Bitcoin mining has become a growing and popular way to invest in the Bitcoin (BTC) ecosystem, in addition to buying Bitcoin and holding it in a crypto wallet.

Bitcoin Mining or Buying Bitcoin: Which Is More Profitable?

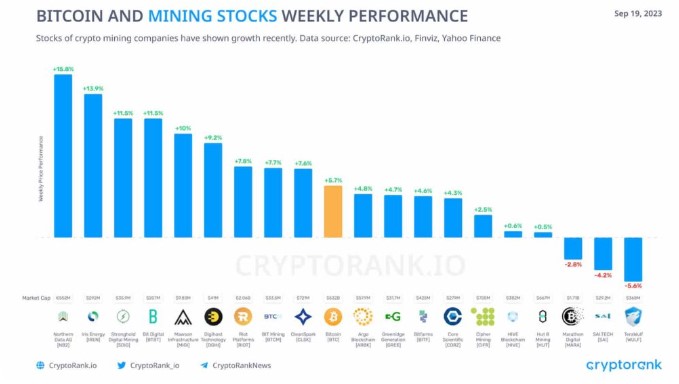

Interestingly, this alternative investment method sometimes allows investors to achieve higher returns than trading Bitcoin on the spot market. At least, the data shared by CryptoRank suggests so.

When we examine the weekly performance of Bitcoin mining stocks on September 19th, nine Bitcoin mining companies outperformed BTC in terms of gains.

- Northern Data AG (NB2): +%15.8 with a market value of 552 million Euros;

- Iris Energy (IREN): +%13.9 with a market value of 292 million dollars;

- Stronghold Digital Mining (SDIG): +%11.5 with a market value of 35.9 million dollars;

- Bit Digital (BTBT): +%11.5 with a market value of 207 million dollars;

- Mawson Infrastructure (MIGI): +%10 with a market value of 9.83 million dollars;

- Digihost Technology (DGHI): +%9.2 with a market value of 41 million dollars;

- Riot Platforms (RIOT): +%7.8 with a market value of 2.06 billion dollars;

- BIT Mining (BTCM): +%7.7 with a market value of 33.5 million dollars;

- CleanSpark (CLSK): +%7.6 with a market value of 721 million dollars;

- Bitcoin (BTC): +%5.7 with a market value of 532 billion dollars.

Bitcoin Mining Companies Facing Difficulties

The fact that the market value of these Bitcoin mining companies is much lower than the cryptocurrency they mine attracts attention. This situation can explain the reason for higher weekly performance even in a bad scenario for the industry. According to the old data obtained on August 28th, publicly traded 16 Bitcoin mining companies had a total accumulated loss of 4.47 billion dollars within a year.

Furthermore, with the readjustment of the difficulty level of Bitcoin mining, the hashrate required to find a single valid block reached its all-time high with 57.12 trillion hashrate, rewarding the lucky miner with 6.25 BTC.

The previous all-time high of 55 trillion hashes was reached on August 23rd. Both events directly affected mining profitability by increasing mining costs and could have a negative impact on the future performance of Bitcoin mining stocks.

Türkçe

Türkçe Español

Español