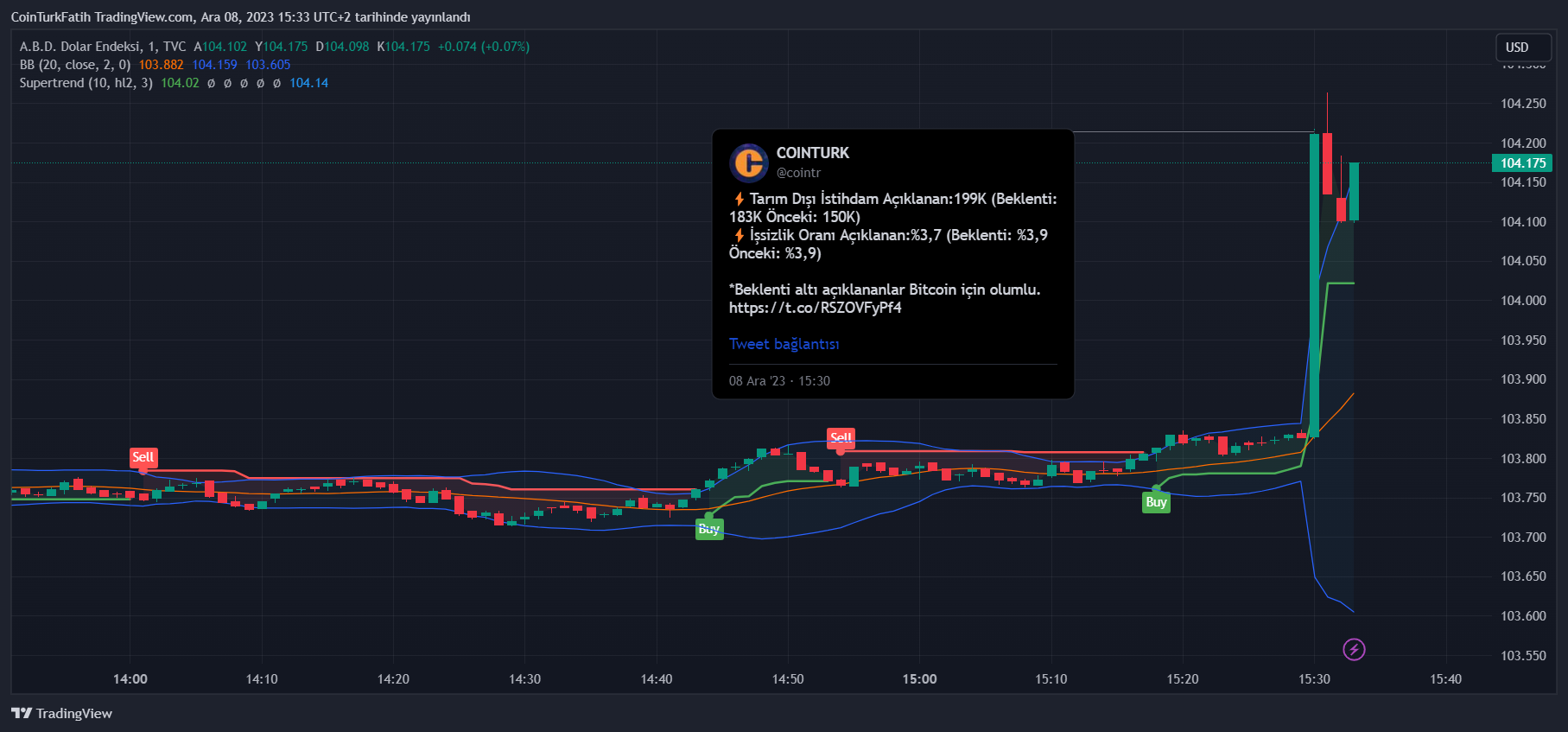

We are expected to have much busier days in the macro front next week, and the most critical day of this week was today. We have been experiencing the results of the data coming from the US side on risk markets (stocks, cryptocurrencies) for a long time. Today, many important data were announced, from employment to wage increases. So what is the expectation after the data?

Economic Data Released

On the US front, we had announced in our weekly evaluation on Saturday morning that today is extremely critical with the upcoming data. Today, Non-Farm Employment, Unemployment, and Wage Increases data are directing the markets. The previous data were extremely positive and it was confirmed that the interest rate increase would be passed at the Fed meeting to be held next week.

The ADP data that came the other day confirmed the slack in employment. Also, the JOLTS data released this week clearly reflected the decline in open job positions. The Fed said that the slack in employment and wage increases is important for them. For the fight against inflation, these data need to come under expectation.

- Non-Agricultural Employment Announced: 199K (Expectation: 183K Previous: 150K)

- Unemployment Rate Announced: %3.7 (Expectation: %3.9 Previous: %3.9)

- Average Earnings Announced: %4 (Expectation: %4 Previous: %4.1)

The data received were against Bitcoin, stocks, and gold. An increase in the dollar index and a slight decrease in crypto are likely. Especially before the Fed meeting, the bad data can increase investor anxiety.

Türkçe

Türkçe Español

Español