The leading cryptocurrency, Bitcoin (BTC), has been battling at the $35,000 level in recent times, indicating a significant struggle between bulls and bears.

Anticipated Movement in Bitcoin

According to blockchain analytics firm IntoTheBlock, the specified level was surpassed twice last week. Although BTC is currently trading slightly lower, some upward signals on the chain have increased the likelihood of a major breakout.

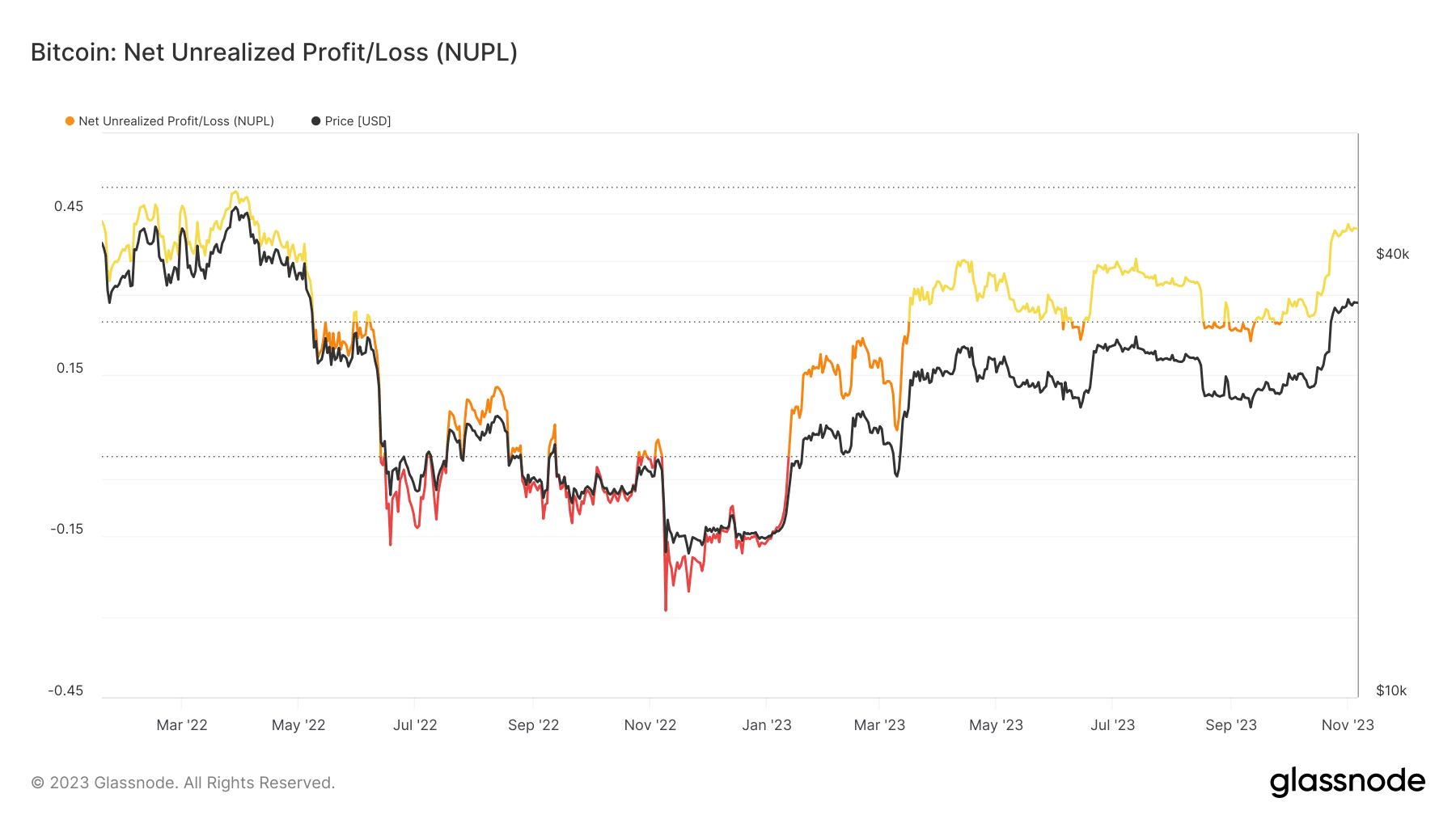

IntoTheBlock stated that over 78% of BTC holders have made a profit from their purchases. This claim is considered more reasonable by experts after analyzing Glassnode’s popular NUPL indicator.

Values above zero generally indicate a profitable situation, and the figures suggest that market sentiment is leaning towards optimism. Another way to evaluate market profitability may be to examine the spent output profit ratio (SOPR), which differs from NUPL as it considers tokens actually moving on the chain.

The SOPR indicator has been on an upward trend, indicating that cryptocurrencies are being sold with a profit on average. Additionally, this situation can be seen as a possibility of an increase in liquid supply in the near future and the opportunity for many potential buyers to acquire BTC. IntoTheBlock emphasized the importance of the $35,000 mark in the cryptocurrency, stating that around 1.94 million addresses have purchased BTC at this level.

Expert Opinion on BTC

The popular analytics firm stated that if the leading cryptocurrency manages to stay stable, bulls could achieve a “great victory.” Moreover, upward trends have been discovered in technical analyses according to experts. Leading crypto analyst Will Clemente shared his comments on the relative strength index (RSI) on social media platform X.

According to the expert, this situation is a positive signal and has brought strength back to the market. According to Hyblock Capital, Bitcoin holders were becoming greedy, which could imply that they were in a buying mood. The critical index generally assumes that greed increases token values in the short term.

Türkçe

Türkçe Español

Español