In September, the price of Chainlink (LINK) showed an impressive increase of 35.5%, but since the beginning of October, it has faced a 10% correction. Investors are concerned that breaking the support level of $7.20 could lead to further downward pressure and erase all previous gains.

Bullish Start in LINK

The bullish run of LINK began with the release of a report titled “Connecting Blockchains: Overcoming Fragmentation in Tokenized Assets” by SWIFT, the leader in messaging for international financial transactions, on September 31. After several tests, SWIFT announced the ability to provide a single access point to multiple networks using the existing infrastructure. It was stated that this system is based on Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and significantly reduces the operational costs and challenges for institutions supporting tokenized assets.

Part of the increase in Chainlink’s value can be attributed to the successful testing of the Australian dollar stablecoin using Chainlink’s CCIP solution by the Australia and New Zealand Banking Group (ANZ). ANZ referred to this transaction as a milestone for the bank in its announcement on September 14. Nigel Dobson, ANZ’s banking manager, claimed that ANZ saw real value in tokenizing real-world assets and suggested that this could be a revolutionary move in the banking industry.

Latest Developments in LINK

Furthermore, on September 21, Chainlink announced the mainnet launch of the CCIP protocol on the Ethereum Layer-2 protocol Arbitrum One, which aims to drive cross-chain decentralized application development. The latest integration will provide access to Arbitrum’s high-performance, low-cost scaling solution. StarkWare, another major Ethereum scaling technology firm, had previously benefited from Chainlink’s oracle services.

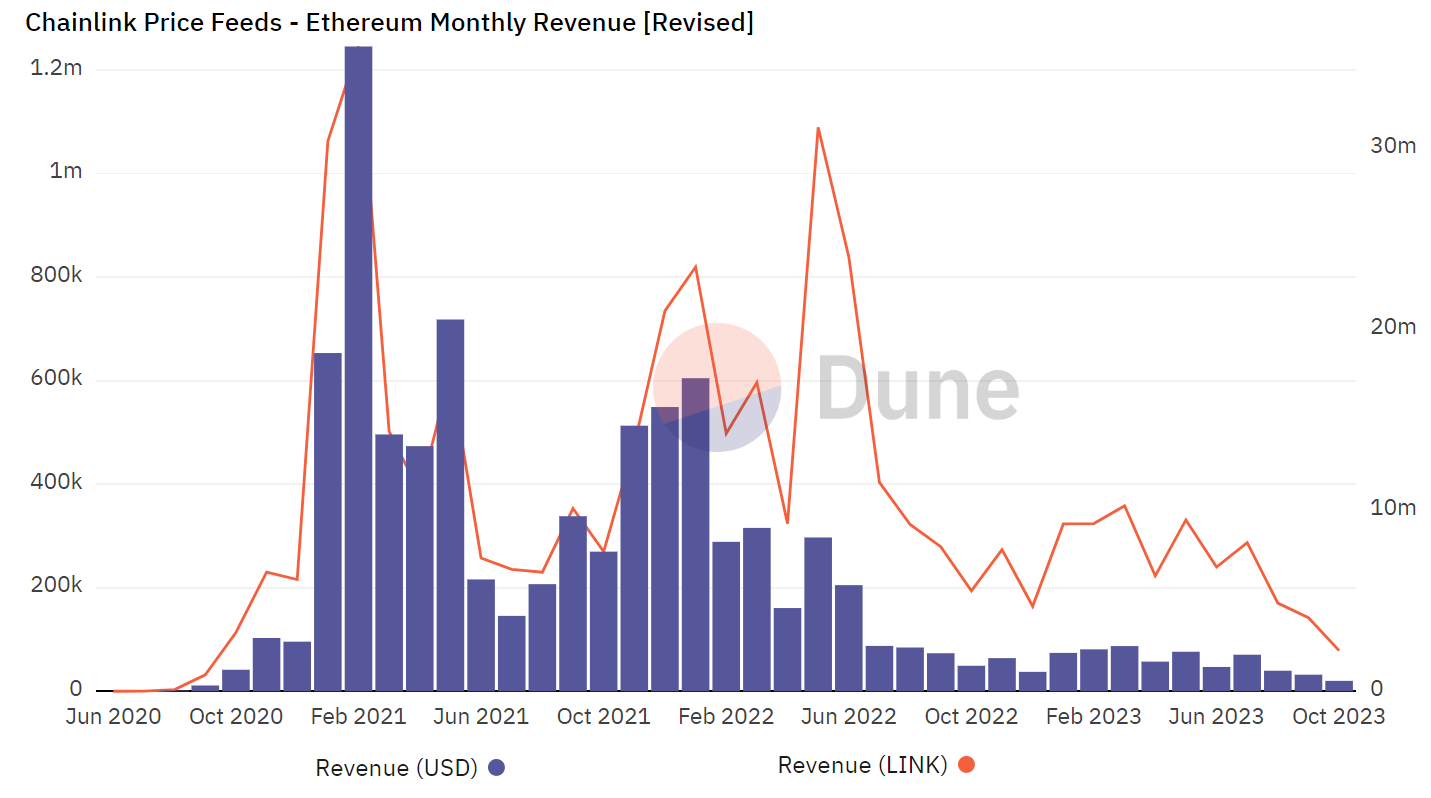

However, the protocol revenue derived from Chainlink’s most important metric, the price feeds, has been declining in terms of LINK for the past four months. In September, Chainlink price feeds generated 142,216 LINK fees, a 57% decrease compared to May. This decline can be attributed in part to the decrease in the total value locked (TVL) of Ethereum, which dropped from $28 billion in May to the current $20 billion, representing a 29% decrease. As a result, investors are concerned about whether LINK can maintain the support level of $7.20 and its $4.1 billion market value.