In the past few days, <a href="https://en.coin-turk.com/bitcoins-market-fluctuation-in-response-to-us-unemployment-data/”>Bitcoin (BTC) has experienced a significant increase in trading volume, contributing to its upward price trend. It is noted that a significant portion of the increased volume is associated with a specific transaction sequence.

Bitcoin Analytical Reports

The latest report from analytical platform IntoTheBlock sheds light on the recent price trends in Bitcoin. The analysis data reveals that the price increases are mainly driven by increased transaction activity, resulting in higher trading volumes.

It is mentioned that the contribution of derivative volume is relatively less. According to the shared charts, the ratio of Bitcoin’s open positions in perpetual swaps to market capitalization (OI/MC) remains close to the lowest levels of last year.

This indicates that the trading volume affecting price trends is originated from spot transactions. It may also imply that the price trend is influenced by normal demand rather than leveraged derivative trading.

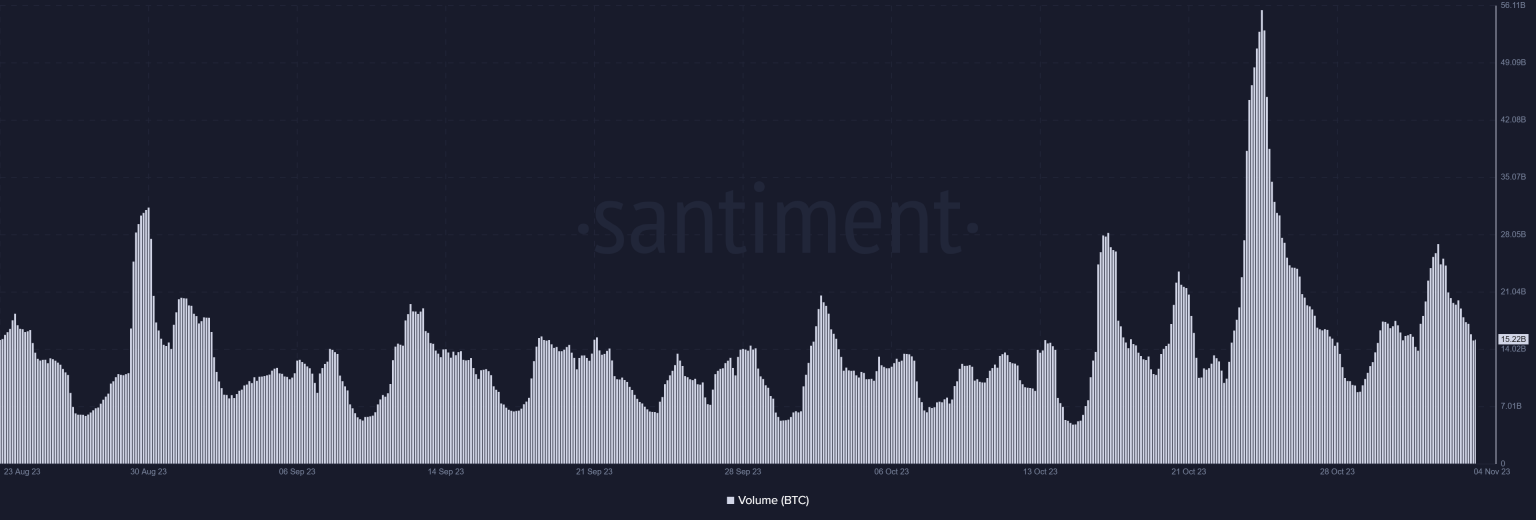

Critical Report from Santiment

Another cryptocurrency analytics platform, Santiment, shows similar values in the Bitcoin volume chart and the Open Interest chart on Coinglass.

Santiment’s volume table indicated a figure of approximately $15.2 billion. Specifically, it shows a recent decrease in trading volume in the past few days. In contrast, the Open Interest chart on Coinglass showed a value of approximately $15.4 billion at the same time. However, the OI volume is showing an upward trend.

The daily price trend chart for Bitcoin reveals a recent decrease in the past few days. On November 3rd, the price experienced a decrease of approximately 1%.

This decrease followed a similar decrease of over 1% in the previous trading period. Despite these declines, the Bitcoin price remained within the $34,000 price range.

In conclusion, the increase in trading volume in Bitcoin is driven by spot transactions, while the impact of leveraged derivative trading is low. The price trend is shaped by normal demand and spot transactions.

Türkçe

Türkçe Español

Español