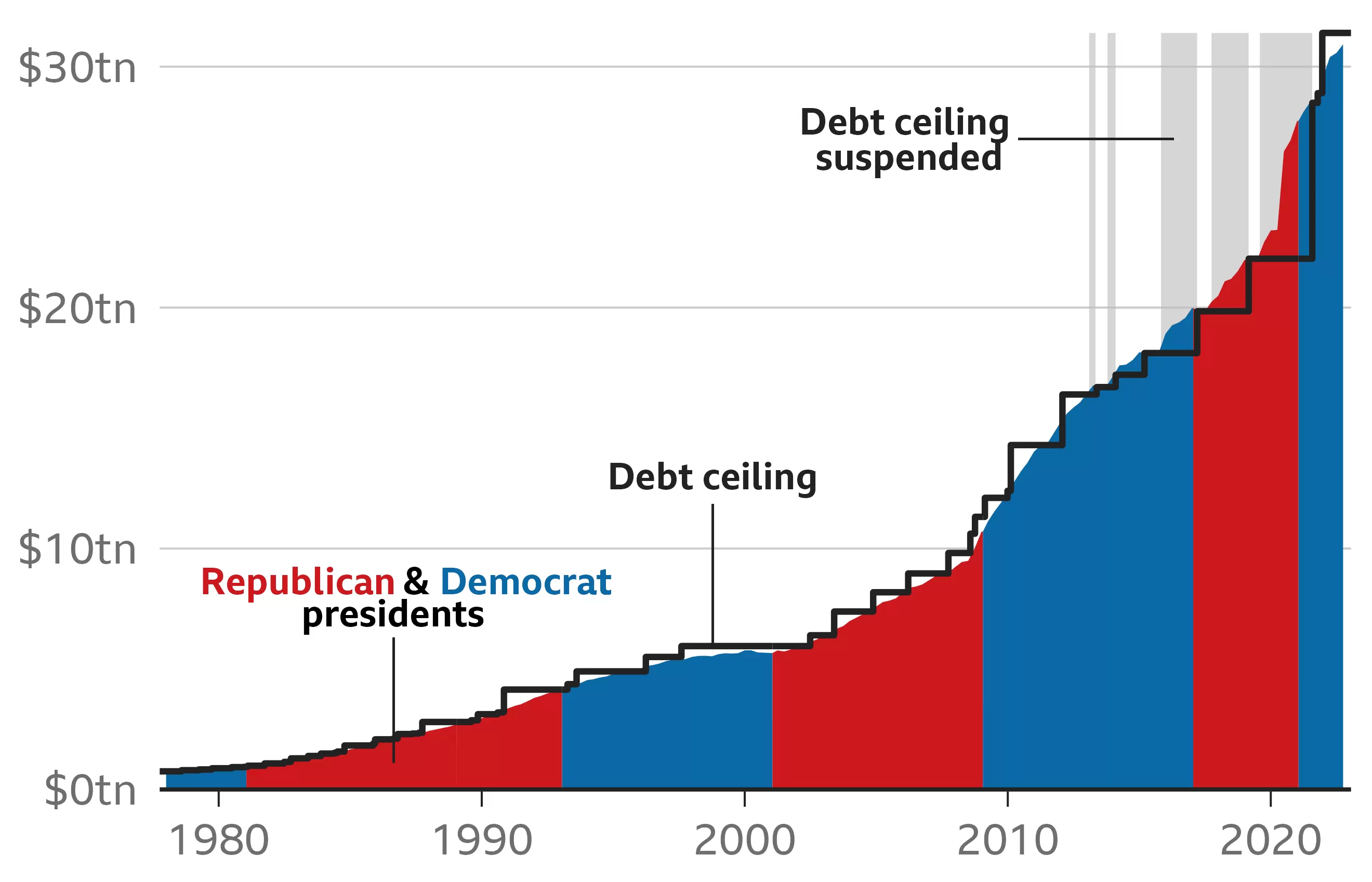

Especially considering that the US debt has reached $33 trillion, it is clear that this situation is unsustainable.

So what are the consequences for cryptocurrencies in the short and medium term? In fact, recessions, inflation, monetary tightening, and other major events do not directly affect the direction of cryptocurrencies. At the most basic level, we need to return to an environment where people are “willing” to invest in virtual “things”. Today, there is no massive influx of capital into cryptocurrencies because people are struggling to pay their bills and other expenses. Those who have money in times of high inflation and risk are turning to less risky options where they can still make profits.

Türkçe

Türkçe Español

Español