In recent times, the cryptocurrency market has witnessed a consistent decline in market value due to increasing fear and uncertainty. According to the renowned analytics platform Santiment, investors are seizing the opportunity to navigate through the market turmoil and benefit from the ongoing decline.

Santiment Provides Hope

This shift towards a downward trend has triggered a chain reaction. Santiment has stated that investors’ entry into the market increases the likelihood of liquidation, which in turn leads to an increase in prices.

Santiment explains it as follows:

When investors start entering crowded markets, it increases the likelihood of liquidation, resulting in price increases.

According to Santiment, the short selling of cryptocurrencies may represent a long-awaited signal for bullish investors who anticipate a market rebound.

Are Short Positions Being Encouraged?

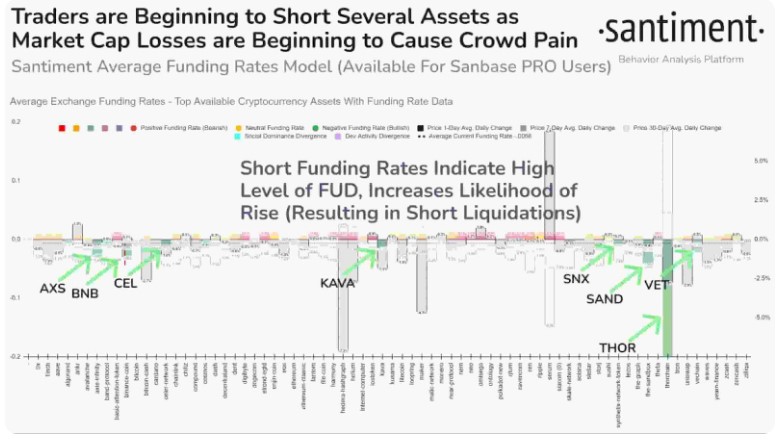

Santiment’s chart reveals increased short selling activity in many well-known cryptocurrencies, including THORChain (RUNE), VeChain (VET), The Sandbox (SAND), Kava (KAVA), Binance Coin (BNB), Axie Infinity (AXS), and more.

The increasing short funding rates indicate high levels of fear, uncertainty, and doubt (FUD). In such an environment, the probability of investors liquidating their short positions is higher, which can ultimately lead to a “short squeeze.” As more short positions are liquidated, demand for cryptocurrencies increases, driving up their prices.

This chain reaction can create a self-sustaining upward price cycle as panicked short sellers rush to buy and close their positions, reinforcing the overall upward momentum in the market. With fear prevailing, the total cryptocurrency market value has lost over $25 billion.

Meanwhile, on August 17th, cryptocurrency prices showed a significant downward trend due to notable changes in market sentiment. To be more precise, it seems that the feeling of “fear” has replaced greed among cryptocurrency investors. As a result, according to CoinGecko, the global cryptocurrency market value has lost more than $25 billion, decreasing by over 2.1% in the last 24 hours.

Disclaimer: This article does not provide investment advice. Investors should be aware that cryptocurrencies are highly volatile and carry risks, and they should conduct their own research before making any transactions.

Türkçe

Türkçe Español

Español