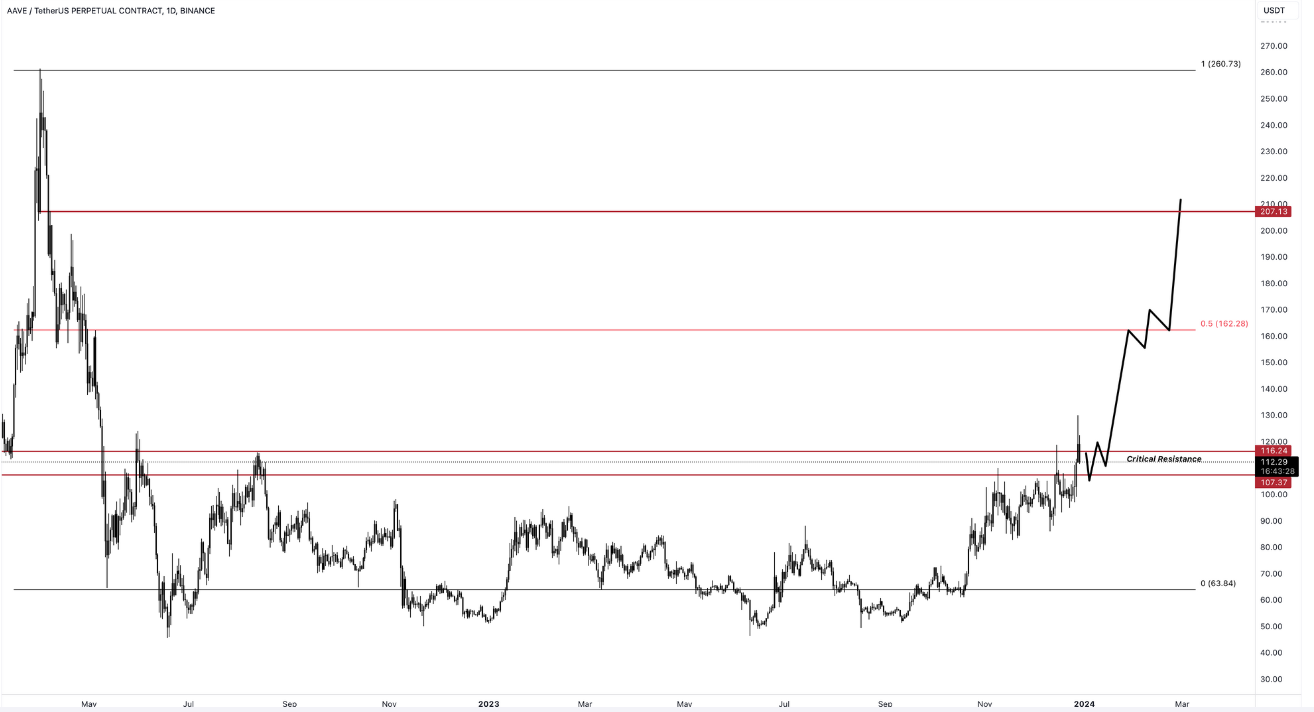

Aave (AAVE) price is currently facing a critical stage as it struggles with the $116 resistance level. The outcome of this battle could pave the way for a significant 40% rally, taking AAVE to $162. However, a break below the support level of $107 and its subsequent transformation into a resistance barrier could invalidate the bullish outlook, necessitating caution among investors.

Altcoin Momentum Amidst Ethereum Rally

As the bull run gains momentum, altcoins, including Aave, are providing significant returns for investors. Ethereum, after a period of relative inertia, has recently joined the rally, impacting the performance of Ethereum-related altcoins.

Initially led by newly launched tokens such as PYTH, PENDLE, and TIA, the momentum has spread to established altcoins like UNI, ETC, and AAVE. The crypto community refers to this trading strategy as “ETH-beta” and believes the rise is connected to Ethereum.

AAVE Holders Eye Potential Gains

Aave holders find themselves at a very important point as the price fell below the support levels of $116 and $107 on May 9, 2022. Despite numerous attempts to push the altcoin higher, AAVE encountered resistance. Notably, Aave remained resilient when Bitcoin experienced a drop on December 28, highlighting the ongoing struggle to establish $116 as a support level.

For those considering a strategic move, accumulating the altcoin AAVE at $107 during an intraday dip could be seen as a potentially rewarding yet risky bet. This tactic relies on the expectation that Aave’s price will successfully transform the $116 hurdle into a support base. If successful, the rise from $116 to $162 would represent a significant 40% gain.

AAVE Chart Analysis and Potential Scenarios

Upon examining the AAVE/USDT 1-day chart, a drop below the $107 support level and its transformation into resistance would indicate that the potential rally has failed.

In this scenario, AAVE could trigger a dip to lower levels by breaking through the $95 support level, thereby invalidating the optimistic outlook. This development could trigger a 20% price drop, potentially taking Aave down to $75, collecting liquidity below the October 27 low.

In conclusion, Aave’s price action is at a very important stage. It offers both opportunities and risks for investors. Investors are advised to be cautious while monitoring the critical $116 and $107 levels that will determine AAVE’s near-term trajectory.

Türkçe

Türkçe Español

Español